China's New Strategy for Waging the Microchip Tech War – CSIS | Center for Strategic and International Studies

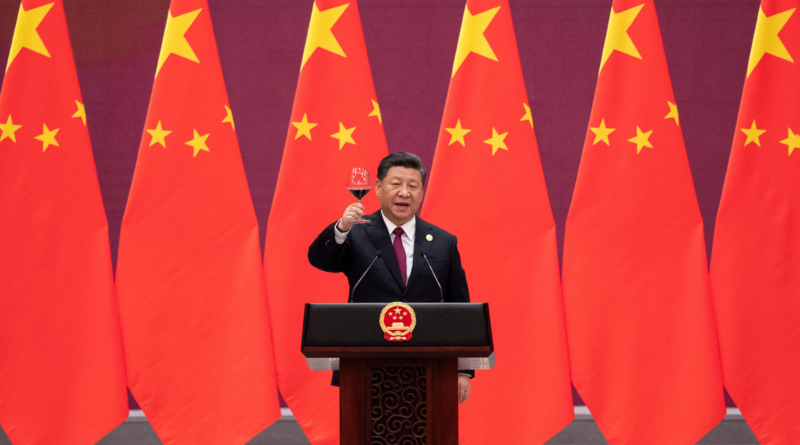

Photo: NICOLAS ASFOURI/POOL/AFP/Getty Images

Report by Gregory C. Allen

Published May 3, 2023

Two dates from 2022 seem certain to echo in geopolitical history. The first, Russia’s invasion of Ukraine on February 24, hardly needs further explanation. The second is October 7, when the U.S. government enacted a series of new export control regulations targeting China’s artificial intelligence (AI) and semiconductor industries. While most Americans are likely only faintly aware of the October 7 policy and its significance, the date marked the beginning of a new era in U.S.-China relations and, with it, international politics.

U.S. secretary of state Antony Blinken nearly said as much in a speech delivered only 10 days after the new policy was enacted. “We are at an inflection point,” Blinken said. “The post-Cold War world has come to an end, and there is an intense competition underway to shape what comes next. And at the heart of that competition is technology.”

In many ways, the October 7 policy was narrowly targeted. It only restricted exports of certain types of advanced computer chips for AI applications and the diverse set of technologies needed to design and manufacture AI chips. However, the implementation approach and underlying logic of the new regulations marked a major reversal of 25 years of U.S. trade and technology policy toward China in at least three ways.

First, rather than restricting exports of advanced semiconductor technology to China based on whether the exports were related to military end uses or to prohibited end users, the new policy restricted them on a geographic basis for China as a whole.

Second, previous U.S. export controls were designed to allow China to progress technologically but to restrict the pace so that the United States and its allies retained a durable lead. The new policy, by contrast, actively degrades the peak technological capability of China’s semiconductor industry. Leading Chinese semiconductor firms such as Biren, YMTC, SMIC, and SMEE have all been set back years.

Third, to the extent possible, the policy seeks to prevent China from ever again reaching certain advanced performance thresholds in semiconductor technology. Rather than revising the performance thresholds upward every few years, as had been done in the past, the Biden administration intends to hold those benchmarks constant, meaning that the gap in performance will grow over time as the world advances and China remains stuck behind.

The October 7 policy and the ongoing U.S. campaign to persuade key U.S. allies to join it create a transformed landscape for the Chinese semiconductor industry, which had previously been making rapid, albeit uneven, technological progress. This report provides clues to understanding China’s updated semiconductor strategy in this new era of global technology competition. In doing so, it draws upon dozens of CSIS interviews with global semiconductor industry executives and U.S. and international government officials, as well as an analysis of noteworthy Chinese government publications, leadership statements, and commentary from Chinese experts.

Section 1: The turning point in China’s strategic thinking on semiconductors analyzes key Chinese government publications and policies between 2018 and 2022, providing the necessary historical context to understand China’s reaction to the October 7 export controls.

Section 2: China’s post-October 7 industrial policy challenge characterizes China’s current position in the semiconductor value chain to explain why the October 7 U.S. export controls—as well as the related controls announced in March 2023 by the Netherlands and Japan—pose such a significant challenge for China’s industrial policy.

Section 3: China’s strategic objectives in responding to October 7 provides analysis of China’s strategic objectives for the semiconductor industry.

Section 4: China strikes back—new and old tactics for the updated strategy analyzes how China’s government and industry are responding to October 7 and shows how they form the basis of an updated Chinese semiconductor strategy.

In the initial months after the U.S. export controls enacted on October 7, 2022, China’s response appeared relatively muted. China publicly criticized U.S. actions in a variety of diplomatic fora, filed a suit against the United States in the World Trade Organization (WTO), and reportedly considered (but did not publicly announce) proposals for massive additional semiconductor industry subsidies of more than 1 trillion yuan ($143 billion). A January news report from Bloomberg, citing anonymous Chinese sources, stated that the subsidy plan is on pause. Overall, the aggregate Chinese response in the first few months after October 7 appeared far from equivalent to what the United States had done.

Of course, developing major policy responses takes time, and in the past two months, there are indications of both retaliation against the United States—such as initiating a cybersecurity review of U.S. memory chip producer Micron—and a shift in China’s overall semiconductor strategy. These will be addressed in greater depth in Section 4 of this report.

However, part of the reason that China’s response to the October 7 export controls seems muted is because China’s “response” had already been underway for years. For China’s leadership, the decisive moment in shaping semiconductor strategy was not October 2022 but April 2018, when the United States imposed extremely strict export controls against a major Chinese telecommunications company, ZTE. While the October 7 export controls were in many ways a far more decisive action on the U.S. side, the harrowing experience with ZTE had already led China’s leadership to view the semiconductor industry primarily in national security terms, not economic terms. They came to believe that more extreme U.S. moves in the future were inevitable, including some of what was ultimately included in the October 7 policy (though China was clearly surprised by the timing, breadth, and sophistication of the controls). Thus, much of the shift in China’s semiconductor strategy to blunt future U.S. semiconductor export controls was already underway.

Regarding the intensity of China’s efforts to eliminate U.S. and allied technology from its semiconductor supply chain, one senior U.S. government official told CSIS, “Even before October 7, on a scale of one to ten, China was already an eleven.”

Thus, understanding how China adjusted its strategy in response to the April 2018 semiconductor export controls against ZTE provides the vital context through which to view China’s response to the October 7 export controls.

The story of the ZTE sanctions is complicated. To briefly summarize: ZTE had illegally evaded U.S. sanctions by selling telecommunications equipment containing U.S. chip technology to Iran. ZTE got caught by U.S. authorities in March 2016 and, after a year of legal wrangling, pled guilty, settled with the U.S. government, and paid a $1.2 billion fine in March 2017. However, in early 2018, the U.S. government caught ZTE failing to abide by the terms of the settlement and making false statements to the U.S. government, which ZTE again admitted.

In export controls, the most extreme punishments are usually reserved for companies that repeatedly engage in unlawful activity, especially after pleading guilty. In April 2018, the United States dropped the hammer: the U.S. government imposed sanctions and export controls upon ZTE—China’s second-largest telecommunications equipment company at the time. Among other restrictions, the controls prevented ZTE from buying U.S.-designed semiconductors for use in its telecommunications products. Since many U.S. semiconductor products are specified in international telecommunications technical standards, there was no viable alternative to U.S. technology. ZTE’s manufacturing and sales ground to a halt because they could not build their products without U.S. chips.

In a matter of months, ZTE’s financial situation transformed from significant profitability and rapid growth to imminent bankruptcy. ZTE was ultimately given a lifeline by the intervention of then-U.S. president Donald Trump at the personal request of Chinese Communist Party (CCP) general secretary Xi Jinping.

How did China’s leadership react to the ZTE crisis? Reaching a firm conclusion about the decisionmaking process of China’s most senior leadership is notoriously difficult because they have learned to be vague and secretive. After the 2015 publication of China’s Made in China 2025 policy sparked an international backlash, the industrial policy language in public Chinese government documents and leadership speeches, including on semiconductors, became significantly more secretive. Even though Made in China 2025 is no longer openly discussed in Chinese government leadership speeches, there is ample evidence that it remains a keystone industrial policy.

Despite the secrecy and evasiveness, there are three pieces of strong and publicly available evidence that U.S. export controls on ZTE directly led to a major shift in Chinese strategic thinking. First, the Chinese government immediately began commissioning research on its strategic technology vulnerabilities. Second, speeches by Chinese leadership indicate that ZTE was viewed as a turning point. Third, China made significant changes to its semiconductor policy in the years following ZTE.

In July 2018, Science and Technology Daily, an official newspaper of China’s Ministry of Science and Technology, published a series of articles detailing China’s most vulnerable technology “chokepoints.” (Note: the same Chinese phrase “卡脖子” is sometimes alternatively translated as “strangleholds.”) Chokepoint technologies are those for which China is critically dependent upon U.S., Japanese, and European suppliers and for which producing Chinese substitutes is extremely difficult.

Ben Murphy of the Center for Security and Emerging Technology published an astute analysis of the series. In it, Murphy points out that the articles are a rare example of public Chinese government publications that provide specifics on a vague but extremely important phrase, “key and core technologies are controlled by others.” The “others” are the United States and its allies. The “key and core technologies” are the 35 identified chokepoints, 7 of which directly relate to the semiconductor industry, spanning nearly every segment of the semiconductor value chain. The phrase began to frequently appear in Chinese leadership speeches and state-run media after April 2018.

The second key set of evidence on the importance of April 2018 are Chinese leadership speeches. In November 2018, Dr. Tan Tieniu, then the deputy secretary general of the Chinese Academy of Sciences, gave a speech before many of China’s most senior leadership at the 13th National People’s Congress Standing Committee. In the speech, he argued:

The U.S. ban on ZTE fully demonstrates the importance of independent, controllable ‘core-, high-, and foundational’ technologies. In order to avoid repeating this disaster, China should learn its lesson about importing core electronic components, high-end general-purpose chips, and foundational software.

Some of what Tan argues is consistent with decades of Chinese industrial policy, including Made in China 2025. However, Tan’s speech is indicative of how the ZTE experience in 2018 marked a turning point in the thinking of China’s senior leadership. Strengthening China’s position in strategic technologies was already a long-term economic development policy goal, but there was now also an urgent national security priority: reducing China’s vulnerability to U.S. economic pressure.

Though Tan’s language is blunter, the need to reduce the Chinese technology ecosystem’s exposure to foreign pressure on national security grounds likewise became a recurring theme of Xi’s speeches in the wake of the ZTE crisis.

Notably, in a November 2018 speech, Xi said that “internationally, advanced technology and key technology is more and more difficult to obtain. Unilateralism and trade protectionism have risen, forcing us to travel the road of self-reliance.” Keeping with China’s goal of industrial policy secrecy, the speech was censored. For their international editions, Chinese government news outlets removed all of Xi’s uses of the phrase “self-reliance.” The phrase has an important and controversial connection to Mao Zedong-era China. It also echoes the Made in China 2025 strategy of reducing China’s dependence on foreign technology. “The Roadmap of Major Technical Domains for Made in China 2025,” which was published in September 2015 and covered semiconductors and other sectors, included goals such as “replacement of imports with Chinese-made products basically achieved in key industries” by 2025. The self-reliance phrase also recalls Chinese efforts to improve technology through intellectual property theft and coercing foreign firms to transfer technology.

In September 2020, the U.S.-China trade war had caused Xi and other Chinese officials to return to more hawkish (and candid) language. Xi gave a speech in which he compared the urgency of China’s modern need for improved domestic technology independence to the significance of China’s twentieth century nuclear weapons development program, a success that is deeply revered in CCP ideology. Xi further stated:

As for industry, some critical, core technologies are under the control of others. We rely on imports for some critical devices . . . We need to rush forward with technologies that can make rapid breakthroughs and promptly solve problems. As for strategic technologies that require a long time to succeed, these need to be deployed ahead of schedule. . . . China is faced with many ‘stranglehold’ technological problems.

But the overall Chinese strategy goes further than merely freeing itself from technological dependence on the United States: China also wants to ensure that the United States is dependent upon China. On April 10, 2020, Xi gave a speech at the seventh meeting of the Central Financial and Economic Affairs Commission in which he said, “We must tighten international production chains’ dependence on China, forming powerful countermeasures and deterrent capabilities based on artificially cutting off supply to foreigners.”

The third piece of evidence that ZTE marked a turning point in Chinese thinking comes from the actual behavior of Chinese companies and especially the policies of the Chinese government.

In the private sector, Chinese technology companies began—with extraordinary government financial support—amassing stockpiles of chips and chip-making equipment, buying far in excess of current demand as a hedge against potential future restrictions. Semiconductor executives told CSIS that they had routinely referred to Chinese customers under the label of “non-market demand,” meaning that the customers were buying for strategic reasons unrelated to market conditions or profit maximization.

In the public sector, the Chinese government continued with earlier efforts to massively subsidize growth of the Chinese semiconductor sector but changed its emphasis. The $21 billion National Integrated Circuit Industry Fund (commonly referred to as China’s “Big Fund”) that China’s central government launched in 2014 was renewed in 2019 with an additional $35 billion.

As with all Chinese industrial policy, China’s local governments play a critical role in implementing central government semiconductor policy, including bearing much of the financial burden. In addition to the national-level Big Fund, China’s local governments established 15 semiconductor investment funds, worth an additional $25 billion. China also stepped up its basket of other industry support tools, including government grants, tax breaks, equity investments, and low-interest loans. The U.S. Semiconductor Industry Association estimated in 2021 that these direct and indirect subsidies were worth more than $50 billion.

After the ZTE experience, China’s massive state support increased. More importantly, the subsidies shifted to prioritize the growth of domestic semiconductor capacity and alternatives to foreign technology dependencies, especially on the United States. Rather than pursuing the most profitable market opportunities, the Chinese government directed state support toward eliminating chokepoint dependencies in China’s semiconductor value chain.

Much of this strategic shift was put in motion shortly after the ZTE experience, but it was formally written down in the Chinese State Council’s July 2020 Document No. 8 “Issuance of the New Era to Promote the Integrated Circuit Industry.” In an analysis of Document No. 8, Tai Ming Cheung, Barry Naughton, and Eric Hagt wrote that China’s central government “essentially advocated unlimited support for semiconductor projects” and directed all Chinese local governments to “do everything in their power” to promote the semiconductor sector.

Document No. 8 provides financial and other support measures such as exempting most Chinese semiconductor companies from most import duties and corporate profit taxes, with some sectors exempted from taxes for as long as 10 years. The document acknowledges China’s need for foreign semiconductor technology imports, but it firmly grounds this in a self-reliance mindset. It states that “for a certain period of time, key integrated circuit and software companies receiving state support that must temporarily import equipment for their own use.” China views semiconductor equipment imports as a temporary waypoint on the path to technological self-sufficiency.

Shortly after the publication of Document No. 8, China published its 14th five-year economic plan, covering the years 2021 to 2025. In an August 2020 speech discussing the five-year economic plan, Xi stated:

The international economy, technology, culture, security and politics are undergoing fundamental shifts in many ways. The world is entering into a time of turbulence and transformation. For a while, we will face an external environment with more adverse forces. Therefore, we must be prepared for a series of new risks and challenges.

. . .

We must bring into full play the obvious advantage of China’s socialist system, namely its ability to focus effort on undertaking daunting tasks and do a good job in the fierce battle for key and core technologies. China has a gigantic market and full-fledged industrial system, which is a unique advantage to foster massive application and rapid iteration of new technologies. With such strength, we are able to accelerate the conversion of S&T achievements into real productive forces, and to improve and protect the security of our production chain.

Unsurprisingly, Xi’s thinking is reflected in the final public version of the five-year plan adopted in October 2020, which declares the semiconductor industry to be a top technology priority. The official summary of the CCP’s Central Committee meeting adopting the five-year plan was blunt: it stated that China would “make technological self-sufficiency a strategic pillar of national development.”

Of course, the ZTE event did not occur in a vacuum, and it was not the sole factor in the Chinese government’s new semiconductor strategy. Other events during the Trump administration also weighed heavily, including U.S. sanctions on Huawei and Fujian Jinhua, the Dutch government blocking exports of extreme ultraviolet lithography machines, and the U.S.-China trade war. Nevertheless, the three lines of evidence summarized above show that Chinese national security leadership was focused on the problem of dependence on U.S. technology years before October 2022. These leaders, including Xi, knew that even their strongest technology companies could potentially be strangled quickly and decisively by a U.S. government willing to exploit America’s control of technology chokepoints. Thus, when the Biden administration launched the October 7 export controls policy, many of the key strategic pillars of the Chinese response were already underway.

Just as Moscow’s weaponization of Europe’s dependence on Russian natural gas sparked efforts to remake Europe’s energy sector toward a future without Russia, countries that exploit their strategic position in the semiconductor industry risk persuading geopolitical competitors that they must fiercely work to free themselves of such vulnerabilities or develop countermeasures. Countries with a privileged position in the semiconductor value chain therefore face a trade-off between the foreign policy benefits of exploiting their advantage now and the potential risks of weakening, over time, the customer dependence that is the source of that advantage.

But that trade-off was less of a factor in this case. From the perspective of the Biden administration, the United States and its allies were already bearing most of the cost of enacting a policy such as the October 7 export controls even before Biden took office. The key here is that China was already aggressively pursuing a semiconductor self-sufficiency strategy in the mid-2010s under the Made in China 2025 economic development policy. Then, in April 2018, the ZTE crisis and related U.S. actions shifted China’s main semiconductors focus from one of many economic development “nice to have” goals to an urgent national security priority.

By the time the Biden administration took office, China’s leaders were already persuaded that the United States could never be trusted when it comes to semiconductors and that China should do whatever it takes to build an all-Chinese supply chain as quickly as possible. In making such an assessment, the Biden administration had the benefit of not only all the publicly available evidence reviewed in this report but also classified intelligence.

If China were already going to pursue semiconductor technology independence at any cost—regardless of the Biden administration’s actions—that necessitated a changed approach from the United States and its allies. Instead of attempting to persuade China away from its “self-reliance” strategy, the United States now needed to ensure that the strategy failed.

The global semiconductor value chain is remarkably complex. Some companies play a diverse set of roles, and others are highly specialized. But no single company—indeed no single country—is currently capable of internally performing all roles in the value chain for all the types of semiconductors required for a modern economy. Leading chip sellers routinely have tens of thousands of suppliers distributed globally, and some suppliers are the only companies in the world that possess their technological capabilities at the required performance and reliability.

The U.S. October 7 export controls, alongside the related export controls adopted by Japan and the Netherlands in March 2023, have been analyzed at length in other CSIS reports. Readers are advised to consult these analyses for a more in-depth treatment of the challenge that these policies pose to China’s AI and semiconductor industries, as well as the legitimate national security reasons that the United States and its allies have for pursuing the policy.

This section will focus instead on the significant challenge that the (now multilateral) October 7 export controls pose to China’s industrial strategy for semiconductors. The three countries—along with Taiwan and South Korea, which are partly covered by U.S. application of the Foreign Direct Product Rule—are working together in a way that challenges China’s ambitions across nearly every segment of the semiconductor value chain. The export controls target China across design, design software, fabrication, materials, chemicals, and manufacturing equipment. Within equipment, the combination of U.S., Dutch, and Japanese controls covers nearly every type of advanced chip-making equipment, including etching, lithography, deposition, and metrology, among others.

In practice, this means that China’s dreams of self-reliance will face multiple extremely challenging technological barriers that China must overcome simultaneously in order to extract any benefit or financial return on investment. Even if China succeeds in creating an advanced AI chip-design firm, Chinese foundries cannot fabricate the chips without advanced foreign equipment and chemicals, which are restricted by the export controls. International chip foundries will refuse to fabricate the Chinese designs because these are covered by the U.S. application of the Foreign Direct Product Rule on U.S. chip design software and U.S. manufacturing equipment.

The story is even more difficult for Chinese chip foundries, which cannot import the advanced production equipment they need to make chips better than the performance thresholds covered in the export controls (16 nm logic, 18 nm DRAM, and 128-layer NAND). Even if a Chinese semiconductor equipment firm succeeds in making a single type of advanced equipment domestically—an astonishingly difficult and expensive task—that piece of equipment is nearly useless by itself. In the same way that no commercial jet airliner can fly without wings, engines, electronics, and landing gear, only a complete set of semiconductor production equipment can produce a finished chip.

Moreover, the degree of precision and reliability required for advanced semiconductor manufacturing means that there is a major gap between building a prototype system and producing such systems at competitive performance and scale. Thus, individual Chinese company successes in a single advanced technology cannot gain commercial market traction. The entire Chinese semiconductor ecosystem has to be domestically self-sufficient before China can produce chips at the October 7 performance thresholds. This is the October 7 challenge that China’s semiconductor industrial policy confronts. Of course, it also faces the traditional challenges of industrial policy: information asymmetry and crony capitalism.

Information asymmetry refers to the fact that government bureaucrats generally do not know which firms will effectively use government subsidies and protectionist policies (which firms want) to advance the country’s overall technology level (which the government wants).

Crony capitalism refers to the fact that many approaches to allocating subsidies (aka “picking winners”) will merely result in political capture through an alliance of rent-seeking firms and corrupt government officials. Politically connected firms often secure government support for reasons unrelated to their technological and managerial competence.

The traditional industrial policy mechanism for solving these two challenges is “export discipline,” which conditions state support such that it primarily rewards firms for successfully exporting in foreign markets rather than selling to protected domestic ones. Foreign customers in technologically advanced economies will naturally demand that their exporting suppliers adopt international best practices in management and technology to meet their stringent standards. Foreign customers can also provide expertise and other support to directly aid a supplier’s advancement. This solves both the information asymmetry problem (since bureaucrats can align subsidies to a clear export metric that provides the needed market signal) and the crony capitalism problem (by automatically allocating subsidies according to export success rather than political connections).

Export discipline played a significant role in the successful industrial policies and technological development of Japan, Taiwan, and South Korea during the twentieth century. China’s modern export boom, however, occurred after China joined the WTO, which banned export subsidies for its members in 1995. China has at different times provided various government incentives—such as tax rebates, an undervalued currency, and low-interest loans—to encourage exports, but the Japanese, South Korean, and Taiwanese approaches were more targeted and linked to specific performance criteria, fostering a stronger sense of export discipline.

Thus, China’s post-WTO industrial policy approach (especially after 2006) to ensuring that subsidies and protectionist support are productively allocated toward desired economic and technological development goals has taken a different path, one that relies more on foreign firms owning production facilities in China. China was far more reliant upon foreign direct investment than South Korea, Japan, or Taiwan during their major growth periods. The influx of foreign capital, technology, and managerial expertise has been instrumental in the growth of many industries in China, including semiconductors. By contrast, Japan, South Korea, and Taiwan relied more on domestic investment (through strict government control of the financial system) and technology transfers through licensing agreements.

Fortunately for China, the Chinese domestic market is now large enough that some of the traditional weak points of industrial policy are less of a factor than they were in those countries. Even in Chinese industries that are almost entirely protected from foreign competition, such as internet technology, the competition in the domestic market is fierce enough to weed out weak players and the market is large enough to support multiple large-scale firms. Semiconductor producers in South Korea and Taiwan, by contrast, had no choice but to rely on exports in order to generate sufficient revenues to support the relevant economies of scale and the organizational learning scale provides.

This is the necessary background to understand why the October 7 export controls pose such a challenge for the advancement of the Chinese semiconductor industry. For Chinese chipmakers and chip equipment makers, as well as the bureaucrats seeking to support them, exposure to international markets was the key to providing the critical feedback needed to ensure that they pursued the right technological and operational development path.

Before October 7, China’s chip manufacturing industry could walk that path one step at a time, making progress in advanced etching equipment while lagging in lithography, for example. Now, however, for China to produce chips at the 16 nm logic node or better (or the equivalent technology benchmarks in memory), China will have to break through every single incredibly difficult technological barrier before its firms can begin producing advanced chips.

Worse, Chinese semiconductor equipment firms will have to do so almost entirely without expertise and advice provided by U.S., Japanese, and Dutch firms. The export controls make transfers of such knowledge also subject to export license requirements, and thus de facto banned.

Finally, there are essentially no prospects for foreign customers of Chinese chipmaking equipment. Most of the advanced Chinese equipment producers have been added to the U.S. entity list, meaning they are too risky to have as a supplier for products where a long-term relationship is essential.

The prospects are better for foreign customers of Chinese chipmakers (aka “fabs”). Since many international companies assemble their finished goods in China, many “domestic” chip sales actually represent global market and international customer demand. Even here, however, the situation has worsened.

In mid-2022, Apple was on track to purchase advanced NAND memory chips from China’s YMTC for use in iPhones. Apple cancelled the order in the wake of the export controls. Qualcomm, which alone accounts for about 20 percent of Chinese foundry SMIC’s revenue, is reportedly considering whether to drop SMIC as a supplier even for chips less advanced than those covered by the October 7 performance thresholds. Computer manufacturer Dell announced plans to cease purchases of Chinese chips by 2024. As China’s semiconductor industry becomes increasingly government-driven and cracks down on foreign firms, this global exodus will accelerate.

For China’s advanced node (though not legacy node) chipmaking industry, export discipline (or the version with Chinese characteristics) is now essentially off the table. That means China will have to achieve economies of scale and the organizational learning that scale brings with almost entirely domestic sales. That is not inconceivable, but it is far riskier and more expensive. China’s domestic semiconductor market is massive. But as mentioned above, much of that “domestic” demand is international in nature since semiconductors are an intermediate good for finished products assembled in China for foreign-owned firms and export to global markets. These domestic Chinese chip sales to foreign firms are likely to drop off. Without export discipline, China lacks a clear path to avoid the traps of information asymmetry and crony capitalism.

Unsurprisingly, China’s government has a poor track record of picking winners in the semiconductor industry. In recent years, the strategy has essentially been to flood the sector with money, watch new entrants rush in, and then double down on the winners. In segments of the semiconductor industry with low capital expenditure, such as chip design, this is a viable strategy, especially when paired with export discipline. But in segments of the industry with high capital expenditure, such as chip fabrication and semiconductor equipment manufacturing, the costs of doing anything other than picking a small set of winners in advance are astronomical. Thus, China has had to place a few extremely expensive bets and watch most of the “winners” that the Chinese government picks go bankrupt even with massive government support. In the first eight months of 2022, 3,470 Chinese chip companies shuttered (i.e., even before October 7), up from 1,397 in all of 2020.

Widespread corruption does not help. Many of these bankrupt chip companies died under a cloud of corruption, financial fraud, and extraordinary waste. Several of the top leaders of China’s semiconductor “Big Fund” were arrested in 2022 on corruption charges.

The high capital expenditure requirements of these segments already made executing China’s standard playbook especially difficult. A near total loss of the ability to rely on export discipline—certainly in advanced segments—is going to make China’s crony capitalism and corruption challenges worse. In the non-advanced segments, Chinese chip equipment producers are still subject to foreign competition, whose products are vastly superior on every metric that matters.

China is probably willing to pump vastly more money into the system, but at this scale the marginal value of additional money is relatively low and probably more likely to enrich corrupt officials than to produce leading firms. A U.S. government official told CSIS that “Chinese semiconductor subsidies were already past the limit of what the industry could productively absorb.”

Despite these extraordinary headwinds, China is not going to give up. Perhaps twentieth century Japan, South Korea, and Taiwan had the better industrial policy, but twenty-first century China is richer and more stubborn. In many other sectors, such as electric cars, China’s leadership has shown extraordinary patience and a willingness to waste astonishing sums of money in order to give birth to globally competitive Chinese firms. Sometimes, however, this patience has borne fruit: a recent article in the Economist was titled “China’s BYD is overtaking Tesla as the carmaker extraordinaire.”

In sum, China’s basic strategy of pursuing self-reliance in semiconductors on national security grounds was already solidified after April 2018 and remains in place. However, October 7 was a watershed moment in international relations, one that occurred sooner than China expected and poses major challenges to China’s industrial policy for semiconductors. There is no doubt that China will respond with an updated strategy and new tactics. Some elements of this are already underway. This response is the focus of Section 3.

Section 3: China’s Strategic Objectives in Responding to October 7

In the wake of October 7, China is pursuing four strategic objectives:

Limiting China’s Exposure to Foreign Pressure

Much of the relevant economic pressures are covered in Section 1, but there is an additional issue worth raising: the risk of an all-out semiconductor embargo by the United States and potentially U.S. allies as well. China imported more than $350 billion worth of semiconductors in 2020, more in dollar terms than China’s imports of oil. Loss of access to all foreign chips and chip technology would be economically apocalyptic.

Indeed, multilateral chip export controls would have been apocalyptic for Russia had China not helped to fill the gap for its “no limits” Russian partner. An all-out chip embargo on China is likely in the event of a Chinese invasion of Taiwan and perhaps plausible in some other scenarios, such as a blockade of Taiwan. Given that Xi has reportedly given the Chinese military the goal of being able to invade Taiwan by 2027, this is no doubt a factor.

Deterring Future U.S. and Allied Economic Pressure

In the wake of the October 7 export controls, a great deal of commentaryfocused on how China might retaliate. As will be discussed more in Section 4, China is retaliating and will continue to retaliate. However, some of this focus on retaliation confuses ends and means. China’s central strategic aim when it comes to AI and semiconductors is not to punish the United States: it is to gain and preserve the strategic benefits of the technologies. The point of retaliation is to deter future action by the United States and its allies, not to score points.

The October 7 export controls were a significantly more damaging set of semiconductor sanctions and export controls than those pursued by the Trump administration. U.S. economic pressure has increased significantly over the past five years (in response to escalating Chinese provocations) and at this point are damaging what China perceives to be its core strategic interests. China had two options if it wants to change U.S. behavior: deter or appease. As will be discussed more in Section 4, China has chosen to deter and is undertaking a retaliatory campaign that is more willing to inflict pain upon the United States—even at the cost of pain to China—than during prior disputes.

Increasing Foreign Dependence upon China

The greatest current source of global dependence on China in the semiconductor industry is as a customer. This is the natural flip side of the $350 billion in Chinese imports mentioned above. When the flow of chips stops, so does the flow of money, and semiconductor companies need a lot of money. According to 2019 data from the Semiconductor Industry Association, Chinese customers comprised:

In 2021, China was also the world’s largest customer market for semiconductor manufacturing equipment, representing 26 percent of global demand. However, China’s share of both chip demand and equipment demand has shrunk significantly due to both China’s Covid-19 lockdown restrictions and the October 7 controls. China has also proven willing to cut off access to its customers as a tool of foreign policy, in markets as widely divergent as fishing, wine, and NBA basketball TV broadcasts. Chinese leaders talk openly about their willingness to use conditional market access as a tool of foreign policy.

However, demand-side coercive power only goes so far, and China seeks strengthened supply-side coercive power as well. Xi said in April 2020, “We must tighten international production chains’ dependence on China, forming powerful countermeasures and deterrent capabilities based on artificially cutting off supply to foreigners.”

China has become an important supplier of chips across the world, responsible for 9 percent of global production in 2020, but the Chinese share of global chip production declined significantly during the Covid-19 lockdown years. China’s chip production capacity is concentrated in legacy nodes, defined as 28 nanometer or larger. Legacy chips remain vital for a large set of industries, demand is expected to increase, and China is by far the largest investor in this area. If China succeeds in establishing a dominant position in legacy chips, this could give China genuine coercive power in key market segments, such as automotive chips.

China’s most frequently discussed source of near-term coercive power is its dominance of rare-earth metal mining and especially refining capacity, controlling more than 60 percent and 80 percent of global capacity, respectively. There is an important difference, however, between China’s dominance of rare-earth metals and U.S. dominance of semiconductors. China is vulnerable in semiconductors because it lacks technology and a credible path to acquire it. The United States and its allies are vulnerable in rare-earth metals only because they have not shown adequate political will to address the problem.

The United States’ position in rare-earth metals is analogous to the crisis of Europe’s dependence on Russian natural gas. Europe had all the technology to build additional liquid natural gas shipping terminals and the wealth to acquire foreign sources. It simply had a different strategy of “peace through trade” that ensured no substantive attempt to build out the capacity. However, once Russia invaded Ukraine, the crisis created the necessary political will. Any Chinese move to cut off rare-earth metals would spark a rush to develop new mines and new refining capacity—as occurred when China restricted rare-earth metal exports to Japan in 2010. Developing alternative sources is far from instantaneous, but the typically slow timelines in mine permitting and refining facility construction and can be vastly accelerated during a crisis.

The same is not true of China’s pursuit of semiconductor manufacturing equipment. China has been pursuing an intense development effort for more than a decade. After April 2018, that effort morphed into a genuine national security priority with nearly unlimited resources. Even so, China has relatively little to show for its efforts other than waste and corruption.

Gaining the Economic and Security Benefits of AI

With respect to AI, senior leaders in China, including Xi himself, believe that leadership in AI is foundational to the future of military, economic, and geopolitical power. They are correct. Over the past decade, modern AI has already demonstrated remarkable national security capabilities spanning military, intelligence, surveillance, and propaganda, most recently in the war in Ukraine. For nearly a decade, senior U.S. national security leaders have openly stated that they believe that AI will be the key technology to enable continued U.S. military superiority over China. The recent generative AI revolution makes it clear that continued rapid progress in AI technology is unlikely to slow anytime soon.

As explained in a previous CSIS report, the purpose of the October 7 export controls was to exploit U.S. control of strategic semiconductor technologies in order to choke off China’s access to future progress in AI, including its national security applications. In fact, many of the policy ideas implemented by the October 7 export controls were recommended 18 months earlier in the final report of the National Security Commission on Artificial Intelligence.

In short, the Biden administration views export controls on semiconductors as the means to an end. The end is ensuring that the security of the United States and its allies is not threatened by Chinese advances in AI. This is the challenge that China’s leaders are responding to. Retaliation is one tool in that policy response, but it is not the most important one. Section 4 will address the major initiatives that China is undertaking in pursuit of its strategic objectives.

Section 4: China Strikes Back—New and Old Tactics for the Updated Strategy

Though the overall strategy and its goals are broadly similar, China has adopted a combination of new tactics and redoubled efforts on old ones. Though there is more to China’s efforts worthy of consideration, this section will focus on five major tactics that China is employing:

Evading or Circumventing the Controls to Continue Accessing Western Technology

Of the four major categories of exports covered by the October 7 controls, the restrictions on chip-making equipment are by far the easiest to enforce. The equipment is large and extremely expensive and requires a massive amount of post-sales support. These are all features that make export controls easier to enforce. By contrast, AI chips are small and lightweight and may require no post-sales support whatsoever. That makes them an ideal target for smuggling. While no confirmed cases of post-October 7 AI chip smuggling have been reported, chip smuggling has long been a familiar practice in China. In December 2022, a woman was arrested by Chinese customs officials for attempting to smuggle 202 chips inside a false pregnancy belly, though she was trying to avoid Chinese import duties, not evade U.S. export controls.

A U.S. government official told CSIS that China is “definitely” attempting to evade the controls or even outright smuggle the chips. This is easy in small quantities but considerably tougher to accomplish at the needed scale for training large AI models. A small set of hyperscale cloud operators and datacenter providers constitute the vast majority of global demand for the most advanced AI chips. That makes corporate export compliance through “know your customer” and other efforts much easier. Attempting to achieve the necessary scale by aggregating many small purchases through shell companies is possible but would be a slow and laborious process. The U.S. government has also stepped up intelligence community support for export controls enforcement, which should aid the likelihood of catching smugglers.

However, in recent weeks, China has begun a crackdown on the foreign consulting firms that support corporate due diligence efforts, including those related to identifying shell companies and other measures for complying with U.S. export controls and sanctions. As the U.S. government and U.S. firms are trying to gather more information that will allow them to precisely target de-risking efforts, China is taking a classically authoritarian approach that is making that more difficult. There is almost certainly more to come in this area.

A more pressing Chinese tactic for avoiding the controls is accessing computing capacity through the cloud. Since the regulations target a geographic destination and not corporate ownership, it remains entirely legal for Chinese AI companies to import the chips to their subsidiaries in, say, India and then allow Chinese programmers in China to access the computing capacity via the cloud. As predicted in a previous CSIS report, this is indeed occurring.

Finally, Chinese AI companies can simply absorb the performance hit of using chips that comply with the export control performance thresholds, which require chips to meet a dual threshold across processing power and interconnect speed. Nvidia, a leading provider of chips for training AI models, has released reduced interconnect variants of its best AI chips that can legally be exported to China. Lennart Heim of the Centre for the Governance of AI has estimated that the overall performance penalty for using one of these chips compared with the international market model is less than 10 percent. That is certainly tolerable for well-resourced Chinese AI companies and national security organizations.

Seeking to Divide the United States from Its Allies

Four countries—the United States, Japan, the Netherlands, and South Korea—are responsible for the vast majority of global semiconductor equipment sales. Unsurprisingly, as soon as the United States announced the October 7 controls, Chinese firms began courting equipment makers in the other countries. China’s government also began pressuring the other countries to not go along with the U.S. controls. In the case of the Netherlands and Japan, that pressure continues even now. Only days after Japan submitted draft export control regulations for public comment, Chinese foreign minister Qin Gang told his Japanese counterpart, Hayashi Yoshimasa, that

the U.S. once brutally contained Japan’s semiconductor industry by resorting to bullying practices. Today the U.S. has repeated its tricks on China. As the saying goes, do not do unto others what you don’t want done unto you. As the keenly-felt pain still stings, Japan should not help a villain do evil. The blockade will only further stimulate China’s determination for independence and self-development.

Similarly, in a March 20 interview with a Dutch newspaper, Tan Jian, China’s ambassador to the Netherlands, said, “This will not be without consequences. I’m not going to speculate on countermeasures, but China won’t just swallow this.”

Since the Netherlands and Japan have already made plans to join the United States in placing export controls on advanced semiconductor manufacturing equipment, the real audience for these threats is likely South Korea, Germany, and the European Union, which have yet to join the multilateral export control regime and may weigh the severity of China’s actions toward Japan and the Netherlands in their choices.

South Korea is the most important country to add to the equipment export controls. South Korea is a small but sophisticated player in the global semiconductor manufacturing market, with roughly 5 percent global market share. Though South Korean equipment firms are generally less advanced than those of the other three countries, South Korean equipment companies are significantly more advanced than those of China.

South Korea also has deep linkages to the Chinese semiconductor industry. South Korea’s two largest memory producers, Samsung and SK Hynix both have a significant share of their global memory production located in China, and both operate facilities worth tens of billions of dollars that make chips sophisticated enough to be subject to U.S. export controls. Ironically, these firms are also subject to Chinese export controls, which prohibit the South Korean firms from moving the tens of billions of dollars’ worth of equipment (none of which was built by China) out of China.

However, South Korea has reasons to be grateful for the October 7 export control policy. The controls were a massive setback to key Chinese competitors: memory chipmakers YMTC (NAND) and CXMT (DRAM). In the days after the October 7 export controls, the stocks of both Samsung and SK Hynix increased significantly.

Moreover, planned Samsung and SK Hynix production capacity expansion that would have been built in China is now planned for construction on Korean soil. Next year, South Korea is forecast to overtake China as the world’s largest buyer of semiconductor manufacturing equipment. This will presumably delight the South Korean government, which has fretted about its growing trade deficit with China. Semiconductors alone comprise nearly 20 percent of South Korea’s total exports.

The production shift back to South Korea is probably also in the best interest of Samsung and SK Hynix. Industry officials told CSIS that Chinese talent poaching from Samsung and SK Hynix’s Chinese production facilities played a major role in the rapid technological ascent of both YMTC and CXMT. If operating leading-edge facilities in China requires training the workforce of your future Chinese competitors, Samsung and SK Hynix will certainly view that as a less attractive option.

Both China and the United States are actively seeking to sway South Korea’s government to their side in the export controls dispute. However, the United States likely has the edge. In addition to the above-mentioned benefits, South Korea’s government has recently pursued closer ties with both the United States and Japan.

Acquiring Foreign Technology through Industrial Espionage and Talent Recruitment

Industrial espionage has been a part of the semiconductor industry nearly since its inception. In a declassified Central Intelligence Agency (CIA) report from 1977, the CIA wrote that the Soviet Union’s attempt to steal and copy semiconductor manufacturing equipment technology “dwarfs all of their other known illegal purchase efforts.” Of course, the CIA viewed it as a critical U.S. priority to ensure that Soviet acquisition efforts failed, writing that “if the USSR acquires all the equipment that has been ordered, plus manufacturing know-how and training . . . this capability would elevate the USSR to the status of a major world producer of [integrated circuits] ICs, trailing only Japan and the United States.” Fortunately for the CIA and the United States, the Soviet Union did fail to acquire a complete set of advanced equipment and the knowhow needed to effectively operate it.

In recent decades, some industry players have expressed skepticism that industrial espionage is an effective tool, given the importance of tacit knowledge among skilled organizations and workers. Roger Dassen, the chief financial officer of the Dutch lithography equipment firm ASML, said recently that “a lot of ASML’s technology is not on blueprints. . . It’s in the heads of people. And you don’t need just the blueprints; you need everything surrounding it and the entire supply chain. . . . You’re talking about a decade or more before you could replicate something like this.”

Whether or not Dassen is correct, China is clearly trying to steal ASML’s blueprints and much more. ASML’s CEO said in March of this year that ASML has faced thousands of security incidents each year, forcing the company to increase spending on cybersecurity and other protections by a “significant double digit” percentage for multiple years in a row. In a 2018 trial against a former ASML employee who left the company after successfully stealing source code and providing it to Chinese competitors, ASML’s lead attorney said that the theft represented “a plot to get technology for the Chinese government.”

This view was echoed by the Dutch national intelligence agency, which in its 2023 annual report called China “the biggest threat to the Netherlands’ economic security.” In a 2023 interview with the Associated Press, the head of the agency said, “We see that every day they try to steal that [technology] from the Netherlands.”

ASML is far from the only semiconductor firm that has been subject to repeated and brazen Chinese attempts to steal technology, whether via cyber espionage or by recruiting employees to steal from their employers. In the United States, memory chipmaker Micron has been the victim of massive theft and knowledge transfer to Chinese competitor Fujian Jinhua. Contrary to those who claim that espionage is not an effective tool in the semiconductor industry, Fujian Jinhua was able to quickly introduce a DRAM product line that used Micron’s “1x nm” technology.

Perhaps the greatest challenge is for the semiconductor industry of Taiwan. Officials in Taiwan told CSIS that Chinese design firms are often willing to pay Taiwanese engineers 500 percent more than they can make in Taiwan. One official caveated, however, that “this is not a job for life. China will suck the knowledge out of your brain and then fire you, and no Taiwanese firm will hire you back after working for China.” To get around the stigma, Chinese firms have taken to setting up shell companies in Taiwan and recruiting workers to transfer knowledge to China, without ever requiring them to leave Taiwan.

In response to this challenge, Taiwan has introduced new laws designed to strengthen the security of its industry. This even includes setting up a dedicated economic espionage judicial system to speed up trials and convictions.

Structuring activities to maximize foreign knowledge transfer goes beyond espionage and talent poaching. In interviews, multiple individuals with experience in the semiconductor equipment industry stated that Chinese fabs would often structure their manufacturing operations to run foreign equipment and Chinese-built equipment side by side, operated by the same pool of workers. The Chinese fab workers would then provide feedback to the Chinese equipment companies, advising them how to improve their designs based on their experience with foreign systems.

Pressuring Chinese Firms to Buy Chinese and Eliminate American Suppliers

When considering the challenge of advancing China’s level of semiconductor equipment technology, the two biggest advantages that Chinese firms have is that they do not have to do de novo innovation and that they enjoy a lot of state financial support. Regarding the former, Chinese firms do not have to explore the full range of possible technological paths because the correct solution (or at least a correct solution) path has already been discovered by foreign firms. They can focus research and development resources on a single direction that they know can work. Regarding the latter, Chinese equipment can be competitive on price even when it is not competitive on performance and reliability.

The biggest disadvantage that Chinese firms have is that their competitors’ equipment already works and has terrific performance, which makes even Chinese fab firms hesitate when picking Chinese equipment providers.

In slowing the advance of China’s equipment industry, the October 7 export controls were designed to achieve the best of both worlds. In the advanced node segments, Chinese players struggle to get a foothold because they cannot achieve economies of scale until they have a full stack of production equipment technology. In the legacy node segments where Chinese equipment providers have viable product offerings, they will still encounter competition from foreign equipment providers. Legacy equipment products—even those of U.S. firms—are not covered by export controls, except when selling node-agnostic equipment to advanced-node production facilities owned by China. International providers offer equipment with performance significantly better than that of Chinese providers. Thus, it is difficult for Chinese equipment providers to achieve relevant economies of scale even in legacy segments.

In short, Chinese equipment providers cannot learn how to make good products until they have a lot of operational market experience, and they cannot gain significant operational experience because few are interested in buying their unattractive products.

Chinese leaders have a preferred solution to break this vicious cycle: pressure Chinese fabs to buy Chinese equipment. As Xi said in a speech:

We must firmly grasp this strategic basis that is demand expansion, make each link—production, distribution, circulation, and consumption—rely more on the domestic market to achieve a virtuous circle, specify the strategic direction of supply-side structural reform, and promote the achievement of dynamic balance between aggregate supply and demand at higher levels.

History gives good cause for skepticism of the Chinese government’s goals. The Made in China 2025 roadmap anticipated that by 2023, Chinese equipment providers would have already mastered large-scale production of extreme ultraviolet lithography (EUV) equipment. In reality, China’s leading lithography company, the Shanghai Micro Electronics Equipment group (SMEE) is only producing prototype machines equivalent to what ASML was producing at scale a decade and a half ago.

This “all-Chinese” supply chain is also the goal of some influential Chinese firms, including Huawei. In March 2023, Huawei’s chairman said, “For Huawei, we will render our support to all such self-saving, self-strengthening and self-reliance efforts of the Chinese semiconductor industry.” Huawei recently announced that it had collaborated with other Chinese firms to create new chip design software for chips at the 14 nm node or above. If the tools are successfully verified, which Huawei stated would happen this year, it would provide a Chinese competitor to the U.S. dominant firms in the market.

In the equipment space, Chinese equipment firms will likely supply a majority of the new equipment for fabs producing at the 90 nm node or above, according to CSIS discussions with industry executives. However, the executives were skeptical that Chinese equipment firms could supply even 5 percent of the market at the 28 nm node within three years.

Chinese government pressure to “buy Chinese” appears to be extending beyond equipment to the chips themselves. At a recent visit to Xuzhou Construction Machinery Group, Xi Jinping asked the corporate delegation, “Are the chips in your crane all made locally?” The Chinese government has also launched a campaign to pressure Chinese automakers to dramatically increase their purchases of Chinese-made chips. Currently, only 5 percent of the chips in Chinese cars are made in China, despite many automotive chips being made at legacy nodes.

China’s leaders recognize that it cannot build an all-Chinese semiconductor supply chain overnight, but they are seeking to bolster domestic demand and supply simultaneously by focusing on legacy chips and chipmaking equipment, which does appear to mark a new tactic.

However, one U.S. semiconductor executive told CSIS in an interview that the Chinese government’s actions matter less than those of the United States: “The Chinese government doesn’t even need to have a ‘no American chips’ policy,” the executive said. “The U.S. government’s actions are plenty frightening to persuade Chinese firms that they should avoid buying American unless they absolutely have to.”

Combined, this suggests that China is exploring an approach advocated by Lu Feng, a professor at the Peking University School of Government. In a 2023 interview, Lu argued that China should pursue a strategy of “fully independent manufacturing” in two steps. The first step is “de-Americanisation of the production lines,” buying Chinese wherever possible, then from U.S. allies, and only from the United States if necessary. The second step is to “replace all foreign equipment and materials with domestically made equipment and materials.” Lu argues that the key to this strategy is not to pursue individual technologies—a major focus of prior Chinese industrial policies—but instead to establish linkages between Chinese players in all segments of the value chain.

Retaliating against the United States and Its Allies

Last but not least, China is retaliating. Thus far, this retaliation is taking place in two areas.

First, China is using its anti-trust enforcement regime as a block on essentially all mergers and acquisitions involving U.S. semiconductor industry firms. China has employed anti-trust measures to prevent U.S. mergers before, but a December 2022 analysis by the law firm Skadden finds that “of the thousands of deals that China has reviewed, only three (less than 0.01%) have been prohibited. . . . nearly all of the prohibitions, conditional approvals, and abandonments over the past 10 years have occurred in the technology sectors that are important to China’s national growth, such as semiconductors.” Five months later, the Wall Street Journal reported that essentially all semiconductor mergers involving U.S. companies were being significantly slowed or blocked outright. For semiconductor anti-trust reviews, China has taken things from bad to worse.

Second, China has initiated a cybersecurity review of Micron, the largest U.S. memory chipmaker. In an analysis of the Micron case, Graham Webster, chief of the DigiChina Project at Stanford University’s Cyber Policy Center, writes that “the prevalence of Chinese commentary identifying Micron as a company particularly unfriendly to China is important in understanding the context for its cybersecurity review.”

If Micron fails its cybersecurity review, it could be forced out of the Chinese memory market entirely, a potential loss of $3.3 billion in annual sales. At this point, that outcome seems likely. In addition to being fully consistent with a “de-Americanization” approach, excluding Micron could further benefit the company’s South Korean competitors, Samsung and SK Hynix. It may be that China is using this as a potential diplomatic carrot for South Korea to not join the U.S. export controls regime, in addition to the threatened use of sticks.

Both the anti-trust blocking and the Micron review—especially if Micron is ultimately excluded from the Chinese market—are genuinely more significant retaliatory responses than China has taken in the past during, for example, the ZTE dispute. China clearly feels a need to send a more significant signal to deter further U.S. or allied action.

Of course, it is possible that China will ultimately widen the retaliatory measures to additional areas, such as exports of rare-earth metals. Thus far, however, China appears to have calculated that such measures would do more harm than good.

October 7 was a watershed moment in the history of U.S.-China relations, and the international community is still reorganizing itself in the wake of a new U.S. and allied approach of “de-risking” exposure to China. China is adapting to this changed environment, but perhaps with fewer changes than some expected. This serves as evidence that the Biden administration’s calculations in launching the new policy were generally correct, at least as they concerned the semiconductor industry: U.S. allies got on board, and China had few good options to respond beyond their already extremely aggressive policy.

The weakest link in the new policy, however, is in achieving its primary stated purpose: blunting China’s military adoption of AI technology. That will require strengthened multilateral export control enforcement capacity to prevent chip smuggling, as well as a means of dealing with China’s ability to access needed AI computing resources through the cloud and by purchasing adequately advanced AI chips that comply with the October 7 performance thresholds. Generally, however, this is unsurprising. Technology markets change rapidly, and the only export control regime that has a chance of being effective is one that keeps up with the pace of change.

Gregory C. Allen is the director of the Wadhwani Center for AI and Advanced Technology at the Center for Strategic and International Studies (CSIS) in Washington, D.C.

This report is made possible by general support to CSIS. No direct sponsorship contributed to this report.

The author would like to thank Gerard DiPippo, Emily Benson, and Michaela Simoneau for feedback on earlier drafts of this report. The author would like to thank Ben Murphy for research advice and Akhil Thadani and Conor Chapman for research support.

This report is produced by the Center for Strategic and International Studies (CSIS), a private, tax-exempt institution focusing on international public policy issues. Its research is nonpartisan and nonproprietary. CSIS does not take specific policy positions. Accordingly, all views, positions, and conclusions expressed in this publication should be understood to be solely those of the author(s).

© 2024 by the Center for Strategic and International Studies. All rights reserved.

Center for Strategic and International Studies

1616 Rhode Island Avenue, NW

Washington, DC 20036

Tel: 202.887.0200

Fax: 202.775.3199

See Media Page for more interview, contact, and citation details.

©2024 Center for Strategic & International Studies. All Rights Reserved.