As BYD's Dependence on NVIDIA Increases, What About Hyundai? – BusinessKorea

Chinese electric vehicle (EV) manufacturers are increasingly relying on U.S. semiconductor company NVIDIA.

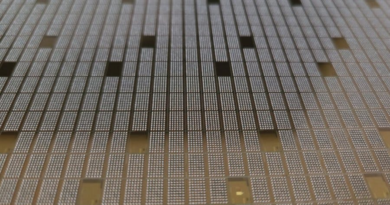

According to the automotive industry on June 9, China's leading EV manufacturer, BYD, plans to equip its new cars, which will be mass-produced next year, with NVIDIA's next-generation automotive semiconductor “DRIVE Thor.” This system-on-chip (SoC) combines a central processing unit (CPU) and a graphics processing unit (GPU), boasting a maximum computational performance of up to 2,000 teraflops (TFLOPS). One teraflop represents the ability to process one trillion operations per second. Prior to BYD, Chinese company Xiaomi launched its electric sedan “SU7” in March, featuring NVIDIA's autonomous driving chip “Orin.” Another Chinese automaker, Geely's premium EV brand Zeekr, also installed the same NVIDIA chip in its new car “Mix.”

The preference for NVIDIA's semiconductors among Chinese EV manufacturers is linked to the vehicle purchasing tendencies of domestic consumers. The younger generation in China, referred to as "Linglinghou" (those born after the year 2000), tends to prioritize autonomous driving capabilities and large displays when buying vehicles.

However, it is not easy for China to secure high-performance semiconductors for electric vehicles without going through the U.S. and its allies, South Korea and Taiwan. NVIDIA's high-performance autonomous driving semiconductors are mainly mass-produced through Taiwan's TSMC. It has been reported that TSMC manufactures non-memory semiconductors for NVIDIA and then attaches Korean-made memory semiconductors to these chips for packaging. Following the U.S. presidential election in November, there is even a possibility that the export paths for NVIDIA semiconductors to China could become narrower or blocked, regardless of who wins the election. The U.S. government's scrutiny of China's semiconductor and electric vehicle industries is expected to intensify.

In contrast, South Korea and Japan are focusing on securing their own automotive semiconductor technologies. Last year, Hyundai Motor Group formed a partnership with AI semiconductor startup TensTorrent, which has former U.S. semiconductor engineer Jim Keller as CEO. Hyundai Motor Group also made a strategic investment of 50 million dollars (approximately 68 billion won) to secure the necessary design assets (IP) for developing high-performance semiconductors. In March, Japan announced that it would support the R&D of automotive semiconductors for major automakers like Toyota and Nissan with 1 billion yen (approximately 9 billion won). The mass production of these developed semiconductors is expected to be undertaken by Japan's public-private semiconductor company, Rapidus.

Never miss another article! Enter your email address below to receive our free daily newsletter: