Why ASML Holding Stock Was Falling Today – The Motley Fool

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Shares of the chip equipment manufacturer pulled back after a disappointing earnings report.

Shares of ASML Holding (ASML 0.31%), the leading manufacturer of semiconductor producing equipment, were moving lower today after the company turned in disappointing results in its first-quarter earnings report.

As of 11:54 a.m. ET on Wednesday, the stock was down 7.4% on the news.

Image source: Getty Images.

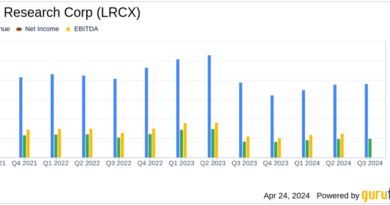

Revenue was down 22% from the quarter a year ago as the company transitions to new technology to prepare for the AI boom. It fell to 5.29 billion euros and was down even more sequentially. That result, which was equal to $5.62 billion, missed estimates at $5.87 billion.

ASML’s gross margin improved from 50.6% to 51%, but operating margins fell from 32.7% to 26.3% as spending on research and development rose, along with selling, general, and administrative expenses.

Earnings of $3.30 per share were down from $5.26 in the quarter a year ago. That still beat estimates at $3.15.

CEO Peter Wennink said, “We see 2024 as a transition year with continued investments in both capacity ramp and technology to be ready for the turn in the cycle.”

The news seems to signal that chip manufacturers like Intel, Taiwan Semiconductor, and Samsung aren’t rushing to upgrade their equipment in order to prepare for the wave of AI-related demand.

ASML’s guidance also indicated a continuing decline in year-over-year revenue. For the second quarter, the company expects revenue of $6.1 billion to $6.7 billion, which compares to $7.3 billion.

The slowdown isn’t alarming because ASML’s business tends to be lumpy, but a pullback in the stock seems justified as the stock had soared along with a broader AI boom since last October. Based on its guidance, dialing back some enthusiasm for the stock makes sense.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

© 1995 – 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.