Nvidia Just Executed a 10-for-1 Stock Split. 3 Artificial Intelligence (AI) Stocks That Could be Next. – The Motley Fool

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

The split appeared to lift Nvidia and could help other stocks, too.

Nvidia stock soared to record highs following its 10-for-1 split. Following that increase, it became the stock with the world’s largest market cap. Another chip giant, Broadcom, is far from such an achievement but has shot higher since announcing its own split.

Given those reactions, such a move could be next for other AI stocks that announce stock splits. The question for investors is which stocks will make such a move. While the answer to that question remains to be seen, a similar increase could happen for the following stocks:

Perhaps it’s no surprise that Nvidia partner Super Micro Computer (SMCI -7.98%) should emerge as a stock-split candidate. Despite a worldwide reach and a stock that has traded since 2007, it was a server manufacturer largely unknown outside its industry.

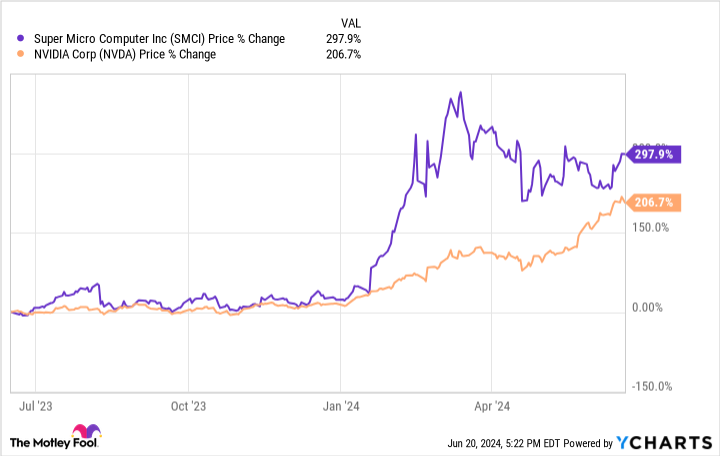

That changed when it and Nvidia announced a partnership. Consequently, Supermicro stock has outperformed Nvidia’s over the last year.

SMCI data by YCharts.

The increase briefly took its share price above $1,000 in March, and despite the surge, it could be undervalued.

Thanks to revenue growth estimated to reach 110% this year, analysts forecast nearly $24 per share in net income. That is quite a feat, considering that its share price was $24 as recently as four years ago.

Despite that increase, Supermicro’s price-to-earnings (P/E) ratio is 52, which is a low valuation given the growth rate. That growth and the possible catalyst of a lower nominal share price after a split could be what Supermicro needs to keep moving higher.

ASML (ASML -0.51%) remains a relatively unknown semiconductor stock. Nonetheless, it is one of the most crucial chip companies because it builds the most advanced extreme ultraviolet lithography (EUV) machines.

Hence, manufacturers such as Taiwan Semiconductor and Samsung need its machines to make their cutting-edge chips.

Moreover, countries want to move more manufacturing away from Taiwan, the island that produces about two-thirds of the world’s chips. That fear has led to tens of billions in subsidies going into ASML’s industry.

The AI-driven demand for chips has become a boon to ASML as chip fabricators scramble to increase capacity. Investors looking to capitalize on the AI boom have bid its stock price higher, and it is up more than 430% over the last five years, taking its stock price to around $1,050 as of this writing.

The run-up has taken the P/E to a lofty 54. Nonetheless, the demand for EUV machines likely means its long-term growth continues, and a split in the near future improves the chances of ASML moving higher in the short term as well.

As one of the largest cloud providers, Microsoft (MSFT -1.30%) plays a key role in running AI applications. It was one of the companies that built an alliance with OpenAI, whose ChatGPT platform makes it a more crucial AI company.

That led investors to bid the stock price higher by more than 30% over the last year, giving Microsoft the world’s largest market cap for most of the year.

Amid its rising value, the company still trades at around $450 per share, which might not inspire most companies to split shares in today’s market.

However, investors often forget that it is one of the 30 components of the Dow Jones Industrial Average. Since that is a price-weighted index, a higher nominal price gives Microsoft a disproportionate influence over the Dow. Thus, the index tends to pressure its members to split their stocks when the price becomes high.

Given the bump that benefited Nvidia and Broadcom, such pressure could be a blessing in disguise. A stock split could give Microsoft investors a reason to bid its stock higher despite its 39 P/E ratio, possibly meaning a split will happen sooner rather than later.

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

© 1995 – 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.