A Closer Look at ASML Holding's Options Market Dynamics – Quantisnow

© 2024 quantisnow.com

Democratizing insights since 2022

Financial giants have made a conspicuous bullish move on ASML Holding. Our analysis of options history for ASML Holding (NASDAQ:ASML) revealed 79 unusual trades.

Delving into the details, we found 46% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 30 were puts, with a value of $1,942,560, and 49 were calls, valued at $3,145,460.

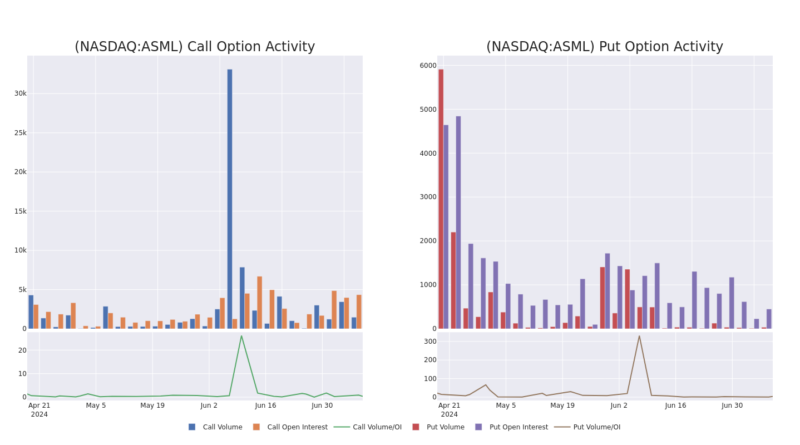

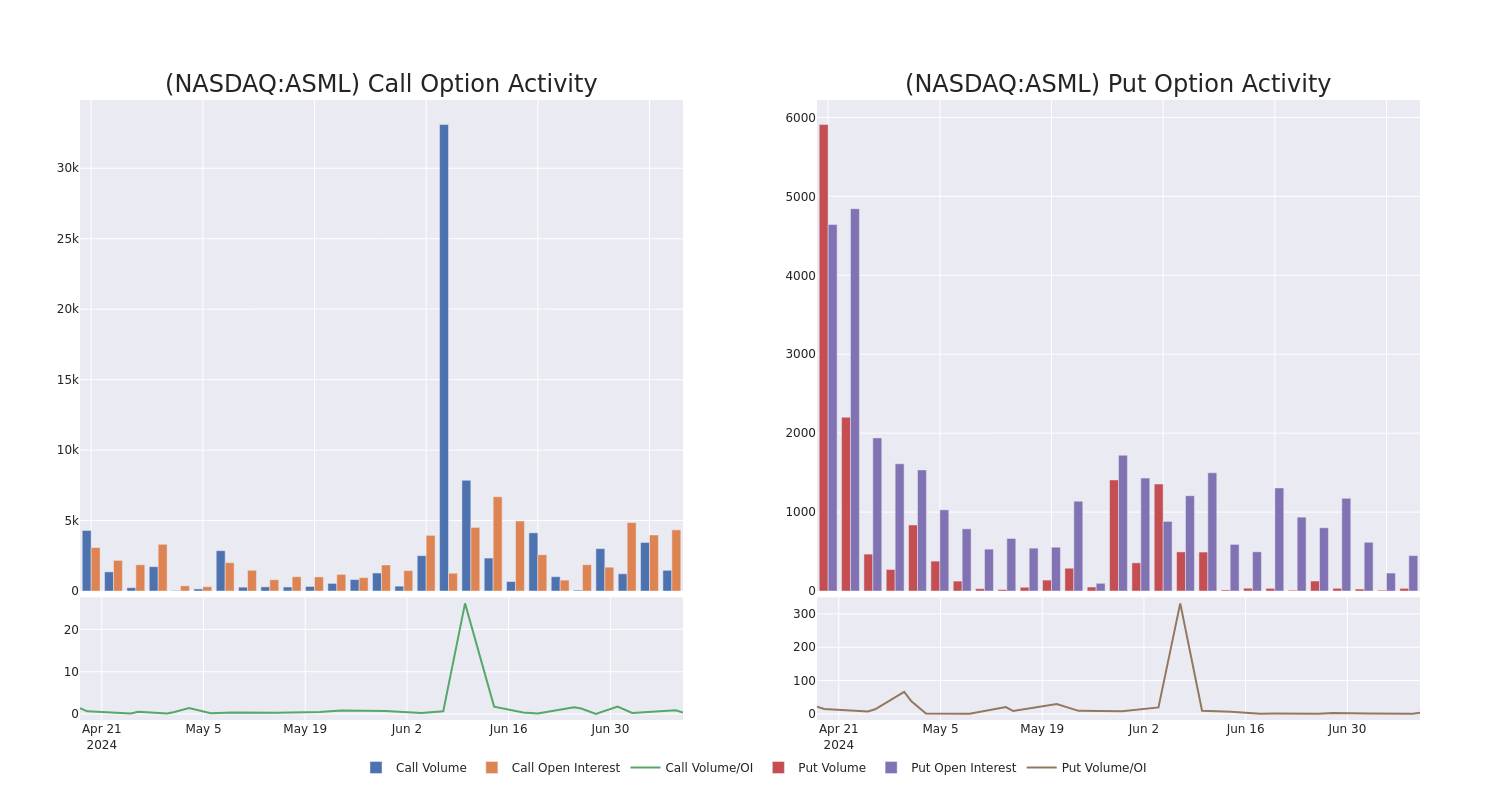

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $820.0 to $1460.0 for ASML Holding over the last 3 months.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for ASML Holding’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ASML Holding’s whale trades within a strike price range from $820.0 to $1460.0 in the last 30 days.

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ASML | PUT | TRADE | BEARISH | 01/17/25 | $75.4 | $73.9 | $75.4 | $1020.00 | $331.7K | 79 | 0 |

| ASML | CALL | SWEEP | BEARISH | 06/20/25 | $74.3 | $70.0 | $70.0 | $1360.00 | $315.0K | 15 | 0 |

| ASML | PUT | TRADE | BEARISH | 07/19/24 | $9.7 | $9.2 | $9.5 | $1000.00 | $190.0K | 876 | 218 |

| ASML | CALL | TRADE | BEARISH | 10/18/24 | $132.9 | $131.5 | $131.5 | $990.00 | $157.8K | 15 | 0 |

| ASML | PUT | TRADE | BEARISH | 07/19/24 | $9.4 | $8.9 | $9.4 | $1000.00 | $104.3K | 876 | 478 |

ASML is the leader in photolithography systems used in the manufacturing of semiconductors. Photolithography is the process in which a light source is used to expose circuit patterns from a photo mask onto a semiconductor wafer. The latest technological advances in this segment allow chipmakers to continually increase the number of transistors on the same area of silicon, with lithography historically representing a high portion of the cost of making cutting-edge chips. ASML outsources the manufacturing of most of its parts, acting like an assembler. ASML’s main clients are TSMC, Samsung, and Intel.

In light of the recent options history for ASML Holding, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

2 market experts have recently issued ratings for this stock, with a consensus target price of $1242.5.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for ASML Holding, Benzinga Pro gives you real-time options trades alerts.

ASML discloses 2024 AGM results Veldhoven, the Netherlands, April 24, 2024 – ASML Holding N.V. (ASML) today announces the results of its Annual General Meeting (AGM) held on April 24, 2024. The 2024 AGM marks the end of the terms of Peter Wennink and Martin van den Brink as Presidents of ASML and the beginning of Christophe Fouquet's term as President and CEO of ASML. At the AGM, ASML's statutory financial statements for the 2023 financial year were adopted. In addition, the following items were approved: Proposal to adopt a final dividend payment of €1.75 per ordinary share, which, together with the two interim dividends paid through the 2023 financial year and the interim dividend pai

ASML reports transactions under its current share buyback program VELDHOVEN, the Netherlands – ASML Holding N.V. (ASML) reports the following transactions, conducted under ASML's current share buyback program. DateTotal repurchased sharesWeighted average priceTotal repurchased value15-Apr-24 10,864 €920.49 €10,000,238 16-Apr-24 11,013 €901.88 €9,932,399 17-Apr-24 – – – 18-Apr-24 – – – 19-Apr-24 – – – ASML's current share buyback program was announced on 10 November 2022, and details are available on our website at https://www.asml.com/en/news/share-buybacks This regular update of the transactions conducted under the buyback program is to be made public under the Market Abuse Regu

ASML reports €5.3 billion total net sales and €1.2 billion net income in Q1 20242024 outlook unchanged VELDHOVEN, the Netherlands, April 17, 2024 – Today, ASML Holding NV (ASML) has published its 2024 first-quarter results. Q1 total net sales of €5.3 billion, gross margin of 51.0%, net income of €1.2 billionQuarterly net bookings in Q1 of €3.6 billion2 of which €656 million is EUVASML expects Q2 2024 total net sales between €5.7 billion and €6.2 billion, and a gross margin between 50% and 51% ASML expects 2024 total net sales to be similar to 2023 (Figures in millions of euros unless otherwise indicated) Q4 2023 Q1 2024 Total net sales 7,237

ASML reports transactions under its current share buyback program VELDHOVEN, the Netherlands – ASML Holding N.V. (ASML) reports the following transactions, conducted under ASML's current share buyback program. DateTotal repurchased sharesWeighted average priceTotal repurchased value08-Apr-24 3,430 €909.33 €3,119,017 09-Apr-24 12,733 €905.30 €11,527,156 10-Apr-24 9,336 €907.57 €8,473,098 11-Apr-24 11,139 €908.86 €10,123,752 12-Apr-24 9,969 €914.97 €9,121,319 ASML's current share buyback program was announced on 10 November 2022, and details are available on our website at https://www.asml.com/en/news/share-buybacks This regular update of the transactions conducted under the buyba

Financial giants have made a conspicuous bullish move on ASML Holding. Our analysis of options history for ASML Holding (NASDAQ:ASML) revealed 79 unusual trades. Delving into the details, we found 46% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 30 were puts, with a value of $1,942,560, and 49 were calls, valued at $3,145,460. Predicted Price Range Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $820.0 to $1460.0 for ASML Holding over the last 3 months. Insights into Volume & Open Interest Looking at the volume and open interest is a powerful move while tradi

In the escalating U.S.-China chip war, the Eindhoven University of Technology, a significant talent source for ASML Holding NV (NASDAQ:ASML), finds itself under increasing scrutiny from the U.S. The Netherlands, a primary source of machinery and expertise for advanced semiconductors, is under pressure from Washington to curb Beijing’s semiconductor production capabilities. What Happened: The Eindhoven University of Technology, located near ASML’s global headquarters, is facing questions from the U.S. due to its large number of Chinese students, Bloomberg reported on Tuesday. The Dutch government finds itself caught between its U.S. ally and a major export market in China amid this escalat

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) stock is trading higher Tuesday as the artificial intelligence tailwinds keep blowing from every end. ASML Holding (NASDAQ:ASML) anticipates nearly €5 billion in orders in the second quarter, driven by Taiwan Semiconductor’s demand for AI chip production tools. Taiwan Semiconductor’s robust orders for ASML’s EUV product line are set to boost ASML’s second-quarter order value above consensus estimates. Super Micro Computer Inc (NASDAQ:SMCI) CEO Charles Liang in an interview with CNBC’s Jim Cramer on Monday expressed optimism about the AI server company’s growth trajectory, stating, “this AI revolution can be bigger even than the industria

ASML Holding NV (NASDAQ:ASML), the leading supplier of equipment to computer chip manufacturers, is poised to witness a surge in new orders, driven by the escalating demand for AI chips. This development is likely to be announced on Wednesday when the company’s new CEO presents the second-quarter results. What Happened: The anticipated influx of orders is attributed to the increasing demand for AI chips, a trend that is expected to prompt ASML’s clients to expand their production capacity, reported Reuters. “We expect ASML’s order received value to reach close to €5 billion (approx. $5.45 billion) in the second quarter, higher than consensus estimates”, Mihuzo analyst Kevin Wang said,

SC 13G/A – ASML HOLDING NV (0000937966) (Subject)

SC 13G/A – ASML HOLDING NV (0000937966) (Subject)

SC 13G/A – ASML HOLDING NV (0000937966) (Subject)

SC 13G/A – ASML HOLDING NV (0000937966) (Subject)

SD – ASML HOLDING NV (0000937966) (Filer)

6-K – ASML HOLDING NV (0000937966) (Filer)

6-K – ASML HOLDING NV (0000937966) (Filer)

20-F – ASML HOLDING NV (0000937966) (Filer)

ASML discloses 2024 AGM results Veldhoven, the Netherlands, April 24, 2024 – ASML Holding N.V. (ASML) today announces the results of its Annual General Meeting (AGM) held on April 24, 2024. The 2024 AGM marks the end of the terms of Peter Wennink and Martin van den Brink as Presidents of ASML and the beginning of Christophe Fouquet's term as President and CEO of ASML. At the AGM, ASML's statutory financial statements for the 2023 financial year were adopted. In addition, the following items were approved: Proposal to adopt a final dividend payment of €1.75 per ordinary share, which, together with the two interim dividends paid through the 2023 financial year and the interim dividend pai

ASML discloses 2023 AGM results Veldhoven, the Netherlands, April 26, 2023 – ASML Holding N.V. (ASML) today announces the results of its Annual General Meeting (AGM) held on April 26, 2023. At the AGM, ASML's statutory financial statements for the 2022 financial year were adopted. In addition, the following items were approved: Proposal to adopt a final dividend payment of €1.69 per ordinary share, which, together with the three interim dividends paid through the 2022 financial year, each €1.37, leads to a total dividend for 2022 of €5.80 per ordinary shareProposals to discharge the members of the Board of Management and the Supervisory Board from liability for their responsibi

ASML intends to appoint Wayne Allan to Board of Management VELDHOVEN, the Netherlands, October 19, 2022 — ASML Holding N.V. (ASML) today announces that its Supervisory Board intends to appoint Wayne Allan as a member of the Board of Management in the position of Executive Vice President and Chief Strategic Sourcing & Procurement Officer. The appointment will be subject to notification of the General Meeting on April 26, 2023. As Executive Vice President and Chief Strategic Sourcing & Procurement Officer, Wayne will be responsible for the Sourcing & Supply Chain organization. The Supervisory Board has decided to position this role in the Board of Management in view of the fact that the perf

ASML selects PwC as preferred audit firm to become its external auditor starting in 2025 VELDHOVEN, the Netherlands, April 29, 2022 – ASML Holding NV today announces that its Supervisory Board has decided to nominate PricewaterhouseCoopers Accountants NV (PwC) as its external auditor for the reporting year 2025. Following the announcement on April 1, 2022 regarding the withdrawal from the 2022 AGM agenda of the proposal to appoint ASML's external auditor for the reporting year 2025, the Supervisory Board and Audit Committee re-initiated the selection process for the external auditor. This selection process has been finalized and PwC has been identified as the preferred audit firm to become

Evercore ISI initiated coverage of ASML with a rating of Outperform

HSBC Securities initiated coverage of ASML with a rating of Buy

Redburn Atlantic upgraded ASML from Sell to Neutral

Cantor Fitzgerald initiated coverage of ASML with a rating of Overweight

ASML reports €5.3 billion total net sales and €1.2 billion net income in Q1 20242024 outlook unchanged VELDHOVEN, the Netherlands, April 17, 2024 – Today, ASML Holding NV (ASML) has published its 2024 first-quarter results. Q1 total net sales of €5.3 billion, gross margin of 51.0%, net income of €1.2 billionQuarterly net bookings in Q1 of €3.6 billion2 of which €656 million is EUVASML expects Q2 2024 total net sales between €5.7 billion and €6.2 billion, and a gross margin between 50% and 51% ASML expects 2024 total net sales to be similar to 2023 (Figures in millions of euros unless otherwise indicated) Q4 2023 Q1 2024 Total net sales 7,237

ASML reports €27.6 billion net sales and €7.8 billion net income in 20232024 expected to be a transition year with sales similar to 2023 VELDHOVEN, the Netherlands, January 24, 2024 – Today, ASML Holding NV (ASML) has published its 2023 fourth-quarter and full-year results. Q4 net sales of €7.2 billion, gross margin of 51.4%, net income of €2.0 billionQuarterly net bookings in Q4 of €9.2 billion2 of which €5.6 billion is EUV2023 net sales of €27.6 billion, gross margin of 51.3%, net income of €7.8 billion ASML expects 2024 net sales to be similar to 2023ASML expects Q1 2024 net sales between €5.0 billion and €5.5 billion and a gross margin between 48% and 49% (Figures in m

ASML reports €6.7 billion net sales and €1.9 billion net income in Q3 2023ASML confirms its expectation to grow towards 30% in 2023 VELDHOVEN, the Netherlands, October 18, 2023 – Today ASML Holding NV (ASML) has published its 2023 third-quarter results. Q3 net sales of €6.7 billion, gross margin of 51.9%, net income of €1.9 billionQuarterly net bookings in Q3 of €2.6 billion2 of which €0.5 billion is EUVASML expects Q4 2023 net sales between €6.7 billion and €7.1 billion and a gross margin between 50% and 51%ASML confirms its expectation to grow net sales towards 30% in 2023 (Figures in millions of euros unless otherwise indicated) Q2 2023 Q3 2023 Net

ASML reports €6.9 billion net sales and €1.9 billion net income in Q2 2023Incremental DUV revenue drives expected 2023 sales growth towards 30% VELDHOVEN, the Netherlands, July 19, 2023 – Today ASML Holding NV (ASML) has published its 2023 second-quarter results. Q2 net sales of €6.9 billion, gross margin of 51.3%, net income of €1.9 billionQuarterly net bookings in Q2 of €4.5 billion2 of which €1.6 billion is EUVASML expects Q3 2023 net sales between €6.5 billion and €7.0 billion and a gross margin of around 50% ASML expects 2023 net sales growth towards 30% compared to 2022 (Figures in millions of euros unless otherwise indicated) Q1 2023 Q2 2023 Net sales 6,746 6,902 …of whi