KLA Options Trading: A Deep Dive into Market Sentiment – Quantisnow

© 2024 quantisnow.com

Democratizing insights since 2022

Investors with a lot of money to spend have taken a bearish stance on KLA (NASDAQ:KLAC).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with KLAC, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 10 options trades for KLA.

This isn’t normal.

The overall sentiment of these big-money traders is split between 20% bullish and 70%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $64,000, and 9, calls, for a total amount of $288,986.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $530.0 to $880.0 for KLA over the recent three months.

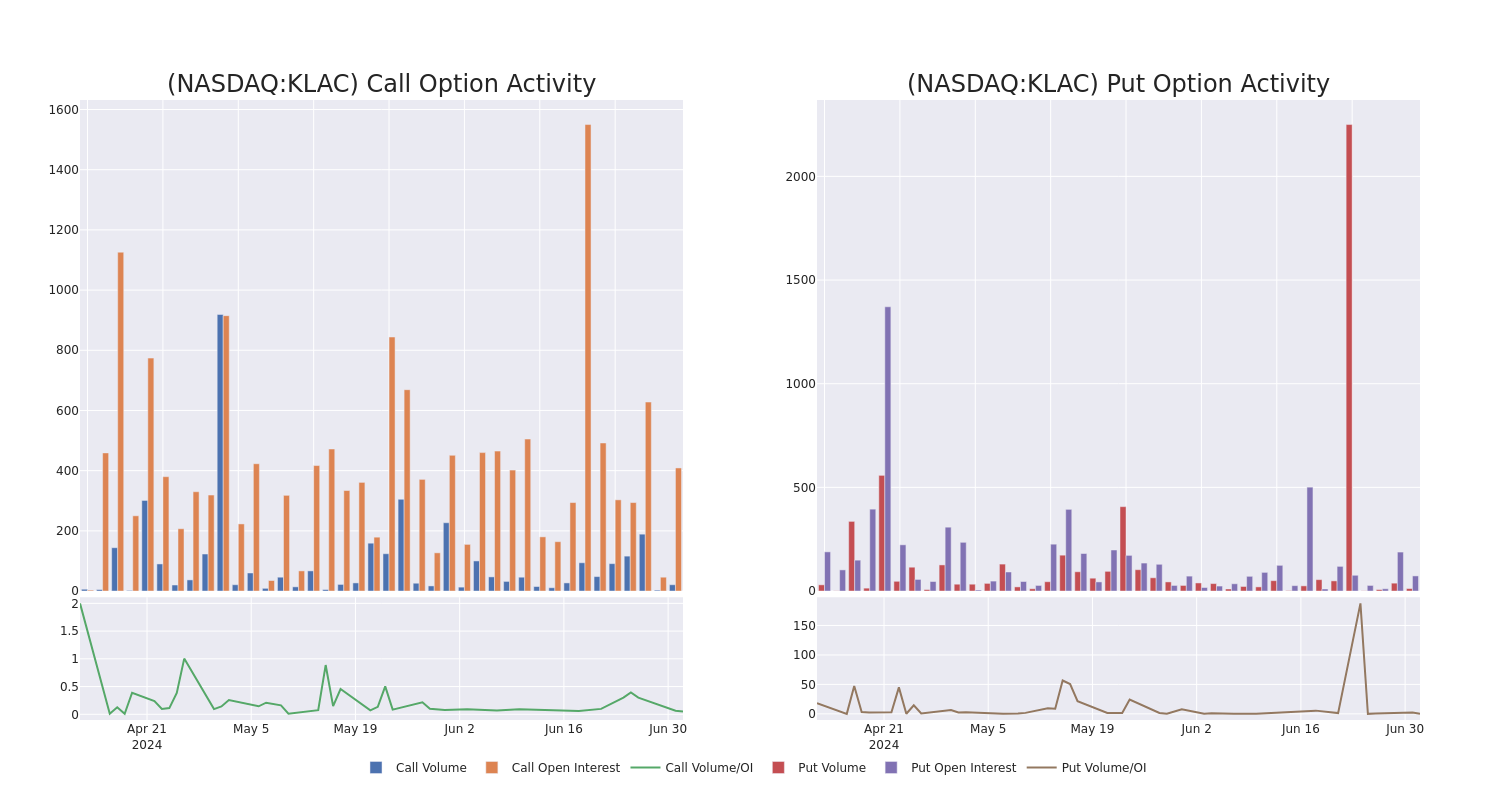

In today’s trading context, the average open interest for options of KLA stands at 118.86, with a total volume reaching 12.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in KLA, situated within the strike price corridor from $530.0 to $880.0, throughout the last 30 days.

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KLAC | PUT | TRADE | BEARISH | 12/20/24 | $32.0 | $32.0 | $32.0 | $750.00 | $64.0K | 56 | 0 |

| KLAC | CALL | TRADE | BEARISH | 01/17/25 | $114.6 | $108.2 | $109.65 | $840.00 | $43.8K | 158 | 1 |

| KLAC | CALL | TRADE | NEUTRAL | 12/20/24 | $192.3 | $186.6 | $189.15 | $710.00 | $37.8K | 8 | 0 |

| KLAC | CALL | TRADE | BEARISH | 01/17/25 | $129.2 | $126.0 | $126.0 | $820.00 | $37.8K | 177 | 0 |

| KLAC | CALL | TRADE | BULLISH | 07/19/24 | $335.0 | $329.2 | $335.0 | $530.00 | $33.5K | 1 | 0 |

KLA is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segment of semiconductor process control, wherein machines inspect semiconductor wafers during research and development and manufacturing for defects and verify precise measurements. In this section of the market, KLA holds a majority share. It also has a small exposure to the etch and deposition segments of the WFE market. It counts as top customers the largest chipmakers in the world, including TSMC and Samsung.

In light of the recent options history for KLA, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

In the last month, 1 experts released ratings on this stock with an average target price of $950.0.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for KLA, Benzinga Pro gives you real-time options trades alerts.

MILPITAS, Calif., July 2, 2024 /PRNewswire/ — KLA Corporation (NASDAQ:KLAC) today announced that the company will review fourth quarter fiscal year 2024 earnings on Wednesday, July 24, 2024 at 2 p.m. PT. The company's results will be published on the same day after the stock market closes, as well as supplemental disclosures including a shareholder letter and earnings slide presentation. All earnings disclosures as well as the live earnings webcast will be available on the Investor Relations page of KLA's website at ir.kla.com. A replay of the webcast will be posted after the event. Logo – https://mma.prnewswire.com/media/806571/KLA_Corporation_Logo.jpg About KLA: KLA Corporation ("KLA") d

MILPITAS, Calif., May 16, 2024 /PRNewswire/ — KLA Corporation (NASDAQ:KLAC) today announced webcasts for upcoming investor conferences: Tuesday, May 21, 2024 – J.P. Morgan 52nd Annual Global Technology, Media and Communications Conference at 9:30 a.m. ETThursday, June 6, 2024 – BofA Securities 2024 Global Technology Conference at 10:40 a.m. PTTuesday, June 11, 2024 – Nasdaq Investor Conference in Partnership with Jefferies at 11:15 a.m. BSTThe live webcasts will be available on the Investor Relations page of KLA's website at http://ir.kla.com/ and a replay of the webcasts will be posted after the event. Logo: https://mma.prnewswire.com/media/806571/KLA_Corporation_Logo.jpg About KLA: KLA

MILPITAS, Calif., May 2, 2024 /PRNewswire/ — The KLA Corporation (NASDAQ:KLAC) Board of Directors today declared a quarterly cash dividend of $1.45 per share on its common stock, payable on May 31, 2024 to KLA shareholders of record as of the close of business on May 15, 2024. Logo: https://mma.prnewswire.com/media/806571/KLA_Corporation_Logo.jpg About KLA: KLA Corporation ("KLA") develops industry-leading equipment and services that enable innovation throughout the electronics industry. We provide advanced process control and process-enabling solutions for manufacturing wafers and reticles, integrated circuits, packaging and printed circuit boards. In close collaboration with leading cus

Total revenues were $2.36 billion, above the midpoint of the guidance range of $2.30 billion +/- $125 million;GAAP diluted EPS attributable to KLA was $4.43 and non-GAAP diluted EPS attributable to KLA was $5.26, both of which were near the upper end of the respective adjusted guidance ranges;Cash flow from operating activities for the quarter and last nine months were $910.0 million and $2.42 billion, respectively, and free cash flow was $838.2 million and $2.20 billion, respectively; andCapital returns for the quarter and last nine months were $569.4 million and $1.84 billion, respectively.MILPITAS, Calif., April 25, 2024 /PRNewswire/ — KLA Corporation (NASDAQ:KLAC) today announced financ

Citigroup reiterated coverage of KLA Corporation with a rating of Buy and set a new price target of $980.00 from $760.00 previously

Barclays upgraded KLA Corporation from Underweight to Equal Weight and set a new price target of $765.00 from $630.00 previously

Jefferies initiated coverage of KLA Corporation with a rating of Buy and set a new price target of $820.00 from $740.00 previously

TD Cowen reiterated coverage of KLA Corporation with a rating of Hold and set a new price target of $700.00 from $650.00 previously

MILPITAS, Calif., May 2, 2024 /PRNewswire/ — The KLA Corporation (NASDAQ:KLAC) Board of Directors today declared a quarterly cash dividend of $1.45 per share on its common stock, payable on May 31, 2024 to KLA shareholders of record as of the close of business on May 15, 2024. Logo: https://mma.prnewswire.com/media/806571/KLA_Corporation_Logo.jpg About KLA: KLA Corporation ("KLA") develops industry-leading equipment and services that enable innovation throughout the electronics industry. We provide advanced process control and process-enabling solutions for manufacturing wafers and reticles, integrated circuits, packaging and printed circuit boards. In close collaboration with leading cus

Total revenues were $2.36 billion, above the midpoint of the guidance range of $2.30 billion +/- $125 million;GAAP diluted EPS attributable to KLA was $4.43 and non-GAAP diluted EPS attributable to KLA was $5.26, both of which were near the upper end of the respective adjusted guidance ranges;Cash flow from operating activities for the quarter and last nine months were $910.0 million and $2.42 billion, respectively, and free cash flow was $838.2 million and $2.20 billion, respectively; andCapital returns for the quarter and last nine months were $569.4 million and $1.84 billion, respectively.MILPITAS, Calif., April 25, 2024 /PRNewswire/ — KLA Corporation (NASDAQ:KLAC) today announced financ

MILPITAS, Calif., Feb. 7, 2024 /PRNewswire/ — The KLA Corporation (NASDAQ:KLAC) Board of Directors today declared a quarterly cash dividend of $1.45 per share on its common stock, payable on March 1, 2024, to KLA shareholders of record as of the close of business on Feb. 19, 2024. Logo: https://mma.prnewswire.com/media/806571/KLA_Corporation_Logo.jpg About KLA: KLA Corporation ("KLA") develops industry-leading equipment and services that enable innovation throughout the electronics industry. We provide advanced process control and process-enabling solutions for manufacturing wafers and reticles, integrated circuits, packaging, printed circuit boards and flat panel displays. In close colla

Total revenues were $2.49 billion, above the midpoint of the guidance range of $2.45 billion +/- $125 million;GAAP diluted EPS attributable to KLA was $4.28. Non-GAAP diluted EPS attributable to KLA was $6.16, near the upper end of the guidance range. GAAP EPS was impacted by a $219.0 million impairment charge for goodwill and purchased intangible assets, or $1.59 per diluted share.Cash flow from operating activities for the quarter and last twelve months were $622.2 million and $3.48 billion, respectively, and free cash flow was $545.4 million and $3.17 billion, respectively; andCapital returns for the quarter and last twelve months were $634.7 million and $2.50 billion, respectively.MILPIT

4 – KLA CORP (0000319201) (Issuer)

4 – KLA CORP (0000319201) (Issuer)

4 – KLA CORP (0000319201) (Issuer)

4 – KLA CORP (0000319201) (Issuer)

SD – KLA CORP (0000319201) (Filer)

8-K – KLA CORP (0000319201) (Filer)

10-Q – KLA CORP (0000319201) (Filer)

8-K – KLA CORP (0000319201) (Filer)

SC 13G/A – KLA CORP (0000319201) (Subject)

SC 13G/A – KLA CORP (0000319201) (Subject)

SC 13G/A – KLA CORP (0000319201) (Subject)

SC 13G/A – KLA CORP (0000319201) (Subject)

MILPITAS, Calif., July 24, 2023 /PRNewswire/ — KLA Corporation (NASDAQ:KLAC) announced the appointment of Michael R. McMullen to its Board of Directors and Compensation and Talent Committee. McMullen was named President of Agilent Technologies in 2014 and Chief Executive Officer in 2015 and has been with the company and its predecessor, Hewlett-Packard, for more than 30 years. "We are excited to welcome Mike McMullen to the KLA board," commented Robert M. Calderoni, chair of the board of KLA. "Mike's extensive experience in driving growth at a global scale in complex multinational equipment businesses makes him an ideal fit for KLA's board as we execute our long-term growth strategies." Log

Saidin brings over three decades of technology operations experience to Tassat Tassat Group Inc., the leading provider of real-time digital payments solutions for commercial banks and their corporate clients, today announced the appointment of Zain Saidin as Chief Operating Officer. This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230214005566/en/Zain Saidin, Chief Operating Officer at Tassat Group, Inc. (Photo: Business Wire) Saidin is a technology operations veteran, bringing over 30 years of technology integration, and strategic business development to Tassat. Prior to joining Tassat, Saidin served as the Chief Engineer and an

LYON, France, December 6, 2022 — EDAP TMS SA (NASDAQ:EDAP) (the "Company"), the global leader in robotic energy-based therapies, announced today that the Company has hired medical capital equipment finance industry veteran Ken Mobeck as Chief Financial Officer of EDAP Technomed Inc., the Company's U.S. subsidiary. During his extensive career, Mr. Mobeck has demonstrated significant leadership expertise in driving transformational business growth while establishing a track record of creating lasting shareholder value. Marc Oczachowski, Chairman and Chief Executive Officer of EDAP TMS, stated, "I am very pleased to welcome Ken onboard our U.S. subsidiary. Ken is a great addition to Ryan Rh

Sunrise, Florida, April 08, 2021 (GLOBE NEWSWIRE) — Nano Dimension Ltd. (“Nano”, Nasdaq: NNDM), an industry leading Additively Manufactured Electronics (AME)/PE (Printed Electronics) provider, announced today the appointment of Hanan Gino as Chief Product Officer and the Head of Strategic M&A. For over 30 years, Mr. Gino has been a senior executive leading international technology corporations. As the President of Verint Systems Inc. (Nasdaq: VRNT) global Security Intelligence business (“SI”), he was responsible for 1,200 employees and grew SI’s revenue from $200 million to $400 million annually. As the CEO of Verint Systems Ltd., he was also responsible for the acquisition a

AMAT, AMD, AMKR, ARM, AVGO, KLAC, LRCX, MRVL, MU, NVDA, TSM

Cantor Fitzgerald analyst C J Muse maintains KLA (NASDAQ:KLAC) with a Neutral and raises the price target from $800 to $950.

Stifel analyst Brian Chin maintains KLA (NASDAQ:KLAC) with a Buy and raises the price target from $760 to $875.