Nvidia earnings, crypto rally, new housing data: Catalysts

On today’s episode of Catalysts, Co-Hosts Seana Smith and Madison Mills invite top experts and strategists to break down some of the market’s (^DJI,^GSPC, ^IXIC) biggest stories, from the crypto rally to the summer travel season driving consumer trends.

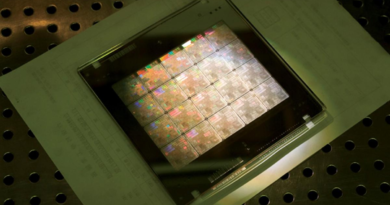

Nvidia (NVDA) earnings are highly anticipated, as the chip company is expected to report a massive 242% surge in revenue. If Nvidia meets or tops these expectations, investors are hopeful it will spur a broader market rally. Skybridge Capital Founder and former White House Director of Communications Anthony Scaramucci encourages shareholders to stick with the company regardless of its earnings results: “I think if you hold it over the next decade, you’re going to be very well rewarded.”

Newly released housing data shows existing home sales dropped in April, declining by 1.9% versus the expected 0.8%. HousingWire Lead Analyst Logan Mohtashami notes that while inventory levels have been on an upward trajectory, lingering challenges, like high mortgage rates and housing prices, are stunting the housing market’s overall growth.

Cryptocurrencies bitcoin (BTC-USD) and ethereum (ETH-USD) are rallying as the House is set to vote on the Financial Innovation and Technology for the 21st Century Act, or FIT21. The new crypto legislation could boost the entire sector as it would remove it from the purview of the Securities and Exchange Commission (SEC). Scaramucci adds that with the upcoming election, the Biden administration should show the sector some favorability as more individuals are looking to boost their wealth by investing in cryptocurrencies.

As the summer travel season heats up, US Secretary of Transportation Pete Buttigieg joins the show to discuss how Americans should plan for their vacations ahead. He encourages all travelers to know their rights before making their trips, pointing to new measures that guarantee automatic refunds if flights get canceled.

Buttigieg explains that the Department of Transportation is focused on getting “America’s airlines to succeed and thrive. We want them to do it by providing good customer service and through honest practices.” He adds that while many may be flying on Boeing (BA) planes this summer, consumers should not be afraid: “Look, I’m on a Boeing airplane every few days… so this is personal to me as well as something I care about as a policymaker. And bottom line is the FAA is not going to allow anything to go forward that they’re not satisfied is safe.”

For more expert insight and the latest market action, click here

This post was written by Melanie Riehl

Video Transcript

10 a.m. here in New York City.

I’m John Smith alongside of Madison Mills.

Let that let’s dive into the cat that are moving markets this morning.

It’s big tax grand finale here and video reporting its latest earnings after the bell as goes in video so goes the market for the chip giant, a firm markets as the S and P is sitting near all time highs.

We’re going to discuss targets disappointing sales pointing to cracks in the consumer Ceo Brian Cornell saying that inflation is straining customers wallets very similar warning to what we’ve heard from Home Depot lows and even some fast food companies this earning season and the housing market is stalling the latest data coming out here showing that mortgage rates are weighing on buyers and sellers inventory in the existing homes market remaining near record low keeping prices high.

So when will things start to ease?

We’re going to unpack all of that and more.

But first we have to talk about the biggest catalyst for markets today.

Of course, the A I darling and video, Wall Street got very high expectations for the chip giants report after the close expecting profits to rise more than 400% from a year ago.

A senior portfolio manager at catalyst funds saying that the company would have to top estimates by 15% to avoid a sell off.

We’ve got Yahoo Finance anchor, Josh Liton with us to talk about this, Josh, great to have you here.

I mean, this is the day we’ve all been waiting for.

We can’t stop talking about it.

What are you most excited about?

I mean, you’re right to say we have a lot of strategists we talked to and this is one of those days they had marked on the calendar as a potential catalyst because you think of the market and what’s been motivating, you guys know it’s, you know, it’s decent economy, decent earnings and this boom of interest in the A I.

And of course, NVIDIA is the poster child of A I.

What’s amazing too is I am very hard pressed and maybe you guys can think of something else.

I can’t think of another stock where there’s this much love for the name, right?

I mean, everybody is piled on the same side of the boat with NVIDIA.

90% of analysts who cover this name think you should buy it.

The stock is up 90% already this year.

So you have the sky high expectations and yet the strategist and analysts we talked to seem to be broadly pretty positive and optimistic that you’re gonna see them report another beat and raise this quarter.

Yeah.

And, and, and when we talk about just how much emphasis is on this name, we just had it up on the screen just a few minutes.

So we talk about the size of NVIDIA right now.

It’s market cap just around 2.3 trillion.

I believe it accounts for about 5% of the waiting in the S and P 500 about 10% in the NASDAQ 100.

It, if it doesn’t live up to expectations, what do you think that means more broadly for the tech sector?

For some of the other names that I know you’ve very closely tracked now for quite some time.

Well, it’s not, you know, it’s interesting.

It’s not just the tech sector like our Carly, Josh Schafer had a really interesting piece and Josh is right to note, look at the movement you’ve seen in some other sectors, right?

You can look at utilities, traditionally, you would move into utilities because you’re getting nervous.

It’s time to hunker down, get defensive by ammo and tuna, fish and utilities, right?

But now it’s defensive move, but it’s also offense people move into utilities because it’s an A I play.

So I think Schafer is really right to say, not only are you listening to the report, but when you hear Co Jetson while get on the call, depending on how he sounds on that call about what he’s seeing in his business this quarter.

And the quarters head that could have broad ripple effects across multiple sectors.

Certainly.

Yeah, he was right to point that out.

And it’s so interesting just how focused so many of these companies are making sure that they are communicating that A I message to their investors.

If you go public, you almost have to Sprinkle some A I dust on everything.

I saw that with Reddit too.

All right, Josh love doing great stuff.

Thanks so much.

Well, after the bell today in an exclusive interview, Yahoo Finance will be speaking to NVIDIA Ceo Jensen Wong.

You could find that interview at Yahoo finance.com or watch it tomorrow on the morning brief.

You will not want to miss that.

You can also see our very own Josh Lipton, a brand new show.

Congrats, by the way, asking for a trend Monday through Friday.

That’s at 4:30 p.m. eastern time.

You certainly do not want to miss that.

Let’s turn now to some breaking news that we’ve got on housing existing home sales falling in April down about 1.9% from the prior month.

That’s more than the 0.8% dip that economists had been expecting.

So again, you’re seeing existing home sales fall.

Once again, this all comes back to that inventory story, Mattie that you and I have been talking about time and time again, simply these home uh homeowners are not putting their homes on the market because of higher interest rates because of that, we have depressed inventory levels and that, of course, is then weighing on sales simply because the supply is not there.

So, not necessarily a huge surprise that we do see a drop once again here this latest month.

Absolutely.

And it’s interesting to point out the inventory piece as well, which I know you, but the inventory of unsold existing homes climbing 9% from a month ago, that totals 1.2 million at the end of April.

And that is the equivalent of 3.5 months supply just to put that 9% number into context here.

So 3.5 months of supply, that is pretty big the question that how does that impact home prices and particularly not just you know, homes for buyers but also for rent.

Because so much of that shelter component does factor into the consumer price index that the fed looks at to us out the rate of inflation in the US.

It helps them decide what they’re going to do with the federal funds rate.

Questions about whether or not this is going to start to show up in that CP I data in the coming months here and home prices seen their 10th consecutive month of the year over year price gains in April there.

But the pace of price increases could start to taper off soon.

That’s according to the National Association of Retailers joining us.

Now, with his perspective, we have Logan Moi Wire, lead analyst, Logan.

Thank you for being here a lot of different data points in the existing home sales here.

But I’m curious what stands out to you as the single biggest data point that is driving the perspective when it comes to housing prices and supply supply is growing uh year over year.

Our weekly tracker uh inventory has been showing that the new listings data has been growing year over year every week.

The total inventory data is growing year over year every week.

The home price growth seems a little bit strong.

But we have to remember last year.

At this time, the uh uh n er s existing home sales prices were actually showing negative.

So it’s a very low C this month and then the next month will be the lowest comp and then toward the second half of the year, the growth rate of pricing should cool as inventory is up year over year, new listings data is up and also price cut.

Percentages are slowing grow are slowly growing up.

That’ll be a positive in the sense of trying to keep housing as affordable as possible with total active listing still near all time lows.

But we’re still the positive story is gonna be that inventory will be up this year versus what we had in 2023 Logan.

Why are you so confident that it’s going to be up?

Uh Just naturally 2023 was the lowest new listings data ever recorded in history.

And even when mortgage rates got to toward 8% the data line didn’t move down any uh any last year was a historical event.

Then we started to see new listings data grow.

We were, we were at extremely abnormal levels last year.

So our weekly data is gonna be a few months ahead of everyone else.

And we’ve consistently seen every single week inventory grow and new listings data grow and we’re almost at the seasonality point where that data line starts to head lower.

So for this year, uh the positive story will be more active listings, more new listings data and now the price cut percentages will start to pick up a little bit more.

We’ll see this in the existing home sales reports coming down a few months.

Well, talk to me about the aggregate data then Logan I’m curious if we’re missing out on any weakness that could be seen under the hood here.

We know according to Zillow that home buyers need 80% more than they did four years ago to purchase a home.

That’s according to Zillow, as I mentioned, are you seeing that big of a hurdle coming up in the data?

Yes, because if you look at 2022 2023 and 2024 this is the third calendar year of the lowest home sales ever.

We have to take it in context to we have over 100 and 58 million people working now.

So we’re not that far from the great recession, lows and demand and it shows right.

Uh, even this recent report, we’re not seeing any real growth in sales.

We haven’t seen it for a while until mortgage rates head down towards 6% and stay there.

It’s very hard for this housing market to grow because the majority of all buyers are mortgage buyers and they’re the ones getting impacted the most with home prices accelerating out of control, mortgage rates this high and also now property taxes and insurance uh are part into the mix.

So you have massive housing inflations and we’ve seen it in the home sales basically trying to get near all time lows for some time now.

All right, Logan, always great to talk to you.

Thanks so much for joining us here this morning, lead analyst with Housing Wise Wire.

We appreciate it.

All right, let’s turn now to crypto, both Bitcoin and Ethereum.

Rallying this week.

Investors looking to Washington DC hopeful that regulation and new products potentially could expand the industry’s mainstream appeal.

Joining us now to lay out what’s on the table for crypto in Washington is our very own.

Jennifer Schomer Jen.

Good morning, Shana.

That’s right.

The crypto world hopeful for some gains this week in Washington as it pushes for a new regulatory framework and approval for an E ETF.

Today, the house set to vote for the very first time on comprehensive crypto legislation called the Financial Innovation and Technology for the 21st century Act or as it’s known for short fit 21 legislation which house Financial Services chair Patrick mchenry has been pushing for the better part of a year would establish the commodities future and trading commission as the leading regulator of digital assets.

There would be clear divisions for what the CFTC will regulate and what would fall under the purview of the Securities and Exchange Commission which has vehemently cracked down on the crypto industry with a litany of enforcement actions.

This legislation would also establish consumer protections and borrow the sort of co mingling of customer funds that played a role in the undoing of the crypto Exchange FTX back in 2022.

Now Republican lawmakers say this legislation will bring clarity for the crypto industry but most Democrats led by House Financial Services Committee, ranking member Maxine Waters opposed the Bill Waters warns the bill would effectively deregulate most crypto by removing them from the purview of the SEC.

In a rare rebuke Sec chair, Gary Ginzler put out a lengthy statement this morning on the legislation saying quote, it would create new regulatory gaps and undermine decades of precedent regarding the oversight of investment contracts, putting investors in capital markets at a measurable risk.

The house expected to vote on this legislation around 5 p.m. this afternoon where it is expected to pass the chamber largely thanks to support from Republicans and a handful of Democrats but prospects in the Senate remain.

Dimmer mchenry told reporters late yesterday afternoon that he’s hopeful that a strong vote tally will galvanize the Senate to take a fresh look at this legislation.

Meanwhile, elsewhere here in Washington, the SEC reportedly facing a deadline of May 23rd, that’s tomorrow for approval or denial of an ether ETF when I asked the SEC for comment, they said we do not comment on individual filings guys.

All right, Jennifer, thanks so much for bringing that down for us.

Let’s talk more about the crypto rally because crypto is back, investor is once again optimistic that the se is going to potentially approve the spot Ethereum ETF.

So what’s ahead and how much further maybe can this rally that we’ve seen in crypto?

Go?

Who better to ask than our very own?

Anthony Scaramucci is the founder of Skybridge Capital and author of the new book from Wall Street to the White House and back.

Congratulations on the new book, Anthony.

Thank you.

I brought copies for you.

Oh, thank you.

We were hoping to rule is it doesn’t have to go to your house, but it can’t come back to mine.

Ok. Too many books in the bank comes our houses.

I’m confident of that.

I’ve got my yearbook picture from 1982 on the front looking, you’re looking good in that picture.

A lot of money to airbrush a picture like that.

So I, you know, because I was reading um it’s sort of odd to me that we’re in a state of politicization of our regulatory system, you know, years ago, it was what is right or wrong for the country?

How are we gonna stimulate growth?

How are we gonna create transparency for investors and give investors a full understanding of the risk?

Now, we’re like either hard right, regulatory environment or hard left regulatory environment as opposed to left and you know, right or wrong.

And, and again, Gary Gensler is an example.

I work with him at Goldman Sachs.

He has taken the politics of this full hog.

And so it’s disappointing for us uh on Wall Street because years ago and there’s a great book on this Diana Henriquez wrote a book called Taming The Street.

Years ago when they created the SEC, they went to the industry, the legislators, the regulators, the administrators and they worked together to create the system that has been very successful in the United States for 90 plus years.

We’re starting to see though a bit of a sea change though in Washington, when, when you take a look at the fact that at least the street is a bit more optimistic that we are going to get some sort of approval.

You have the House, considering this legislation, you have the Senate pushing back on some of the regulation here.

There does seem to be more bipartisan support here for crypto.

So we are, are we starting to see maybe that narrative change inside Washington?

I, you know, I hope so.

You know, the, the, the, the problem is you have, you have people that are in their seventies and eighties, some of them are even closing in on 90 that are running this thing.

And so they really don’t have a full understanding of what’s going on.

Uh Mike Novogratz said something to me today uh yesterday, which I’ll share with you guys.

There are 85 million people in this country that own crypto in one form or another.

There are 65 million dog owners.

So you have more crypto owners and you have dog owners.

I mean, it just imagine a politician saying, I’m, I’m anti dog.

Uh How would that go down?

OK with the, the body politics.

So, so I think the Biden administration is looking at polling data and recognize that younger people, uh Hispanic community, African American community are in crypto.

You guys really wanna go that hard against crypto.

Um I don’t think it makes sense from a uh electoral perspective and I would have predicted.

And of course, I did so many things wrong and I write about how many things I’ve gotten wrong in my life in that book.

But if you had said to me in 2023 what’s gonna happen?

Presidential wise in 2024?

I would said both candidates will be pro crypto because they’re not going to lose any votes being pro crypto, but they might lose some votes, particularly from younger people being anti crypto.

But we are, both of them are pro crypto just to jump in here and the Biden is pro crypto.

Well, you came on our show and said that he was previously.

Do you not think that anymore?

The Biden administration?

No, I think that what I said, I hope I said it correctly if I didn’t get to correct myself.

I said the president is agnostic to positive on crypto when we talk and sit down with the members of us in the crypto community.

Gary Gensler and Elizabeth Warren are decidedly anti anti crypto and he’s allowed them to control the regulatory brains that could be changing.

I mean, I think that’s the point and that’s why the Wall Street is optimistic about the Ethereum ETF.

There could be a signal coming from the president and his team, particularly the campaign that this may be a mistake, the direction that we’re going in.

Well, do you think that the fact that we are in an election cycle?

You’ve got Biden and Trump both making it a political football.

Do you think that makes the approval of the Spot Eve ETF more likely I do.

And if you had asked me that last week as he brought me on last week, I said, there’s no way this ETF is gonna get approved uh because it’s gonna open up a Pandora’s box for other types of ETF, so Solana ETF, an avalanche, ETF et cetera.

Why would those be excluded if Ethereum is included?

And so I do think there’s a sea change and I think you saw it literally this week, the market was blah.

And then all of a sudden we had a 10% move and stuff, 20% move in Ethereum.

So where does that leave this by going back to what Mattie asked just a moment ago?

Biden versus Trump is one better than the other today for crypto?

Ok.

So I’m, I’m, I’m obviously supporting President Biden.

We’ll have to get into that in a second.

You’re asking me a specific question.

I think President Trump has very good political instincts.

He was anti crypto as president.

You can see tweets that he said anti Bitcoin, anti crypto.

He came out about 10 days ago and said he’s pro crypto now and I think he is probably gonna tug the Biden campaign into the pro crypto camp.

Ok?

I think they come reluctantly and again, the president, you’re correct agnostic on it.

But it’s really some of the people like that work for Gary Gensler or Elizabeth Warren, which has more staying power though.

Should voters be concerned about a waffling from either candidate once the election is over?

And he is a good question.

But I, I don’t think so because I think younger people like the two of you are coming into power and those older people, I mean, I think, I don’t know, was Chuck Rangel like George Washington’s great grandfather or something like that, he’s still in the con, I mean, guys give up the reins, let younger people run this thing and I think the younger people will modify this.

And remember, uh, the regulars did not want Uber go back 1012 years ago, regulators, legislators were fighting Uber, but you know, who wanted Uber?

The people wanted Uber and thank God in a country like this, the people still went out.

So let’s start our conversation a bit and talk about the big story of the day.

And that is NVIDIA.

I’m curious to get your thoughts, just market current valuations.

You’ve got lots riding on this report.

There certainly has been a lot of hype about what we are going to hear and see from NVIDIA after the bell.

How big of a bellwether is it for the market?

And, and what does it ultimately mean here?

Just in terms of the larger story, the more macro story that’s playing out within the markets today.

So I’ve said this consistently that we own it.

We like it.

We like a I could it be overvalued, could be it be in a crowded trade.

Yes, we could be.

But I wanna just point out to people if you’re a long term holder, you’re gonna benefit from these great companies like NVIDIA, you know if you, if you took Amazon go back 25 years.

Uh 10 periods of time down at least 21 period of time down 80.

Uh the very famous Jeff Bezos letter in the year 2000 when he was writing about uh the demolition of his stock.

But yet the improvement of fundamentals NVIDIA is growing and evolving.

Could it have a short term impact on the market here?

No question.

Do we own it?

We own it.

Are we staying in it?

Yes.

And uh you know, I I just point out to people that are listening.

Uh There’s a guy named Warren Buffett, he made a 70 year bet on America sometime in 1954.

He decided, you know what, I’m getting long America, I’m getting along super high quality companies.

I’m gonna take this ride with America and I think you have to start thinking like that again.

NVIDIA is one of those names.

I think if you hold it over the next decade, you’re gonna be very well rewarded.

I know a year ago we spoke and you said regarding the fed from a macro perspective that they would declare victory around 4% inflation.

We’ve seen them very much so not do that.

They’re sticking to that 2% goal.

What do you think that that does for risk assets for the tech trade, including names like in video?

Ok, so you’re right.

They are jaw boning people and telling the people, they’re going to go to 2%.

But when you really look at the data, I think they cut rates well, before they get to those targets.

And so I’m still in the two, possibly three camp this year.

Hopefully you guys will invite me back to either prove me right or wrong on that.

But the reason I’m saying that is they have this debt bullet, they’re staring down the barrel of a debt bullet.

You, you don’t wanna get the US in a situation where we’re spending 1.5 to $2 trillion on interest payments.

Uh We’re upside down right now.

27% of the GDP is in federal spending, 6 to 7% of it is in deficit spending.

Uh, if alarm bells are not going off at the fed or if you’re looking at the economic dashboard of the country and seeing this imbalance, uh, this is wild deficit spending for a nation at full employment with these wage numbers.

Well, let’s talk about the book because I’m curious about your thoughts on how it ties to the election, the new book, uh, from Wall Street to the White House and back here, I’m curious, what is one thing that you know, from your time in the White House about President Trump that you think that voters should know heading into November?

Listen, there’s 40 of us.

I was with Secretary Esper this week, I was with General Milley.

Uh uh General Kelly is a personal friend of mine.

There are 40 of us that have spoken out about the danger of Donald Trump returning to the White House, the vice president of the United States for four years prior, Mike Pence has spoken out about he was on the ballot with the president.

So I submit to the two of you and your viewers and listeners, if we worked at a car company and we told you the car was not manufactured properly, it was gonna blow up and kill your family.

Are you getting in the car if we worked at a pharmaceutical company?

So that, you know, that pill is gonna kill you?

So you’ve got 40 people that were in the cabinet, sub cab and assistance of the president are telling you how dangerous he is or telling you how unpredictable he is, how rational the decision making is.

He’s also stating publicly, you know, he used the, in his, uh, advertising recently the words unified Reich, I mean, who does that in the United States?

He’s saying publicly that he wants to deport 15 million people.

Ok?

You just gotta stop and think about what he’s saying.

He wants to go after people like you guys in the media.

If you don’t agree with him, he has said publicly, he wants to pull FCC licenses from people that don’t agree with him.

He told two of his defense attorneys, both of which left his defense that he wants to use the FBI as the gestapo.

Now, the good news is, he doesn’t understand history, he doesn’t read books.

He doesn’t even know what that word means to gestapo.

So we got a lot of people on Wall Street that like him.

They think that the short termism of those business policies are gonna help the country.

But what has been great about this country is the predict abilities of the law and the subordination of all of us to the law.

And the founder set up a system that said no one person could have that amount of power.

And so he talks about unitary executive power and he’s got guys on his team from the Heritage Foundation, but believe in that.

So go read about unitary executive power and read their 1000 page plan for what they wanna do for America and it’s gonna make America different in the country we grew up in.

And so I will take policies from the Biden administration that I disagree with and I’ll sweat out those policies, OK?

In order to get to a younger smarter uh center right candidate.

So, and I’m gonna ask you because when you take a look at the polls right now as diplomatic as I’ve ever been, I mean, if this was like N MS NBC, it would have probably been hitting him a lot harder.

I just want to point that out.

But why is it though?

His messaging still registering with voters.

And then what does that ultimately tell us about what the messaging should be at this point?

Maybe more so from the Biden administration, li listen, the Biden administration is placating the hard left.

You gotta give President Trump credit.

He’s moving to the middle.

He is and even he, he, his hard right, uh, wants to ban abortion in the country.

They wanna stop IVF, he knows this.

He’s out there saying, hey, we gotta get, we gotta cut that nonsense out.

So President Trump, former President Trump tacking to the middle, the Biden administration is still placating the hard left is a very big mistake for them.

And this is why the sentiment has changed in favor of President Trump.

All right, Andy Scaramucci, we wish we had more time.

Thanks so much for joining us.

This is almost as long as my White House.

I’m very happy Skyridge and also congratulations on your new book from Wall Street to the White House and back.

We really appreciate that to be here with you guys coming up.

We will be sitting down with Pete Buttigieg, you as the Secretary of Transportation.

He will talk to us about the state of travel.

Boeing’s manufacturing problems and much, much more.

He’ll be joined by our executive editor, Brian Sazi.

Don’t go anywhere.

Memorial Day will be the start to a very busy summer travel season.

According to AAA, the number of travelers were will most likely surpass pre pandemic levels at about 43.8 million marking this the busiest Memorial Day holiday weekend in nearly two decades.

Us, Transportation Secretary Pete Buttigieg joins me.

Now, Mr Secretary always nice to get a few moments with you.

So we’ve talked a lot in the past about just chaos in America’s airports because of these large crowds.

What should consumers expect this weekend?

Well, we were very encouraged by last year’s results.

Uh The cancellation rate for flights last year was uh at a 10 year low.

And that included some uh very smooth sailing across some of the busiest travel days ever recorded last year.

So what I’m looking for this year is can the airlines and the airports of this country keep that up when we have even more travelers coming?

Uh A lot of ts a projections would suggest we’re, we’re gonna have the busiest summer holiday travel season ever.

Memorial Day is really the launch of that.

Obviously, we’re pleased about what that means economically, but, but that’s still a big challenge to the system.

44 million travelers expected by AAA, about 3 million going through TS A checkpoints on Friday alone, which we think will be the busiest day of that Memorial Day weekend as far as air travel is concerned.

Definitely a good idea for travelers to allow a little extra time, make a plan, be patient.

And also for air travelers, we’re urging them to make sure, you know, your rights because so much has changed in the last couple of years as we have launched new rules and new passenger protections to make sure that airlines take care of you, especially if you do experience some kind of disruption and the airliner is responsible.

Uh Mr Secretary, of course, a lot of these publicly uh these airlines in many respects are, they are in fact publicly traded Delta jetblue, you name it.

So they wanna make a lot of money uh on a weekend like Memorial Day, they stuff the planes.

But in terms of scheduling are airlines in this country scheduling realistically, you know, this is a big concern, especially in summer of 22 when we saw huge amounts of delays and it seemed that the airlines just weren’t prepared to service the schedules, they were actually selling.

So what I’m looking at now is results, the results have certainly improved.

But I think one of the side benefits of the rule we just launched on automatic refunds, which says that if you flight gets canceled and you don’t fly, you don’t have to ask for your money back.

It’s just going to come to you is that really changes the economics for airlines that might have been tempted to engage in unrealistic scheduling.

Any time there is a credible concern in our department about unrealistic scheduling, we will investigate, we’ve actually had some reviews underway and if we make a determination that that’s what happened there are consequences to that.

The best way, of course, to deal with all of that is for the airlines to do the right thing in the first place.

Look, we want them to succeed.

We want America’s Airlines to succeed and thrive, we want them to do it by providing good customer service and through honest practices.

And Mr Secretary, how much progress has been made on uh made on addressing the pilot shortage?

Uh So from my conversations with the sector, there’s been definite improvement in the availability of pilots.

Uh The pay for pilots has been going up in an extraordinary way, not just for the uh uh the uh captains of those wide body long haul aircraft who can often make north of half a million dollars a year.

Uh But I’ve been encouraged to see the entry level, the other end of that career pipeline in those regional area that pay has, has gone through some noticeable improvements.

Now, of course, raising the pay is one thing it’s taken a while for the training pipeline to catch up with that, especially because of the rigorous standards that we right, we have on what it takes to even qualify for safety reasons.

But, uh again, real real improvement on the pilot front, continuing to keep an eye on mechanics as well.

That that’s an area where there can be a lot of tightness in that skilled labor market and uh watching what’s going on with the flight attendants making sure that they are well taken care of and, and uh and that, that pipeline is strong, by the way, we’re doing the same thing over on our end at the FAA increasing the hiring of air traffic controllers that was just in Congress asking for the funding to be able to do 2000 controllers next year.

On top of the 1800 that we are hiring this year and the 1500 that we hired last year, we finally reversed the decade long loss in the number of air traffic controllers or what I should say is we’ve stopped that trend line from going down.

Now.

We’re pushing to accelerate it, going back up.

That’s certainly good to hear.

And, and of course, a lot of the, the pilots and flight attendants they’re on Boeing planes.

Mr Secretary.

Uh Have you been encouraged by anything this company is doing to address legacy problems it’s having and seemingly new problems that continue to pop up almost every other week?

Yeah, the good news is that there has been a lot of engagement.

They’ve taken a number of steps in response to the pressure that the FAA is putting on them, but there’s still a long way to go in a few days.

We’re going to see the results of the 90 day review.

The administrator, Mike Whitaker put them on a 90 day clock and said we need to see a comprehensive plan on how you’re going to on top of these quality issues and what it’s going to take to get that done.

We know that there’s new leadership coming in at Boeing as well.

At the end of the day, it’s all about the results.

Uh They’re saying the right things, they’re taking encouraging steps, but we need to make sure that we see it on the shop floor that we see it in terms of the quality of the product that rolls off the line.

And that’s why Fa is taking this extra step of not permitting them to increase their production rate until they’ve shown beyond a doubt that they can safely address those quality issues and increase that production in a way that’s consistent with the quality that everybody expects from such an important company and producer in the United States.

Should, should Americans trust Boeing that they’re going to get it right.

Look, I, I, I’m on a, a Boeing airplane every few days.

I was on one yesterday.

I think I’ll be on one next week too.

So I, this is personal to me as well as something I care about as a policymaker and bottom line is FAA is not going to allow anything to uh to go forward that uh that they’re not satisfied is safe.

Sometimes that means putting extreme pressure on a player like Boeing or on the aviation sector.

But uh uh you know, it’s in everybody’s interest, including those companies for safety to be beyond a shadow of a doubt.

And that’s the standard uh often for some of these safety engineering choices, uh there is a billion to one standard as in, there has to be less than a one in a billion chance of failure for the FAA to be satisfied.

And that is what has made flying on a commercial airliner in America by far, the safest form of transportation.

A lot of work is going to go into keeping it that way.

And of course, Mr Secretary and lastly, we saw that ship uh move out of the uh uh that crashed into the France at Scott Key Bridge this week.

Uh positive development.

What steps is the administration taking to protect, protect and improve the nation’s bridges?

Uh really encouraged to see that boat move.

That means that that ship, I should say move, that’s a 400 ft channel opening up.

Uh and a big step toward getting the full 700 ft channel up and running and get everybody back to normal at the port of Baltimore.

This has opened up a new level of attention to something that I think uh over the next years, that will be a major focus, which is what can be done to make sure things like this don’t happen again.

Some of the questions are about the design and protection of bridges.

Some of the newest bridge designs have what are called dolphins, fenders or even islands around their peers.

But also it’s difficult to describe the level of physical force that a ship of 248 million even when it’s going at about 10 miles an hour brings with it when it has a collision like this.

So the most important things to make sure that that can’t happen in the first place, that is the focus of so much of the information coming in from N TSB.

Of course, their work continues as an investigator, but we as a department are paying close attention to what that an independent N TSB report is gonna tell us Transportation Secretary Pete, but always nice to get some time with you.

Have a wonderful and safe holiday weekend.

We’ll talk to you soon.

Thanks, same to you.

Thank you, Madison back over to you.

Thank you so much for that great conversation.

Appreciate it.

Moving on to our trending takers here.

More bad news for Tesla.

The car maker registering only about 14,000 just shy of that number of vehicles in Europe last month.

That is according to the European Automobile Manufacturers Association and that is down 2.3% year over year.

This is Tesla’s worst monthly showing in Europe since January of 2023.

So that is a 15 month low in a slow start to the quarter in Europe, Elon Musk saying that things are expected to pick up in Q two.

Obviously, he’s going to say that but under 14,000 vehicles is really low, particularly when you look at the context here, Shana because overall we saw a 14% rise in month for battery evs.

So it’s looking like it’s an idiosyncratic issue specific to Tesla, which is a really negative signal for the brand in terms of sales.

And I think that’s so critical to point out it’s also very similar to what we’re seeing play out over in China when you take a look at falling sales there in Shanghai.

Whereas if you, it’s a bit of a contrast to what is happening with the broader ev industry there.

And going back to what Musk had said on the earnings call just last month, he was trying to reassure investors right now saying that yes, there have been some issues when you talk about the Red Sea disruptions when you talk about the fires that played out at one of its plants in Germany, that that was largely going to be in the past.

And he thinks that demand will then return sales are going to get a boost.

So when you get updates like this, obviously, that’s in contrast to what we heard from Musk not too long ago, it’s also important to point out that there has been some changes, some dialing back of subsidies, ev subsidies in Europe, specifically what is going on in Sweden and in Germany.

So that of course, probably weighing on sales just a bit and that would be more overall for the industry so much Tesla specific.

But I think this is a trend worth watching, right?

When you take into account what is happening overseas, when even when you take into account, what is happening here, you have consumers under a bit of pressure pulling back on those larger ticket items here.

Those big discretionary purchases EVs the pick up and EVs the adoption rate, not nearly as it is still growing, obviously, but not nearly at the rates that the industry had initially forecasted.

So it looks like it could be maybe a little bit longer in order for Tesla and some of its other peers, but the industry to regain some of that loss momentum that we have seen.

But yes, especially what’s going on over in Europe and even in China, it seems more of a Tesla specific problem rather than an industry wide problem.

You mentioned Germany, those registrations down 32% for Tesla, the rest of the industry looking flat there.

All right.

Well, coming up, does NVIDIA have enough Jews to push investor optimism to the next level?

We’ll speak to a strategist about the chip giants impact on markets right after the break and video already hitting a fresh record high this week ahead of its earnings.

While the V closed at its lowest level in five years of volatility, low major indices hovering near record highs could and video be the fuel for the next wave of optimism in the market here to break it down for us.

We have Venu Krishna.

He is Barclay’s head of us Equity strategy and he joins us here in studio.

It’s great to speak with you.

Thank you for coming in.

I mean, talk to me about the signal that Nvidia’s earnings could have for the rest of the market and what folks should be looking at within the earnings and just more broadly as a signal for where the market might be heading.

Listen, Nvidia’s earnings are very important because in general, if you look at what has been critical to S and P’s rise, it’s been big tech and NBD is a critical component, probably the most important component of that subgroup of just six stocks.

And if you look at even for example, what the market is pricing in the options market, for example, it’s, it’s unbelievable that uh the the most things which the market cares about right now is the CP I print followed by NVIDIA earnings and then the non farm payrolls over the next month.

So that just tells you how important uh NVIDIA also is in the big scheme of things, right?

Uh But that said, I think uh at least in the options market, it’s pricing less of an upside for NVIDIA in this earnings compared to the last earnings.

But remember, this is a 2.3 trillion plus stock.

What does that tell us just about future earnings growth?

And what exactly that is going to look like if we are starting to see it slow just a little bit.

Obviously, NVIDIA has certainly been an outlier in terms of the tremendous growth, astronomical growth that they had seen over the last four quarters.

But what does that tell us?

Just maybe will we start to see more of this return to normalization?

What does that ultimately then mean for the broader market as well?

So I would say to some extent, you’re already seeing that, right?

If I look at Big Tech as a group and you look at the extent to which the earnings surprises have been happening in the last few quarters, they have been coming down.

So if you go two quarters ago, it was almost 14 plus percent, then last quarter is about 8 8.5%.

So now it’s inching lower.

That’s not because they’re not doing well.

It’s because a lot of the upside and optimism is getting baked into analysts, earnings estimates, right?

So to your point, what it does mean that going forward, the ability of these drivers of the market to continue to surprise and raise gets more challenging, right?

So we do think that going forward, it does get incrementally challenging, but it’s also a fact that over the next probably call it 2 to 4 quarters, the visibility is quite high, including for NVIDIA.

So when we talk to a fundamental analyst, they are fairly confident where it starts getting a little blurred is when you start going a year from now, what is the end state that is still unknown because of the torrid pace at which it’s been growing?

What would, uh that’s really interesting to me, what is going to help us inform what our market is looking like a year from now.

The most I know you talk through a couple of different things, things like CP I and video earnings payrolls being big catalyst for the market.

Which of those is the biggest thing that you think will help us understand a year from today.

I think one thing certainly is the CP I number and I wouldn’t just put it directly on CP I right now, the equity markets sensitivity to CP I prints is the most negative.

It’s been in 25 years.

So in other words, the market does care a lot and I think one of the channels in which it’s going to percolate into the equity market is to the rates market.

So if the 10 year curve, treasury curve starts moving the wrong direction, that is it’s come down recently, starts going up and especially once it starts getting closer to the 5% threshold, you can see the equity market getting a lot more antsy, right?

So, so that’s one the other thing I think, which is very important to the equity market is fundamental, actually, they are improving, right?

That’s what Q one showed which is a very, very healthy sign, but the expected broadening has been just about incremental.

So I think what one would have liked to see is, is the broadening outside of tech, especially big tech indeed happening.

And is it gaining pace?

So there are some very early green shoots of that, but I think a lot more needs to happen to get comforter on that level because we’ve been dragged up by big Tech quite substantially thus far.

Going back to what you just said a minute ago, the action that we’re seeing in the bond market, we are coming down just a bit.

But if we were to go back to those 5% levels, I guess what readings in the inflation print would cause it would it need to come in much hotter than expected or even if we stay around the current level that we have been hovering around, we did see a bit of improvement here, but the elevated levels that we are still hovering around is that going to be enough to really put some more fear back into the market when it comes to inflation.

So, one of the interesting things on CP I readings is that in fact, the surprises have been coming down, right?

And so that’s good news.

In other words, most of the inflation forecasts are broadly in line with expectations, right?

So nothing is surprising us.

So surprise will come if it goes up a lot more.

So it is debatable what the number is.

But I would argue that a 1% threshold around expectations, that’s a pretty wide one for inflation can be thought of in some ways as being reasonable.

If it goes above that and the market is going to fall.

If it goes below that, then probably there is more optimism that potentially rates can get cut.

Right.

So I think so that’s what it is because even though inflation, the big part of inflation battle in my mind has kind of been one because member core PC, which is what the fed cares about has come down from around 5.6% at the peak to around now, 2.82 0.9% level.

But if you look at the four month CP I it is analyzing 4% right now core PC.

So I think we are in an interesting situation where inflation is somewhat sticky.

But I think for equity markets to work, inflation doesn’t need to have come down quite sharply from here because the market has handled, you know, it quite well thus far.

But any risk of rates being increased or rates actually going up rates increased by the fed is definitely a negative.

It’s that last leg of the marathon.

That’s always the hardest, right?

Venu thank you so much for joining us and coming in the studio, we really appreciate it so much.

That was Venu Krishna.

He is Barclay’s head of us equity strategy joining us in studio now, China is signaling a 25% tariff on imported cars.

This follows Washington’s announcement of tariffs on China and could be the first sign of a tit for tat that will increase between the nations.

For more on this development.

We have our very own a fit for more.

What are you looking at here?

Yeah, Maddie, you pointed to the timing of this no coincidence that reports of a potential tariff on goods coming into China could be ramped up just one week after President Biden announced a steep increase in tariffs particularly around Chinese EVs.

Now, the Deputy Director of China’s Automotive Strategy and Policy Research Center is publicly calling for an increase in tariffs for cars imported into China right now that rates at 15%.

He wants that to increase to 25%.

Now the question is how significant of an impact will this be when you consider where cars are manufactured?

China is the largest manufacturer?

And there questions about how much of this is really going to be symbolic.

Now China is reportedly looking to raise the tax on cars with larger engines that would largely apply to German carmakers that export suvs and sedans to China.

And we saw those shares BMW Mercedes getting punished in European trade down more than 2%.

The Deputy director here saying China imported 250,000 cars in that specific bracket.

Last year compare that to the 30 million vehicles that were sold in all of China.

So it’s a very small portion here.

Now all of this comes as the eu wraps up its own investigation into Chinese subsidies.

Preliminary tariffs are due by July fourth for that.

But officials have hinted they could be announced sooner.

And on the US trade front, we got a clearer picture on when some of those steep increases on tariffs for Chinese goods are likely to take effect the US TRS office saying today those for Chinese imports including ev batteries, computer chips and medical products are set to take effect on August 1st guys.

All right, Akiko, thank you so much for bringing that reporting to us.

Really appreciate it targets a disappointing earnings report this morning saw sales fall 3% year over year.

This is yet another example of consumers pulling back on certain discretionary items.

Targets report comes after Wal Mart said shoppers were trading into their stores and Macy’s reported that consumers are being more discerning and spending for more on the polls of the consumer.

We have Jerry storage advisors, Ceo and former toys, Rs Ceo Jerry.

Thanks so much for being here with us.

Obviously, you have incredible experience to bring us about what it’s like to lead a retailer during difficult economic times.

So I’m curious from your perspective, does this earnings season indicate to you a potential downturn that we are about to see in the broader retail space.

I I think the consumer has been snowing for some time uh to some degree, this has been disguised oddly enough by inflation.

So the government reports, for example, the sales report that just came out uh recently said that sales during the month of April grew by 3.5% 3.7% something like that.

2.7.

You look at just retail, but they don’t factor out inflation, inflation is more than the growth in retail sales.

So essentially what’s happening is the consumer is spending more and getting less and they know it.

So that’s what’s been going on and then in an environment like that uh whereas the consumer spend well, they spend where they have to spend first.

So on necessities, on food, on, on that, on that core health and beauty care types of uh types of products.

And so, so that’s what’s been happening.

So discretionary sales are simply not happening.

And target being a retailer who’s made its name on those kind of nice to have fun products like apparel, you know, cool apparel, uh electronics, home goods are kind of fancy, kind of fun, you know, chic, chic, shabby, whatever, but uh Targets made its name in those discretionary and that’s not what the consumer is buying right now.

Meanwhile, where they are buying, which is in these necessities I talked about.

Target has uh just simply doesn’t have a strong value perception compared to Walmart or Costco or others.

And consumers saying I’m not gonna pay too much for it at Target.

I’m gonna go to Walmart.

So Jerry, then where does that leave this turnaround story?

When it comes to the fact that people simply are not going to target?

They’re not spending those discretionary items.

We have elevation uh inflation, excuse me, which it remains elevated but has improved just a bit.

How long is it going to take them for this turnaround story to play out?

Well, they’re, they’re doing a lot of things well, and you saw just earlier this week that they, they knew this, obviously that things were tough in this area.

That’s why they just this week, they announced they’re taking down prices on 5000 items.

And so they’re, they’re clearly trying to project value.

The problem is they, they aren’t really set up to do it.

And so, for example, uh uh target, uh you know, years ago, about 20 years ago, made a strategic blunder to basically pull out of the full service grocery business.

What you have target right now is really a large convenience grocery store.

Whereas Walmart is the nation’s largest real grocery store with all the departments and fresh produce and everything else that you want.

And that positions target very poorly.

They can’t fix that overnight.

They can’t suddenly sort of snap their fingers across all these stores and have a real grocery store inside of them.

And So, so it’s kind of a backwards hyper Mart at Target right now where, what you have is, uh, you know, Principal Hypermart is, uh, you go to the grocery part every week and then you pick up the general merchandise at higher margin while you’re there targets kind of kind of backwards.

It’s, uh, you go, you go by general merchandise once a month and while you’re there, you pick up some low margin grocery.

This is a fundamental strategic blunder that target made about 20 years ago and put them in very bad shape compared to Walmart.

But there’s a lot they can do and they’re starting to do more of that, like emphasize price more, uh, uh and so on and so forth.

But I also have to point out they’ve done this themselves on price integrity.

So they’ve, they’ve got a loyalty program that’s very expensive.

And so they have to raise the everyday prices in order to pay for the loyalty program.

Uh, their ads are frequently full nowadays with, with Bogo as we call them the business, you know, buy one, get a sale on something else, buy one, get a dis, get, get a, uh, a gift card discount like on uh, like on laundry products, uh detergent products, things like that.

So this undermines price integrity.

So once Target’s been working for some time against, uh, you know, actually hurting their price perception, they aren’t gonna fix it overnight.

So Jerry is it too late then for Target, when you take into account the move that they’re rolling out.

Target 360 they’re cutting prices on up to 5000 products.

Is that going to move the needle or is it too little too late here?

Of an effort?

Well, I think it will move the needle.

Uh, they, they’re coming from a big hole.

I mean, they still are not matching their prep Denver performance when you look at operating margins.

And so that’s kind of disconcerting when you think about Walmart, you know, flew past those numbers a long time ago, has been just blasting off during the same period.

That target is uh is struggling and so long ago, uh we can stop blaming target’s issues on supply difficulties for the pandemic.

Remember we all said that, oh, it’s all the same.

It was never all the same even when both Target and Walmart were struggling.

Walmart was doing much better than Target.

And so now as you come out of this target’s got to look towards the future and, and fund, ask those fundamental questions.

Where, where are we really gonna stand on prices?

Because it’s not gonna work.

Just to say, well, we’re more expensive than uh than Walmart is in some cases, quite a bit more expensive by the way.

And you’ve got all the, and people like that under pricing even more even lower than Walmart prices, you know.

So where are we going to be on price.

I don’t think they’ve answered that.

Uh, overall, they’re just taking sort of tactical moves to try to impact it.

But, but they’re a huge retailer.

They have a great deal amount of consumer brand equity.

People still love shopping there.

So I think they have a lot of work, a lot to work with.

So I’m not telling them out, but it’s gonna take a while.

I would say they did uh sort of say that their guidance said sales for this current quarter, the second quarter will be between zero and 2% positive, same store sales if they’re able to do that, that’d be the first time.

Targets had positive same store sales in a very long time as you know, they were, you know, negative 3 3% plus in this uh in this uh in this quarter when Walmart was positive 3%.

So the quarters already halfway over.

So they know where they’re going to come out or at least part of it.

And they’re saying, oh, we might be flat and now it up a little bit in this quarter.

That would be significant improvement in trend.

So I’m hoping that’s what we’re going to see.

All right, Jerry.

So we have to leave it there.

Search advisor, Ceo, former Toys R US CEO.

Thank you so much for joining us here and for uh weighing in on target’s results again, target off just around nearly 7%.

Here in early trading.

Well, coming up next, we’ve got wealth.

It’s dedicated to all of your personal finance needs.

Brad Smith.

He has you for the next hour.

Many and I will see you tomorrow.

Stay tuned.