[News] Huawei and XMC Collaborate to Develop HBM, Looking to Break Through U.S. Sanctions – TrendForce

According to a report from the Korean media outlet The Chosun Daily, Chinese company Huawei plans to collaborate with memory manufacturer Wuhan Xinxin Semiconductor Manufacturing Co. (XMC) to produce High Bandwidth Memory (HBM) semiconductors. Additionally, Jiangsu Changjiang Electronics Technology (JCET) and Tongfu Microelectronics, which are developing CoWoS advanced packaging technology, are also participating in the project.

CoWoS is a high-precision technology that integrates graphics processing units (GPUs) and HBM on a single substrate. This enhances computational performance, saves space, and reduces power consumption. Currently, the CoWoS technology developed by leading foundry TSMC is used in the production of AI chips for GPU giant NVIDIA.

In May 2023, according to another report from Reuters, China’s leading DRAM company CXMT (ChangXin Memory Technologies) collaborated with Tongfu Microelectronics to develop HBM chip samples. Additionally, tech media outlet The Information reported earlier that a series of Chinese companies, led by Huawei, plan to mass-produce HBM and increase China’s HBM output by 2026.

Furthermore, in March 2023, XMC announced the construction of an advanced HBM manufacturing plant, which is expected to produce 3,000 12-inch wafers per month.

The report further emphasizes that China is still in the early stages of HBM development. However, under the technological restrictions imposed by the United States in the semiconductor and artificial intelligence sectors, Huawei and a series of Chinese semiconductor companies’ move into HBM production has attracted close attention.

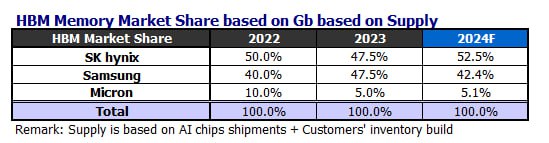

Currently, South Korean companies SK Hynix and Samsung Electronics control most of the global HBM market share, indicating that Huawei’s plan to develop HBM still has a long way to go.

Per TrendForce’s data, the three major HBM manufacturers held market shares are as follows: In 2023, SK Hynix and Samsung each held around 47.5%, while Micron’s share was roughly 5%. Still, forecasts indicate that SK Hynix’s market share in 2024 will increase to 52.5%, while Samsung’s will decrease to 42.4%.

Read more

(Photo credit: XMC)