Semiconductor Manufacturing in Vietnam vs Taiwan – Vietnam Briefing

Vietnam’s North Central and Central Coast regions, home to 11 provinces boasting extensive coastlines, stands to benefit under a new Master Plan. We provide key details.

Vietnam’s packaging industry is booming, with a projected 15-20% growth rate and over 14,000 enterprises. Despite challenges, the sector is innovating and focusing on sustainability.

Vietnam’s foreign contractor tax is a withholding tax that may affect your business if you’re working with a Vietnamese company or sub-contractor. Here’s how.

In effect from July 1, 2024, Decree 52 defines e-money in Vietnam as “the equivalent value in VND stored electronically,” based on prepaid money deposited with banks or provided to payment service organizations and excludes virtual currencies like bitcoin.

Vietnam has amended certain provisions regarding hiring foreign workers and the issuance of work permits. We provide the details.

Vietnam Briefing has developed into a premium source for insight on doing business in Vietnam. It publishes business news concerning foreign direct investment into Vietnam, including the most important tax, legal and accounting issues. The Vietnam Briefing Magazine was first published in 2009, and is contributed to by investment professionals based in Vietnam.

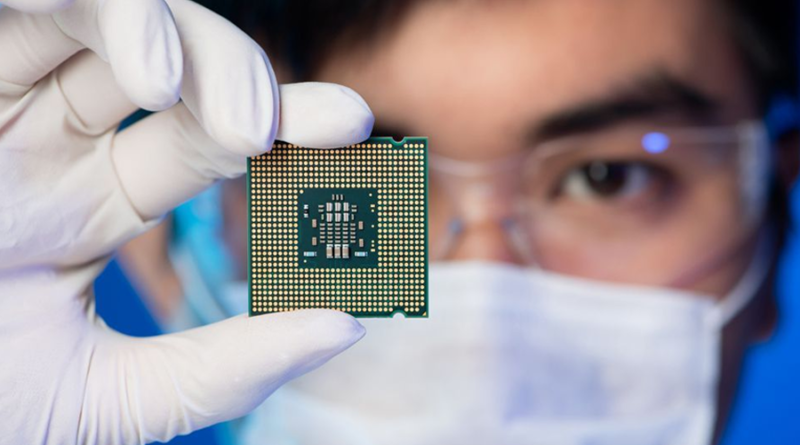

Vietnam is emerging as a notable player in semiconductor supply chains, providing a viable alternative to Taiwan, which has been the traditional hub for semiconductor manufacturing. Here’s how semiconductor manufacturing in Vietnam compares to Taiwan.

Taiwan is currently the world leader in semiconductor manufacturing. The total output value of Taiwan’s integrated chip (IC) industry reached US$145.7 billion in 2021 or about 15 percent of Taiwan’s GDP.

However, the heavy reliance on Taiwan for chip production has raised concerns about over-concentration, as well as geopolitical risks that may impact the industry’s sustainability.

As a result, industry experts have identified Vietnam as a promising alternative for future chip manufacturing projects. Suppliers of Dutch chip maker ASML, for instance, are reportedly exploring opportunities to diversify their operations out of China and into Southeast Asia, with Vietnam being a top candidate.

In this light, it has been suggested that Vietnam could be a key contender for future chip manufacturing projects. Suppliers of Dutch chip maker, ASML, for example, are reportedly looking at diversifying out of China and into Southeast Asia with Vietnam one country at the top of their list.

But how does Vietnam fare as a semiconductor manufacturer compared to Taiwan, the current world leader in this field?

Vietnam has been investing heavily in infrastructure, including roads, ports, and airports, to support its growing semiconductor industry. The Vietnamese government has also been actively promoting investment in the sector, offering tax incentives and other benefits to companies that set up operations in the country.

Moreover, Vietnam has been building more advanced facilities for semiconductor manufacturing, with several new projects planned or under construction. One of the largest semiconductor manufacturing plants in Vietnam is the Samsung Electronics facility in Ho Chi Minh City, which produces a wide range of products, including memory chips and displays.

Additionally, Vietnam has a lower cost of living compared to Taiwan, making it cheaper to set up factories in the country. It also has a large pool of young, educated, and skilled workers, which is essential for the semiconductor industry.

Vietnam has invested billions of dollars in setting up research and education centers to train workers in order to attract major chip manufacturers.

More than 40 percent of Vietnam’s college and university graduates specialize in science and engineering, representing a significant proportion of the labor force. This demographic advantage is reflected in Vietnam’s ranking among the top 10 countries in terms of the number of engineering graduates.

Vietnam has benefited from a lower cost of living and the presence of major multinational corporations in the semiconductor industry, allowing it to attract talent from around the world. This influx of skilled workers has helped the industry grow and expand rapidly.

Meanwhile, Taiwan boasts a rich history in the semiconductor industry, with a highly skilled workforce developed over many years. It also has a well-established system for training and educating semiconductor engineers and technicians, and a strong tradition of innovation and entrepreneurship in this field. However, this expertise comes with a higher cost, as wages in Taiwan are significantly higher than those in Vietnam.

Both Vietnam and Taiwan have implemented policies and provided government support to foster the growth of their semiconductor industries.

Vietnam’s government has introduced various measures to attract investment and support the development of this industry. For instance, businesses investing in the sector can enjoy exemptions from land and water surface rents, or a reduction of up to 50 percent in centralized high-tech parks.

Additionally, companies investing in socio-economically deprived areas are exempt from land and water surface rents for the duration of their lease.

The Vietnamese government’s focus on digital transformation is a key driver for the growth and development of the semiconductor chip industry. The government has recognized the importance of this industry in achieving its long-term goal of becoming a digital economy and has implemented various policies and initiatives to that effect.

Similarly, the Taiwanese government has invested heavily in the semiconductor industry, recognizing it as a crucial driver of economic growth.

Taiwan’s government has established policies and programs aimed at developing the industry, such as the “five plus two” innovative industries plan, which includes the “Asian Silicon Valley” project. This aims to promote the development of high-tech industries on the island. Taiwan’s government has also provided support for the development of the semiconductor industry through investment incentives, tax credits, and subsidies.

Vietnam’s semiconductor industry is still in its early stages, and the country is lagging behind Taiwan in terms of investment and funding. However, Vietnam has shown a willingness to invest in the industry and has implemented policies to attract foreign investment.

Vietnam’s government has set up various funds to support the development of the semiconductor industry. For instance, the National Technology Innovation Fund (NATIF) was established to provide funding for research and development activity. The country also has the Vietnam-Korea IT Incubator (VKII) to provide funding and support for start-ups in the semiconductor industry.

Vietnam is strategically located in the center of Southeast Asia, making it an ideal location for manufacturers looking to enter the region’s fast-growing semiconductor market.

Vietnam’s location provides it with easy access to the world’s leading semiconductor supply chains, which run through China, Japan, and South Korea. In contrast, Taiwan, as an island in the Pacific, requires more expensive shipping and logistics to get its chips where they need to go.

Furthermore, Vietnam has made significant investments in building up its transportation infrastructure, such as ports, highways, and airports, to improve the connectivity of its manufacturing hubs with the rest of the world.

In terms of the supply chain of materials for chip production, Vietnam’s chip makers still heavily rely on imported materials from other countries.

Only two domestic enterprises, namely VHT and FPT, are involved in chip design, while the majority of companies working on the IC design, assembly, and testing phases are foreign-invested enterprises. Taiwan, on the other hand, has a more integrated supply chain formed by industrial clusters surrounding Taiwan Semiconductor Manufacturing Company (TSMC), its biggest chip manufacturer.

Yet Vietnam is also making significant progress in building a domestic supply chain for its semiconductor industry. The government has implemented policies to attract investment in supporting industries for chip production, such as the production of electronic components and materials.

In addition, Vietnam has signed several free trade agreements that reduce trade barriers and facilitate the import and export of the raw materials and goods needed for chip production.

Moreover, Vietnam has abundant natural resources and raw materials, such as silica sand and an abundance of rare earths. This provides a unique advantage for Vietnam to develop a more integrated supply chain.

Taiwan Semiconductor Manufacturing Company (TSMC)

According to a report published by IC Insights in late 2021, the Taiwan Semiconductor Manufacturing Company (TSMC) is the top-ranked semiconductor manufacturer in Taiwan. This company accounted for 50 percent of the total value of chips produced among the top 10 companies in Taiwan. TSMC is also the third-largest semiconductor manufacturer globally, trailing only Samsung in South Korea and Intel in the United States.

MediaTek

The second-largest semiconductor company in Taiwan is MediaTek, which ranked ninth among the top 10 semiconductor companies worldwide in 2021.

ASE Group

ASE Group is the third-largest semiconductor manufacturer in Taiwan. ASE owns two leading packaging and testing manufacturers, ASE and SPIL, with a combined global market share of over 30 percent.

The establishment of Factory Z181 in Vietnam in 1979 marked the beginning of IC manufacturing. However, the factory ceased operations in the early 1990s.

Recently, Viettel Hi-Tech Industry Corporation and FPT Semiconductor have started participating in the production and design of some microchips, which are used in medical electronics and telecommunications. Around 30 foreign-invested enterprises are also engaged in the IC assembly, testing, and design phases.

Morris Chang, the founder of TSMC, says that Taiwan is the only place where the company can produce high-end chips due to various factors, such as exceptional talent, technology, and corporate culture.

However, TSMC’s advanced process chips are expensive, and with TSMC’s pursuit of advanced manufacturing processes, the cost of chip production has rapidly increased.

In 2020, TSMC reported that its capital expenditure would rise to US$28 billion in 2021, with 80 percent being used for research and development of advanced manufacturing processes. This leaves less funding for infrastructure construction and talent recruitment.

Furthermore, foreign investors currently hold over 80 percent of the TSMC’s shares. This could affect the company’s autonomy and decision making, especially in the context of tense international economic and trade relations.

According to Dezan Shira and Associates Country Director Filippo Bortoletti, Vietnam faces a number of challenges developing its semiconductor industry.

Vietnam is currently mostly involved with the semiconductor industry’s low-margin packaging and testing sector. This may limit its ability to climb up the value chain to enter the semiconductor design and manufacturing field, which require specialized labor and manufacturing infrastructure.

But Bortoletti says that Vietnam still has the potential to become a semiconductor manufacturing hub. It will just take some time. He says this will depend on the government’s support for entrepreneurs and favorable global macroeconomic conditions that influence and reshape global supply chains.

Taiwan has been a world leader in chip manufacturing for a long time but there are signs that change is afoot. As trade tensions rise between China and its key markets and major chip makers look to diversify their supply chains, alternatives are currently being sought and at the end of the day,Vietnam is an excellent option.

With its low-cost labor, government support, and strategic location, Vietnam is well placed to support chip makers looking to diversify into Southeast Asia more broadly.

About Us

Vietnam Briefing is published by Asia Briefing, a subsidiary of Dezan Shira & Associates. We produce material for foreign investors throughout Eurasia, including ASEAN, China, India, Indonesia, Russia & the Silk Road. For editorial matters please contact us here and for a complimentary subscription to our products, please click here.

Dezan Shira & Associates provide business intelligence, due diligence, legal, tax and advisory services throughout the Vietnam and the Asian region. We maintain offices in Hanoi and Ho Chi Minh City, as well as throughout China, South-East Asia, India, and Russia. For assistance with investments into Vietnam please contact us at [email protected] or visit us at www.dezshira.com

Our free webinars are packed full of useful information for doing business in Vietnam.

Meet the firm behind our content. Visit their website to see how their services can help your business succeed.

Subscribing grants you this, plus free access to our articles and magazines.

Subscribe to receive weekly Vietnam Briefing news updates,

our latest doing business publications, and access to our Asia archives.

Subscribe now to receive our weekly Vietnam Edition newsletter. Its free with no strings attached.

Not convinced? Click here to see our last week’s issue.

Type keyword to begin searching…