These 5 Semiconductor Suppliers Are Undervalued – Morningstar.ca

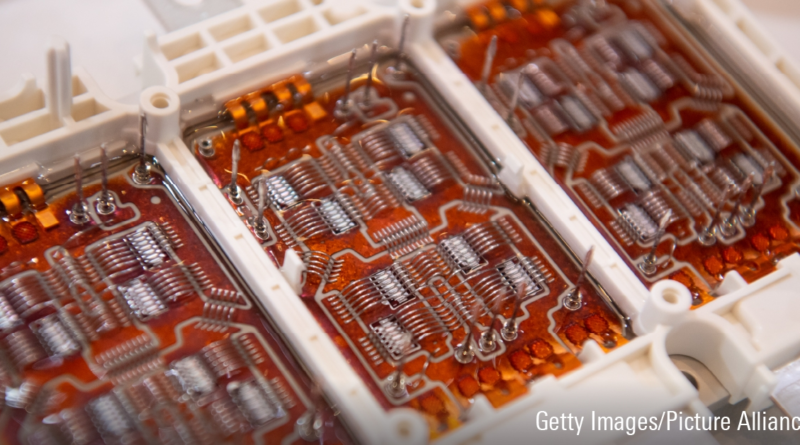

When most people think about investing in semiconductor stocks, their usual focus is on big chip producers such as Nvidia (NVDA) and Intel (INTC).

But there is another way to play the latest trends in technology: the handful of major companies that supply semiconductor manufacturers with the tools and equipment they need to make the chips themselves. And with many of these stocks having fallen faster than the broader equity market this year, they offer investors a chance to pick up these names at their lowest valuations in over a decade.

When it comes to 5G, artificial intelligence, and cloud computing “semiconductors are essential for all of it,” Morningstar’s equity sector strategist for semiconductors and technology Abhinav Davuluri says.

“But we’re most excited about the stocks of companies that are supplying semiconductor companies with the materials for production,” Davuluri says. “Instead of having to worry about Nvidia vs. Intel winning a deal, we are focused on the ‘arms dealers’ in that battle. They profit regardless of who wins the final chip design.”

ASML, a global corporation specializing in photolithography machines used to make microchips, has fallen 40.1% this year as of June 17. The company is currently trading at about half of its fair value estimate price. The stock hasn’t been this undervalued at any point since Morningstar analysts began covering the company in 2004.

Microchip quality-assurance testing equipment producer Teradyne is down 45.4% this year, and chip component manufacturer Lam Research has plunged 41.3%, leaving each at valuations cheaper than any time since March 2009.

As equity markets fell into bear territory, semiconductor equipment suppliers were hit harder than most.

The Morningstar Global Semiconductor Equipment & Materials Index, a collection of companies that design, develop, manufacture and market equipment and tools for the industry, has tumbled 38.1% for the year as of June 17. That is more than the broader Morningstar US Technology Sector Index’s drop of 31.3%, and the equity market’s losses of 23.5% as measured by the Morningstar US Market Index.

As of June 15, 10 companies in the Morningstar Global Semiconductor Equipment & Materials Index are trading at five-star discount prices, and an additional 48 companies are close behind at four-star.

Overall, the microchip space is set to grow, and Morningstar analysts expect semiconductor suppliers to profit.

“Our view for the long term is very healthy. The semiconductor market itself is now worth about $600 billion, by 2030 it’s projected to be about $1 trillion,” Davuluri says.

On top of that, “It’s a highly concentrated market. Five major players account for over 70% of all semiconductor equipment spend.” Davuluri doesn’t see these competitive dynamics changing anytime soon.

“Customers will need to buy newer, more advanced tools,” he says. “They’ll always be upgrading to the next-generation technology. And the costs will continue to elevate because the industry is consolidated.”

Over the past five years, ASML rose 313.9%, KLA climbed 268.1%, Lam Research rose 230.7% and Teradyne gained 198%. Each company more than tripled the Morningstar U.S. Market’s rise of 65.9% for the same period. Applied Materials also saw returns of 140.3% over the past five years.

A closer look at the Morningstar Global Semiconductor Equipment & Materials Index reveals five high-quality, undervalued stocks with strong track records. All five companies have earned Morningstar’s wide Economic Moat designation, meaning their competitive advantages are strong enough to fend off competition and earn high returns on capital for more than 20 years into the future.

The companies on our list make up four of the five “key players” noted by Davuluri. The fifth is Teradyne, a company that makes highly-specialized equipment to test the semiconductors for quality, once they’re ready.

“We believe ASML (ASML) has a wide economic moat based on its intangible assets around equipment design expertise in addition to research and development cost advantages required to compete for the business of leading-edge chipmakers. As the leader in photolithography equipment, the company exhibits considerable scale and technological superiority relative to its competitors. Its technical expertise and large R&D budget (US$2 billion) serve as barriers to entry, but competitors do exist (Nikon and Canon), albeit in a substantially lesser capacity (ASML captured 89% share of the US$12.8 billion lithography stepper market in 2020, according to Gartner). We also believe that incumbent tool providers have intangible assets related to equipment design derived from service contracts and customer collaboration during process development and subsequent high-volume manufacturing. Taken together, these two sources of competitive advantage allow leading equipment firms to earn excess returns on invested capital over extended periods.

“Lithography tools account for a significant portion of chipmakers’ capital expenditures, with next-generation extreme ultraviolet, or EUV, platforms exceeding US$150 million each. ASML’s immersion lithography tools have allowed the company to capture and maintain its leadership position in the marketplace, while competitors like Nikon and Canon do not have the scale or resources to compete in EUV. In 2012, ASML’s top three customers, Intel, Samsung, and Taiwan Semiconductor, committed to help fund a portion of research and development for EUV technologies and acquired an aggregate 23% minority equity stake in ASML (though these stakes have come down in recent years).”

–Abhinav Davuluri, equity sector strategist

“We believe Applied Materials (AMAT) has a wide economic moat based on its intangible assets around wafer fabrication equipment design expertise and research and development, or R&D, cost advantages required to compete for the business of leading-edge manufacturers. These characteristics have allowed it to become the top vendor in the semiconductor equipment market. Applied’s scale and resources allow a research and development budget in excess of US$2 billion to serve cutting-edge technologies and thus benefit from inflections such as fin field-effect transistors, or FinFET, and 3D NAND. Advanced tools in deposition and etch have become critical for multiple patterning that enables leading-edge foundry and logic processes. As a result, these segments have grown faster than the broader market in recent years, and firms such as Applied have directly benefited, as it can outspend smaller chip equipment firms in research and development to develop more advanced solutions.

“When chipmakers operate numerous fabs around the world, maximizing throughput and reducing process variability across their fleet of tools are top priorities. We believe incumbent tool providers, such as Applied, also have intangible assets derived from service contracts and customer collaboration during process development and subsequent high-volume manufacturing. Field service engineers that are on-site at customer fabs help troubleshoot high-value problems to improve yields and output, ultimately driving productivity and reducing cost. We believe a positive feedback loop is subsequently created in which top equipment vendors leverage existing relationships and insights into future customer technology needs to ultimately design and offer superior equipment. Furthermore, the resultant virtuous cycle cannot easily be replicated by potential new entrants. Applied’s installed base of over 43,000 tools is the largest in the industry, which gives us added confidence in our wide moat rating.”

–Abhinav Davuluri, equity sector strategist

“We believe Lam Research (LRCX) has a wide economic moat, thanks to cost advantages and intangible assets. We view the scale and resources required to compete for the business of leading-edge manufacturers as major barriers to entry, with firms such as Lam boasting R&D cost advantages over smaller peers. We also believe that incumbent tool providers have intangible assets related to equipment design derived from service contracts and customer collaboration during process development and subsequent high-volume manufacturing. Taken together, these two sources of competitive advantage allow leading equipment firms to earn excess returns on invested capital over extended periods of time.

“Lam is the market leader in dry etch and a prominent player in the deposition segment of the wafer fab equipment, or WFE, industry. Deposition equipment applies thin-film layers to surfaces while etching selectively removes material. The combination of these two is critical during the chip fabrication process, along with photolithography, which produces the mask that exposes areas for materials to be deposited or removed. Lam provides customers with some of the most advanced tools in these segments, and its leadership position creates scale advantages that fuel research and development spending at levels only Applied Materials and Tokyo Electron can match. At the end of 2021, Lam had an installed base of 75,000 units, up from 40,000 in 2015. This large installed base creates stickiness that helps Lam maintain its leadership position in key process steps for chipmakers’ process flows. It also offers Lam an intimate look into problems faced by chipmakers, providing valuable information it can use to implement solutions and additional capabilities in future tools.”

–Abhinav Davuluri, equity sector strategist

“KLA (KLAC)’s wide economic moat emanates from its comprehensive tools and leading technical expertise that enable its products to be in every major chip-manufacturing facility in the world. The firm’s large research and development budget allows it to stay at the forefront of the process diagnostic and control (PDC) space, with over 50% market share and 4 times the market share of its closest competitor. Also, its database of defects encountered by customers and their respective solutions help chipmakers in troubleshooting endeavors. Through service contracts, customers indirectly have access to this database that can greatly accelerate the time it takes to solve issues in their process flow, thus reducing tool down time and improving yields. The more customers that take advantage of this access by anonymously submitting their own data to the collection, the greater the network effect that benefits all parties involved.

“We also view the growing service revenue component as stickier and less cyclical, which should help the firm better navigate cyclical troughs. Additionally, unlike smaller competitors like Onto Innovation, or the less specialized players such as ASML and Applied Materials, KLA is able to focus considerable resources on aiding semiconductor manufacturers with yield management and metrology issues they experience.”

–Abhinav Davuluri, equity sector strategist

“We assign Teradyne (TER) a wide economic moat rating based on a combination of intangible assets in semiconductor automated test equipment (ATE) and switching costs created at chipmaking customers. We think Teradyne’s proficiency, which has led to a leading market share in ATE, will enable the firm to earn impressive returns on invested capital that will continue for the next 20 years.

“Teradyne’s automated test equipment for semiconductors (71% of 2021 sales) drives our wide moat rating, and we observe similar competitive dynamics at wide-moat-rated wafer fabrication equipment leaders under our coverage. Teradyne’s test equipment is highly capital-intensive and serves a relatively concentrated number of chipmaking customers.

“In our opinion, Teradyne’s ability to design testing equipment for bleeding-edge chips is the biggest driver of its competitive advantage, representing intangible assets that we don’t think are easily replicable. Teradyne provides testing solutions for nearly every semiconductor on the planet during production, both at the wafer level and final device package level.”

–William Kerwin, equity analyst

Subscribe Here

Multi-asset portfolio managers advise turning to Asia as a diversifier.

The e-commerce company’s shares will have a fair value estimate of US$45 following…

Don’t buy these hard-hit stocks. They still look overpriced to us.

With expenses on the rise but its stock down 25%, here’s what we think of Shopify’s outlook.

With a steady streak of beating earnings and huge AI growth, here’s what to watch when Nvidia rep…

We think this wide-moat company is well positioned to drive growth beyond 2024.

These four debt management strategies can help you get back on track financially this year.

The two assets usually move more in tandem during inflationary periods, which makes it harder for…

Tips to categorize your expenses, tailor a financial plan for your life stage and stay healthy in…

With expenses on the rise but its stock down 25%, here’s what we think of Shopify’s outlook.

Lauren Solberg Data journalist for Morningstar.

About Us

Connect With Us

Get Help

Terms of Use Privacy Policy Disclosures Accessibility

The Morningstar Star Rating for Stocks is assigned based on an analyst’s estimate of a stocks fair value. It is projection/opinion and not a statement of fact. Morningstar assigns star ratings based on an analyst’s estimate of a stock’s fair value. Four components drive the Star Rating: (1) our assessment of the firm’s economic moat, (2) our estimate of the stock’s fair value, (3) our uncertainty around that fair value estimate and (4) the current market price. This process culminates in a single-point star rating that is updated daily. A 5-star represents a belief that the stock is a good value at its current price; a 1-star stock isn’t. If our base-case assumptions are true the market price will converge on our fair value estimate over time, generally within three years. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Morningstar Star Rating for Stocks, please visit here

Quantitative Fair Value Estimate represents Morningstar’s estimate of the per share dollar amount that a company’s equity is worth today. The Quantitative Fair Value Estimate is based on a statistical model derived from the Fair Value Estimate Morningstar’s equity analysts assign to companies which includes a financial forecast of the company. The Quantitative Fair Value Estimate is calculated daily. It is a projection/opinion and not a statement of fact. Investments in securities are subject to market and other risks. Past performance of a security may or may not be sustained in future and is no indication of future performance. For detail information about the Quantiative Fair Value Estimate, please visit here

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and reevaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly. For more detailed information about these ratings, including their methodology, please go to here

The Morningstar Medalist Ratings are not statements of fact, nor are they credit or risk ratings. The Morningstar Medalist Rating (i) should not be used as the sole basis in evaluating an investment product, (ii) involves unknown risks and uncertainties which may cause expectations not to occur or to differ significantly from what was expected, (iii) are not guaranteed to be based on complete or accurate assumptions or models when determined algorithmically, (iv) involve the risk that the return target will not be met due to such things as unforeseen changes in changes in management, technology, economic development, interest rate development, operating and/or material costs, competitive pressure, supervisory law, exchange rate, tax rates, exchange rate changes, and/or changes in political and social conditions, and (v) should not be considered an offer or solicitation to buy or sell the investment product. A change in the fundamental factors underlying the Morningstar Medalist Rating can mean that the rating is subsequently no longer accurate.

For information on the historical Morningstar Medalist Rating for any managed investment Morningstar covers, please contact your local Morningstar office.

For more detailed information about conflicts of interest, including EU MAR disclosures, please see the “Morningstar Medalist Rating Analyst Conflict of Interest & Other Disclosures for EMEA”here