Is Now a Golden Opportunity to Buy ASML Stock, With Revenue Set to Jump? – The Motley Fool

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

The company's new High NA EUV system is set to fuel its results moving forward.

Semiconductor equipment manufacturing is a notoriously lumpy business. The companies in this line of business, such as ASML (ASML -0.40%), make the intricate (and expensive) machinery that creates various semiconductor chips, such as Nvidia’s graphic processing units (GPUs). The demand for their services varies from year to year, making investing a bit of a cyclical guessing game.

For ASML, analysts forecast the company will see a jump in revenue later this year and into the next. Let’s look at the reasons behind that upbeat forecast and determine whether now is a golden opportunity to buy the stock.

The lumpiness of ASML’s business could be seen in its fiscal first-quarter results reported in April as the Dutch company saw its Q1 revenue decline nearly 22% year over year to 5.3 billion euros ($5.74 billion), while sequentially revenue fell 27%. The company generates revenue from both selling new and used lithography systems, as well as from after-sales support. Its Q1 equipment sales were down nearly 26% year over year to 3.97 billion euros ($4.3 billion), while its service revenue fell nearly 6% year over year to 1.32 billion euros ($1.43 billion).

The company sold 66 new lithography systems and four used systems in Q1 compared to 96 new and four used systems a year ago. In Q4, it sold 113 new lithography systems and 11 used systems.

While Q1 was nothing to write home about, what is exciting is that the company began shipping its newest machine, a High Numerical Aperture Extreme Ultraviolet lithography system, or High NA EUV for short, to customers. Intel (INTC 0.29%) was the first to receive and install one of these new High NA EUV systems in April.

At the time, Intel said the new system would allow its foundry to provide never-before-seen precision and scalability in chip manufacturing. It will also help it develop chips with innovative features and capabilities that are needed for advancements in artificial intelligence (AI).

Image source: Getty Images.s

Meanwhile, ASML recently said that two of its other large customers, Taiwan Semiconductor Manufacturing (TSM -1.33%) and Samsung, would also take shipments of new High NA EUV systems by year’s end. TSMC had previously balked at buying the system because of its $380 million price tag. However, recent reports indicate that negotiations with TSMC are nearly complete and that ASML expects “significant” 2nm-related orders from its largest customer starting in the second or third quarter of 2024.

ASML is bullish that the new High NA EUV system will be a big growth driver, previously forecasting 2025 revenue to climb to between 30 billion to 40 billion euros ($32.4 billion to $43.2 billion). The company generated 27.6 billion euros ($29.8 billion) in revenue last year.

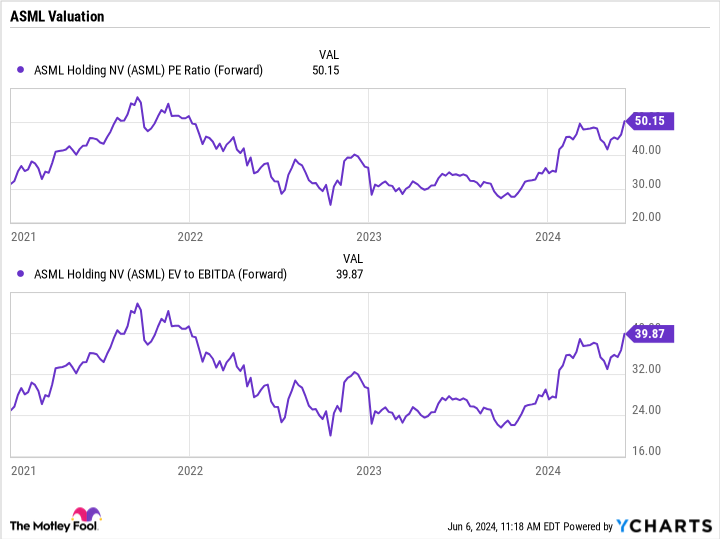

Looking at valuation, ASML stock is not cheap on the surface, trading at a forward price-to-earnings (P/E) multiple of about 50 times and an enterprise value (EV)-to-EBITDA multiple of 40 times. The latter metric takes into consideration its net cash position and takes out non-cash expenses such as depreciation.

ASML PE Ratio (Forward) data by YCharts.

However, with its new system and continued capacity expansions by semiconductor manufacturers to keep up with demand for the latest chips to help power AI, ASML is expected to see a big increase in 2025 earnings per share (EPS) and earnings before interest, taxes, depreciation, and amortization (EBITDA) over 2024 levels. Analysts project 2025 EPS to jump from an estimated $20.76 this year to $32.23 in 2025. For EBITDA, analysts are looking for an increase to over $16 billion from projections of $10.3 billion in 2024. That would bring its P/E multiple down to around 32 times and its EV/EBITDA multiple to about 25 times based on 2025 projected numbers.

Given the growth and tailwinds behind the company, those valuation metrics look attractive. ASML is currently the only company building chip manufacturing machines with High NA EUV technology, and it looks to have a huge technological advantage over its competitors in this area. At the same time, the company is in a good spot as the demand for AI and the chips needed to power it continues to explode.

With TSCM giving in and buying its latest equipment, one large risk has now been removed. As such, now does look to be a golden opportunity to buy ASML stock before its revenue and earnings head much higher from here.

Geoffrey Seiler has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

© 1995 – 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.