PMI data, Treasury yields, Musk pushes limits: Catalysts

Economic data from the US S&P Global Composite Purchasing Managers Index (PMI) was released on Thursday morning, reaching 54.4 in May, the highest level in over two years. Speculation about how the Federal Reserve will make its next policy decision mounts as the data adds to signs of growing US economic output, with Treasury yields (^TNX ^TYX, ^FVX) also climbing. Many CEOs are following Tesla CEO Elon Musk’s (TSLA) footsteps as the number of CEOs who have received annual compensation packages above $50 million has increased in recent years.

For more expert insight and the latest market action, click here

Video Transcript

It’s 10 a.m. here in New York City.

I’m Madison, those alongside Shana Smith.

Let’s dive into the catalyst movie markets today.

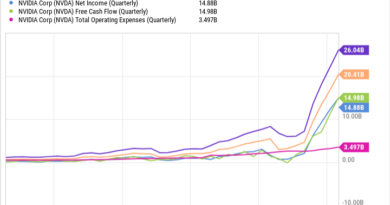

First up, it’s all about in video living up to the hype reporting results above analyst, lofty expectations of stock jumping here in early trading pulling major averages, at least the na that up higher.

We’ve also got a number of names trading to the upside.

We will discuss the potential risks for the A I darling potentially here and we’re getting a fresh read on the economy as global flash you services and manufacturing PM I beating expectations could be another sign that the economy starting to gain a little bit more momentum here.

Not with the Fed wants to hear, but we’re going to explore what it could mean for them in the coming moments here.

Speaking of the Fed, could the f potentially pose a risk here to the markets?

Rally the minutes from the latest meeting, calling into question rate cut expectations with several participants willing to tighten policy or at least questioning whether or not policy is restrictive enough at current levels.

We’ll start off with that first big story of the day.

And that is NVIDIA once again proving its dominance in the chip space with the stellar first quarter earnings results while clearing the way for A I stocks to move to the upside demand for Nvidia’s products is out of this world.

The Yahoo finance asked Nvidia’s Ceo Jensen won an exclusive interview about that demand as NVIDIA analysts.

Here is what as well as NVIDIA analysts as them, their thoughts on the latest results here is what they had to say.

People want to deploy these data centers right now.

And so so that that demand is just so strong.

Their customers told us they were going to spend more Microsoft Amazon Google meta told us they were going to spend more on GP US.

They told us they’re buying any GP U and video will sell them and that should continue for the rest.

If you look at corporate cap X on information software and hardware, it’s still barely ticking up.

So I think we’ve got a ways to go here.

The real issue may be supply constraints from TS MC, the maker of those chips for NVIDIA who’s having trouble cranking out enough chips to meet that demand.

So Matty there certainly is a lot of focus on that demand, outstripping supply.

Exactly how long that is likely to add to last year.

Now, going into this print, one of the concerns here from analysts was surrounding demand and whether or not some of their customers were going to be holding off on orders, waiting for the latest products, Jensen Wong in our exclusive interview.

Pushing back on that notion, I think that was a bit of a relief here for so many analysts because that was really when we talk about the risks that have been presented for the stock, that was one of the biggest concerns going into this.

Absolutely.

I know you were able to ask a lot of really great questions about that in the last hour on morning brief, you also talked a little bit about the demand when it comes to auto maker.

Something that Tesla, Ceo Elon Musk actually posted on X about Jensen, one’s commentary on that to Yahoo Finance and his exclusive interview with us talking about the demand increase from an automaker like a Tesla for their generative A I purposes that they’re putting there on a full self driving technology and the demand that that is going to spur for a company.

Like in the my question though, when do other chips players start to produce some type of lower cost product that could potentially even into videos market share in the space, which is about 80% of the chips market right now.

So we’re going to get to that with our very next guest here and video shares up over 2000% in the last five years when our next guest first about the stock in May 2020 70 bucks a share So this is a happy guest that we’ve got here joining us now to discuss and videos explosive growth story.

We got Dan Morgan.

He is no trust vice president and senior portfolio manager, Dan Congrats on what is obviously great trade for you getting in at $70 for this name.

I’m curious, what do you think the runway looks like from here?

Obviously, you’ve had a stellar growth story for in video thus far.

How do you think this could go?

Well, you know, you mentioned in the beginning of the hour here about all the concerns coming into this uh this upcoming print especially related to some reports that came out.

Uh that potentially said, you know, certain customers were uh not purchasing the Hopper Series chips.

They were gonna hold off into the Blackwell, which is the new GP U that was introduced back in March, that was most likely gonna come out in the fall.

But you know, you look at these numbers, it’s not really indicative of that, right?

We had data center uh segment with was up 427%.

They did 22.6 billion, which is unbelievable number.

And then the guidance that they gave for this upcoming second quarter was consensus was at about 26.5 billion.

They guided at 28 billion plus or minus 2%.

So that gives me an indication that there is no slowdown in terms of order growth going into this upcoming quarter or the past quarter, in regards to let’s say, holding off on buying the Hopper Series in favor of the Blackwell series that’s going to be coming out in the fall.

So I think that put to bed that concern at least for now.

And of course, the stock has responded on 10 for one stock split and all the other good news and we’re moving at higher levels right now.

So very good report across the board when it comes to Blackwell production, something that obviously was asked about in the news hall and Jensen saying that Blackwell right now is in full production, talk to us just about exactly what that means and how quickly you think NVIDIA will be able to scale that production.

That’s a good question and, and a lot of the indications that we have have shown they’ve already built out the supply chain for Blackwell.

So they’re already preparing uh for, you know, companies like Amazon Microsoft, you mentioned getting meta, they’re all building out these huge data center.

Uh they want to use those A I chip.

So they’re, they’re preparing for that.

You know, there’s a lot of news flashing around.

I’ve heard October that they could start bringing out the Blackwell chip.

Other people have said December definitely in that calendar year, fourth quarter.

But you know, there’s going to be delays.

I mean, right now, the Hopper 100 which is their Ka I chip has a, I think about a 10 week delay between ordering and actually delivering.

So I’m sure there’ll be a massive influx in the fourth quarter of customers who want to upgrade, especially to the Grace Blackwell 200 which is supposedly the fastest chip that they create.

There will be people that are willing to pay for that.

It goes for about $70,000 estimated cost.

But I think right now they’re preparing and getting that supply chain ready to go so that they can meet that demand in the fourth quarter.

But there’s going to be lag times, there’s lag times even today with their current Hopper series.

Well, I mentioned this in the intro, Dan, the market share that video has around chips about 80%.

I know you got a lot of chips players in your portfolio here.

Which one do you think has the highest likelihood of biting into that market share from the video?

You know, I wrote a research report about that.

We looked at the competition in the space and it’s kind of interesting because you have really two sides.

You have companies like Intel with Falcon Shores and Gotti, they have chips that are coming out next year.

You have a MD with their M I 300 Ami 300 X.

They’re just starting to ship that.

But you know what’s interesting guys is that you have the companies who actually buy the chips meta has their own MTI A chip.

You have Graviton and Trainum, which is being produced by Amazon.

You’ve got uh Google who has the tensor uh flow series chip.

So you have the companies that actually buy NVIDIA chips, creating their own organic chips that could potentially impact their demand for NVIDIA chips.

And then you’ve got the companies like a MD Intel.

Marvel is in that group, Broadcom is slightly but they don’t produce directly chips, They make mostly accelerators.

But if you look at that group, those would be the three to focus on Marvel Ad Intel and then whether we’ll see a slowdown in demand from their customers producing their own homegrown chip, so to speak, Dan, when it comes to that 10 for one stock split, a lot of it having to do with the psychological factor.

But I’m curious just from your perspective, the significance of this clearly doesn’t change the fundamentals.

But we have, we have typically seen a little bit of a price pop and we’ve seen this happen at other companies.

So what exactly does this potentially mean about some of that activity that we could see in the short term?

Well, there’s studies that have come out that shown that there is no benefit of buying a stock either before or after it splits in terms of appreciation.

I know a lot of retail investors are probably Salva and buying NVIDIA at $90 a share.

But stocks that split more, perform better than stocks.

That split less makes sense.

Right?

And I hark back to alphabet and Amazon that did the 20 for one stock splits a couple of years ago and made their shares more uh obtainable for the users of their products, right.

You know, the search engine and, and online uh buying and so forth.

So I, I think it’s a huge positive because it allows the average retail investor maybe buy 100 shares and it is a psychological thing.

But as you mentioned, it doesn’t change the valuations.

You know, NVIDIA still trades at 50 times times buck, it still trades at, you know, 80 times earnings on a trailing basis.

But it does make it more palatable for people to accumulate 100 shares or 200 shares.

So I think it’s gonna be a win win for NVIDIA that should drive the stock higher because it’s gonna allow retail investors to participate more without having to buy, let’s say fractional shares that Dan, sorry, you might have not heard me there.

What would make you sell in video?

Oh, you have to bear in mind that as you introduced me, you, you introduce the time that we place it on our buy list.

Um I was the one who was the catalyst behind that.

I also own it personally.

So um you know, it would be really difficult to part ways, at least where things are today.

Things would really have to deteriorate for them and you know, they can always lean back on their GP U experience in the gaming space and in the data center space, even away from A I, there are just so many facets of the gross story.

I know on the call, they talked about how they’re broadening their customer bases beyond just, you know, the big tech companies are getting into automotive, you talked about that earlier in other applications.

So I I think this story is really just in the beginning, it would really be difficult to uh to make a strong case right now to think about selling the stock.

But if you guys have some ideas, let me know, I’ll definitely look it.

Well.

Well, Dan, I want and on this because obviously there’s the NVIDIA Am the Intel, but then you got the cloud providers with the silicon chips in the space of Google, Amazon and Microsoft and obviously Google is winning Aws coming in second there.

Which of those three do you think is going to be the winner of that cloud community?

Well, you know, to me it would have to be alphabet.

They really have a lead on in terms of between meta Microsoft and Amazon, their tensor flow unit has been producing chips for a very long period of time.

They just came out with their version six and they talk about how they’re making huge strides in terms of those chips.

So I think if you were to try to bet on who’s gonna have the best organic or homegrown chip to me.

Alphabet seems to be in the driver’s seat.

Microsoft just came out with a chip recently meta within the last year, Amazon just released as I mentioned before, the Graviton and the Trina which are their two new chips.

Those are all more recent.

And let’s admit, admit guys, this is an area, they’re not really a super expert on, right.

You know, there are areas of expertise or in other areas.

So but as I mentioned, tensor has been uh the tensorflow unit has been producing chips with Broadcom and in a dual effort for a very long period of time.

So they would have the leg as far as the, you know, the data center and social media companies.

All right, Dan Morgan, Sonova Trust, vice president and senior portfolio manager.

Thanks so much for joining us here this morning.

Thank you.

We want to get to some econ data out just minutes ago.

Output in May growing at its fastest rate in over two years, giving maybe some investors some reason to doubt the recent worry about growth, the global US PM I composite rising to 54.4 this month.

That was up from 51.3 in April.

The move higher led by the services sector which saw business activity registering the fastest growth in a year reversing a slowdown from the prior months and it was accompanied by expansion in the manufacturing sector as well.

So here to dig into the data exactly what this means about the health of the economy, the fed going forward, we want to bring in Chris Williamson S and P Global Market Intelligence, Chief, business economist.

It’s great to see you again.

So here we are on the heels of this print, we are seeing some reaction play out in the market right now.

We have yields uh heading to the upside.

We’ve got the S and P just right around the flat line.

I’m curious just what your first take is of this report and what it signals about the health and stability of the overall economy.

Oh, yeah.

Well, the census number that we got to make, uh it’s signaling robust GDP growth in the region of well over 3% annualized.

So, back on track after uh what was a, a disappointing April reading looks like GDP strength uh is resumed into the second quarter.

So the economic pace of expansion is solid and it is looking quite broad based manufacturing in particular, Chris, sorry to cut you off here.

We’re having some audio issues.

So I want to try to get this worked out during breaks.

We’re going to take a quick break and hopefully talk to you on the other side.

We’ll be right back.

Commodities have been rallying now for quite some time, we’ve got copper, gold and silver all up between 15 and 30%.

This year.

And that’s pushing the Goldman Sachs commodity index up just about 8% year to date.

So what does all this mean in the feds fight to tame inflation?

And how are the rise in the commodities really threatening some improvement we want to bring in.

Max K. He is HS BC, multi asset strategist here to talk about that and a lot more Max talk to me.

Let’s the, the massive run up that we’ve seen in a number of precious metals.

Specifically when you take a look at the run up in gold hitting multiple records, when you take a look at the massive run up that we’ve seen in copper, how are you factoring that into whether or not this is really reigniting some of those inflationary concerns?

Yeah, I don’t think it reignites a lot of those inflation concerns.

Certainly not in gold.

When we look at gold, I think a lot of that has been related to central bank buying a lot of that has been uh related to this diversifying of uh uh uh central bank reserves.

But it’s also been really led by a little bit of a lack of diversification of bonds and a fixed income.

Let’s remember particularly in the last two years since the FED has been embarking on this rate hiking cycle that actually, you know, most of the risk assets have been moving really with bonds.

So bonds overall uh rates really are no longer fulfilling that diversification property and a lot of that was pushing gold higher.

So I don’t think that has an awful lot to do with inflation copper.

On the other hand, you could be arguing that maybe due to stronger demand, for example.

But again, I think there are special factors in play here.

When we look at the Red Sea disruptions, look at for example, the throughput of copper through the Suez Canal that has really plummeted in recent months.

So it’s really much more led by supply disruptions, which at the end of the, they should be proving more, you know, more temporary rather than a proper pickup and a proper cyclical pick up in demand.

Again, I wouldn’t be too worried about it particularly.

Also when we look at copper, a lot of that has been reportedly driven by CT, a lot of that has been driven by momentum players rather than really by an under sort of fundamental shift.

But Max, as you mentioned, it’s kind of the breadth of these commodity price spikes that we’re looking at the highest in two years.

I do want to specifically get your take on what we’re seeing with natural gas, specifically surging in the last month in terms of July contracts having a 30% trough to peak rally before rolling over a little bit the past couple of days here, does that specific move that we’re seeing in the gas space start to lead to some concern about the outlook moving forward for you, I don’t think quite yet because on the other hand, we’ve obviously seen oil prices down.

So when we look at natural gas prices, yes, they’ve sort of moved really in opposite direction of oil prices at the start of the year.

You know, when, when, uh, energy or oil prices specifically were going up, we’ve actually seen a bit of weakness in natural gas and now it’s the opposite.

I would be more concerned if both really rise in tandem, if we get oil prices up, you know, 30 40% if it push us towards $100.

And then on a year over year comparison, we compare sort of oil prices of 100 with 70 last year and then, you know, that brings natural gas prices up uh as well.

Then I think that would be more concerning, but really what we’re seeing so far is that energy prices in the US are still relatively tame when we look at CP I energy.

So the ener energy inflation basket and in fact, when we look at other categories say, for example, CP I goods, so goods inflation overall is still in disinflationary territory.

So overall not really something that I’m overly worried about, but I think what it does show and that is absolutely clear is that we’re nowhere near 2% inflation.

We’re nowhere near hitting that 2% inflation target any time soon, not in the next three certainly not in the next sort of 3 to 6 months.

So Max, what does all this then tell us about the broader market here?

Because here we are, at least in the US, we’re not too far from those record.

I recognize in some cases when you take a look, there’s been talk of frothy some frothiness that has maybe been showing signs, especially when you look at a few particular names.

But do you think overall, despite the fact that we are at these elevated levels is the momentum to the upside?

And do we have further to run uh the momentum I think is clearly to the upside still.

Uh when we look actually at the frothy areas, our shorter term sentiment and positioning indicators do not even flash a mild cell signal yet.

So we are seeing some pockets of sentiment and positioning that may be a bit frothy and that may be a bit stretched, but on aggregate, it’s not even giving us uh you know, a bit of a AAA mild signal.

We’re not even at that point yet.

That’s number one.

Number two is what we’re seeing.

For example, today, look at the last couple of minutes, we see futures gains in equities erase why it’s because yields have popped and they are popping in a fashion where it’s particularly bond volatility again rising very sharply.

So to me, it’s not really the inflation side, it’s not really higher bond yields.

It’s certainly not the level of yields.

I don’t really care whether the tenure is going to be at 4.5 3.5 or five.

As long as that is matched up by very strong growth.

The concern is if inflation turns to the ugly kind of inflation, if it’s again, just supply chain issues, if it’s a labor mismatch, if its wages strongly rising and, you know, leading to concerns about corporate margins.

So that would be a concern for corporate profitability again.

And the other thing where I would be much more worried is if bond volatility once again, really rises very sharply.

So rather than the level of yield, it’s the speed of the move, it’s the rate of change that is much more crucial.

I think the bond market for the overall risk, asset spectrum.

Well, ma I know your inflation measures and models that you look at are much more complex than what I’m about to say here.

But I’ve got Target Starbucks mcdonald’s, Wendy’s.

I could keep going down the laundry list of companies that have touted the idea of a consumer that is really starting to struggle here.

And we’re seeing price cuts in relation to this to that.

Does that make you worry that your call that inflation isn’t defeated yet might be off?

No, not quite yet because, you know, you, you can see other uh uh parts of the consumer that are still quite strong and overall what we’re actually seeing is when we look at things like, for example, credit card delinquencies, one of those variables that a lot of people are looking at in order to uh uh show the, you know, to show the strength of the consumer waning a little bit.

Actually, when we look at things like delinquencies, there are still miles of where we were on average before the financial crisis.

So still relatively healthy, you know, that ultimately, actually the consumer will be starting to feel some of those strains.

That is, you know, I think that is very clear if yields really do not go down if yields, if the 10 year yield is going to be stuck at 4.5 to 5, if the two year yield is not really gonna move.

If the fed doesn’t cut rates very aggressively, if they’re only going to cut maybe 23 times in the next year and a half, two years, then it’s very clear that at some point perhaps in the next two years, the consumer and the economy overall will be, you know, will be really feeling the strain.

The problem, of course, from a market perspective is that doesn’t help us, we need to attach a timing angle to that.

And I think right now what we’re seeing in these pockets of weakness, we don’t quite see them yet.

So I don’t think we’re at that point quite ma just end in our final minute here your measure of real money investor sentiment hasn’t moved towards a more extreme risk on positioning in the market.

Just, just feels very me to me right now, really skeptical even with the double digit record highs that we’ve seen year to date.

Why is that?

Yeah, I think me, I, I’m not sure if that was the technical term, but I would probably use it as well.

It’s, it’s a, it’s a pretty meh market rate because at the end of the day we’re always discussing about, oh, is it gonna be two rate cuts?

Is it three?

Is it one, are they gonna cut in June or in September?

Well, you know, for risk assets, if we’re really honest, it doesn’t really matter that what really, really matters is if the fed is gonna hike again, if they’re absolutely making 100 80 degree turn and saying actually the next move is gonna be a hike.

If that doesn’t happen.

And that’s been really now pretty firmly taken off the table.

If that doesn’t happen, then it doesn’t really matter whether they’re gonna go in June or in September and December.

Because at the end of the day, we’ve always got to remember why are they doing that?

They’re doing it because it’s demand led inflation.

It’s because growth is so strong that inflation isn’t going down.

It’s not the bad kind of inflation from 2020 to 2022 where it was supply led.

It’s the good kind of inflation where it’s growth led as long as that continues, that’s still pretty good for risk assets.

All right, Max, we got to leave it there, but really appreciate you joining us.

Always great to get your insights here.

Thank you so much.

That was Max Kettner joining us.

He is hsbc’s multi asset strategist.

Now, coming up, social media companies continue to grapple with child exploitation issues on their platforms.

We have the latest on their efforts to combat that when we come back output in a growing at its fastest pace in over two years, giving investors reason to doubt some of that recent worry about growth, the S and P global US PM I composite rising to 54.4 this month.

Now the move higher led by the services sector which saw business activity registering the fastest growth in a year reversing a slowdown from prior months and this was accompanied by expansion in the manufacturing sector as well here to dig into this data.

We want to bring Chris Williamson, he S and P Global Market Intelligence, Chief Business economist Chris.

It’s great to see you.

Let’s talk about this print that we were just getting in real quick.

I also wanna take a look at the market’s reaction because we do have the S and P right around the flat line.

But the story is really in the bond market and we have yields here pushing to the upside.

So Chris.

I’m curious from your perspective, what is this print?

What does this report tell us just about the state of the US economy right now and maybe putting to rest some of those fears that the that economic growth has been weakening.

Well, precisely that, yeah, we’d had some weakening uh growth momentum in this survey up to April 2 months of quite markedly slower growth.

Uh And that’s reversed into May.

We’ve got a much stronger growth picture here.

It’s the fastest for just over two years.

Uh and accelerating particularly sharply in the service sector.

This is obviously a very interest rate sensitive part of the economy and that acceleration in growth.

It is clearly one that’s going to worry the central bank in particular that you’ve got some, some building demand pressures here in the economy.

Again, Chris I know that you called the April data just a bit of a wobble.

Does today’s data feel different to you?

I mean, this is what an eight point standard deviation like this feels like a bigger move off of this PM I it’s a big jump.

We’ve been surprised by the weakness in April.

There’s possibly uh the timing of Easter often creates havoc with the numbers, but we’re getting some other data coming in such as the, the the housing data uh which will weak in April.

So it looks like there was a soft patch in April, but it is difficult to disentangle how much Easter has affected that we do see some underlying factors here that’s improved business confidence, uh which is feeding through to better spending numbers.

Uh And WW a big factor here has, has been the market.

To be honest, we’ve had the earnings season that was better than many had expected, an indication that companies are able to make good returns in this hire for longer environment.

Uh And that’s led to this resurgence in business sentiment and business spending that’s fed through to this upturn in activity.

So if you like some of the fears that were mounting uh in in April, uh about how higher interest rates might be affecting the corporate sector are being allayed, Chris, what does this tell us just about how strong or how much stronger GDP could potentially be here in the current quarter?

Well, we’re running at levels that are consistent with around 3% annualized just over that 3% annualized GDP growth uh in, in May.

So it looks like another strong quarter.

Uh I think the Atlanta Fed now cast is in similar sort of territory.

So, yeah, it, it, it looks like it’s gonna be quarter again.

So defying many expectations of a slowdown, Chris, is it enough, do you think for the fed to hold off potentially even longer?

And then that also brings into the question whether or not maybe another rate hike should be on the table?

Where do you stand just in terms of the thinking surrounding that narrative and that conversation.

Well, the those headline numbers in on their own has suggested that they’re moving into more of a rate hike than a cut territory, right?

But we do have some moderation of inflationary pressures coming through.

It’s only modest but the service sector, in particular, the rates of inflation we’re seeing in this survey in the service sector are among the lowest that we’ve seen in the last three years.

But that still leaves the indication of the survey of, of A AAA an above 2% inflation rate just above.

But it’s still annoyingly above that target.

Suggesting again that this last mile uh to target is proving really frustrating.

Um a positive sign if you like here was that, that we had two months of falling employment as as there’s a lot of caution about the the environment going forward, especially with the elections coming up and geopolitical uncertainties that’s leading to some pull back in hiring.

Uh And that’s helping to alleviate some of those wage pressures in the service sector.

Uh So we need to watch how that progresses over the next couple of months.

Um If that persists, then we’re still on course for some rate cuts later in the year.

But, but as it stands, if we get this big pick up continuing or even gaining momentum, then we’ve got to be looking at whether rate cuts are the right thing to be doing well, Chris let’s talk about the labor market here.

We know that Atlanta fed officials this week at their conference, we’re talking about how CEO S are telling them that they are pulling back on hiring.

At what point does that indicate a broader risk to this market that could stall some of the growth that we’re seeing, keeping fears about the economy at bay.

We are.

So we, we’ve had two months now of, of falling employment that’s been led by the service sector.

It certainly looks like the service sector hiring trend is cooling quite markedly.

However, it is being supplemented by an upturn in manufacturing.

We know there’s a lot of investment going on in manufacturing at the moment.

Uh expanding capacity, the Chips Act and the Ira, they’re helping to expand that manufacturing base and, and we, so we’re seeing this more back economy coming through where growth is slowing perhaps in the service sector according to the jobs market.

Uh but starting to pick up in manufacturing, which leaves this overall, I mean, manufacturing is still a small part.

So it leaves this overall picture of a of a of a slowing job market but not a collapsing one.

So I I think that leads to a suggestion that you’re going to see some some weaker pay pressures come through, which is going to help the the overall inflation picture.

But at the same time that weaker job market, weaker pay growth is a negative for consumer spending.

So it’s gonna be interesting to see how this plays out.

But what I think the important takeaway here is that at the moment, we still have this above trend inflation rate that’s gonna be front of mind.

And even if the labor market is slowing those wage pressures remain elevated by pre Panem standards to the extent that it’s causing some nervousness.

Certainly.

And that’s why we continue to say we just need the goldilocks perfect amount of heat and coldness in all environments here.

Chris thank you so much for joining us and sticking with us through those tech issues.

We appreciate it.

That was Chris Williamson.

He is S and P Global’s Market Intelligence, chief, business economist.

We’re watching several retail stocks today following earnings reports from BJs and VF Court, both moving in opposite directions today BJ is up over 2% after topping estimates in the first quarter, a different story for the F for that company posting an unexpected loss in the quarter.

Now this comes after some toughness for the Corp over the last couple of years here, right?

This is the company owning vans and North Face.

The shares were down 7%.

That was the lowest intraday level since right after the global financial crisis in 2009, the company saying they have a re invent transportation plan but a long way to go da tells the cutting the rating on this name that moving it down to a market perform and describing the results as disappointing.

And this to me is not that surprising.

Yes, the expectations going into the print were a little bit more positive, but we know that this company has been struggling with vans sales and we know that vans are not the issue of the moment right now.

So you’re gonna have a lot of pressure on a company like North Face to pick up.

Yeah.

And David Swartz, we actually spoke to uh earlier this week, he was talking about Macy’s the lack of progress there, but I bring that up because he’s making a similar type of argument just in terms of the lack of progress of this turnaround story when it comes to VF Corp. And you’re saying that these results pretty much solidified, that not a huge surprise, but this is something that’s going to take time.

And I think you talk about the fact that the stock has been under pressure.

Now for quite some time, we’re looking at further declines of just about 4% really speaks to the issues surrounding VF Corp. We know the company has really worked its way to cut cost.

It’s trying to pay down.

Instead, it’s actually announced layoffs late last year, around 500 employees were affected.

So they are taking some steps in order to right size their business, better position their business here for future growth.

But again, like we said, and is really taking some issue with this most recent print really reaffirming the fact that a turn around like this, that this is going to take some time to play out, especially when you take a look at the macro environment that we’re in right now.

Let’s also take a look at shares of Dell because they are moving to the upside after Evercore.

I si added the stock to a tactic tactical out perform list saying that it expects a favorable first quarter of results.

This coming after Dell announced a range of new A I I enabled P CS earlier this week, you’re looking at gains of just about 6%.

Dell shares are up over 100% since the start of the year.

You’re looking at gains of just about 100 and 5%.

So, yes, lots of excitement surrounding the all important A I products.

Exactly what is that, what that is going to do, how big of a driver that’s going to be for their businesses.

Some of the analysts are excited about and this also move higher coming on the heels of NVIDIA print last night.

So certainly a number of these names catching a bit here this morning as we talk about that runway of growth and exactly what that is going to look like in terms of future A I adoption here in the coming quarters and years.

And yeah, and Sea, as you mentioned, the Evercore upgrade here that we are looking at important to point out what you said that the catalyst is going to be upside in those A I expectations on revenue backlog numbers that could help change the narrative around some of these names, not just Dell, but all H pe here and to your point and video really making it clear that some of these places do have room to run with Dell, particularly on the data center side of things.

This is a stock that’s already up over 96% year to date.

They had a really tough year and a couple of years when it came to deliveries of computers following the surgery that we saw in the pandemic.

And now we’re certainly seeing that stock on the upside of following that downward swing.

Thanks to all things.

A now Morgan Stanley is executive chairman James Gorman is stepping down at the end of the year.

The former CEO signing the successful transition of his successor had pick on.

It’s important to note that this is not the newest of news.

He did tease this back in May of 2023.

He said he’d stay for the succession plan, then give up his chairman title, but some context here, he joined the firm in 2006.

Then after the global financial crisis, Morgan Stanley obviously in a lot of trouble and he was able to kind of push the company through that time period when it was really a make or break moment for them and then bring it out on top as this kind of wealth management, Hercule firm in the space.

One thing I’m interested in is who is going to take on this chairman role because we see a lot of the other big banks in the space.

The CEO and the chairman are the same person.

Is that going to be the case?

Yeah, it’s really been remarkable just what he has done in terms of better positioning in the bank over the last four years, it’s been 14 years at the helm and really has transitioned it to into a wealth management powerhouse like you were just saying, and he did that while also um positioning Ted pick to be the successor, naming him as his successor.

Staying on through this transition story.

But I bring this up because he was also able to retain the two other top CEO candidates when it comes to Andy Saperstein and also when it comes to Dan Simit.

And that is something that you don’t necessarily see on Wall Street.

So again, it seems like, but he has said, actually putting in his words, a successful transition to his successor, Ted pick and I think many people are wondering what the bank is exactly going to look like under Ted pick here going forward.

But again, Morgan Saline’s first quarter earnings here, profit beat expectations and we certainly did see a resurgence and a surge here of its investment banking, a unique growth in its wealth management business.

So momentum to the upside here, you’re looking at a one year chart of Morgan Stanley those shares up just about 20% yields.

Also moving here, pushing the upside in a reversal as recent economic data from that PM I print is supporting a hawkish potential move from the FED.

At least that’s what we’re seeing in terms of pricing action here.

Looking at the five year yield at 4.5%.

A little above that right now.

And weekly jobless claims also this morning changing that narrative a bit when comes to yields.

So here to discuss what the moves mean, we’ve got all the side chief Investment Officer at Franklin Templeton fixed income.

Thank you so much for being here with us this morning.

This PM I coming in hotter than expected.

It’s having a really big effect from my perspective on this market here.

What do you think is the biggest thing that the market is moving off of from this?

You know, it’s not just the strength, it’s also the fact that prices paid were somewhat stronger than people had hoped.

So it’s very easy, I think right now for the market to get extremely excited by weak data, anything which points that you know, we we’re still swinging around trying to come to terms with the fact that that is unlikely to cut more than one time this year in many, just just the number of data points they’re going to need at this stage.

It’s too, it’s too many to allow for more cuts.

So, you know, we’re seeing some moves, but I think the market’s gone a long way because uh, previous to maybe a month and a half ago, you would have seen a much bigger move, I think on this data.

So, so what does that tell us just in terms of the range that will likely see the yield?

Because right now we have the 10 year yield right around just below four or five.

Do you think we’ll likely stay range bound around these levels?

Pretty much?

I have, you know, the start of the year I expect when I was asked for the range for the 10 year 45 was right in the center of the 4.5.

And I don’t have many reasons to change that view.

I think it’s 4.5.

I think the fed is going to have a relatively short and shallow cutting cycle and I don’t anticipate the short end going much below four because having a massive recession is not my baseline.

I think at the background, what we really need to be prepared for is a short shallow rate cutting cycle.

But then after that, get prepared for higher long term yields.

Well, back in March, former Dallas fed President Robert Kaplan was on our program and was asked about his thoughts on inflation and fiscal spending and the relationship between those two.

So I want to take a listen and get your thoughts.

The big cross current that I think the fed is dealing with and they may or may not want to acknowledge is fiscal spending.

Uh fiscal spending, I believe is one of the big reasons the economy has been this resilient.

So I love this debate about whether or not monetary policy can outpace fiscal.

And I know that you had a similar experience during your time at the IMF in terms of that debate between the two.

So I’d love to hear your thoughts on what that relationship looks like.

So first of all, I could not agree with him more really, he could be paraphrasing exactly what I think because ultimately, if we take monetary policy in isolation, even without the fiscal spend, the FED is working with monetary policy, which has very narrow channels to operate through.

Because essentially, if I look at the biggest channel through which monetary policy would affect households, for example, through mortgages problem is that 85% of us mortgages were taken out at less than 3.5%.

All these rate hikes really don’t impact people who continue to hold homes.

They’re not, they’re unlikely to move eventually it’s going to feed through.

But it’s a very, very narrow channel through which the, uh, the fed can actually influence consumer behavior.

Certainly Corporates.

That’s a separate issue.

And we can talk to that fiscal on the other hand, you know, we have seen average budget deficits of 8% over the last 34 years.

And if you look at those numbers at a time that the economy is not just growing, it is growing incredibly strongly, it has to come back to fiscal actually doing its part of what’s going on with inflation and the strength of the underlying economy.

It’s also why, by the way, I think that longer term yields are not going back to the post global financial crisis period of always being low.

But to the pre global financial crisis period, when they averaged actually closer to five or above 5%.

I’m talking about 10 year yields here.

Well, let’s stay on that because that’s a really important point.

And I wonder how the fact that we are seeing a little bit more retail investor activity within the bond space impacts your view on that.

Is that something that you think could lead to some more volatility in that view?

You know, I think that ultimately fixed income does begin to play the role that it is historically played, which is balanced in the portfolio.

You’re not going to get those 6% you’re not going to get those double digit returns that you get from equity from fixed income.

The last several years have changed people’s perceptions of what fixed income can and should deliver to a portfoli it’s supposed to be the balance to equity.

So the fact that retail investors are coming back into fixed income.

This is a good thing because I think over the over a life cycle there is space for fixed income in a portfolio.

It’s supposed to yield income most importantly.

And currently it’s doing so certainly more than we’ve seen in the last 15 years and I think going forward it will probably continue to do that.

So now desai always great to get your insight.

Thanks so much for joining us here this morning, Chief Investment Officer at Franklin Templeton, a fixed income.

We appreciate it.

Well, child safety concerns especially related to extortion remain a top priority for social media platforms.

So what are companies like meta doing to better protect its younger users from on this?

We wanna bring Yasmin quorum, Yasmin.

That’s right, Shawna.

Thank you.

Uh uh Sorry meta has a big sextortion problem.

Last year alone, the National Center for missing and exploited Children reported over 36 million instances of child sexual exploitation on social media.

80% of those occurred on Facebook and Instagram.

Despite introducing new rules to combat graphic content on content on its platforms, including a nudity filter, cyber security analysts and invest.

I spoke to say meta doesn’t do enough to stop the blackmail taking place on its platform and its victims are often underage.

We spoke to law enforcement agencies behind the arrest of 33 year old Nigerian Amadeu who scammed thousands of teenage boys in the us to the tune of $26.6 million.

Investigators tell us this is the largest financial sextortion scam leading to an indictment ever.

She allegedly created multiple profiles on Instagram and Snapchat posing as flirty, attractive young girls before coercing users into sending him nude photos of themselves.

He then threatened to send it to the victims.

Followers, often their closest friends and family unless a payment was made extortion scams like Shan have tragically led to more than 30 suicides in the country.

Authorities tell us that meta’s platform specifically, Instagram are more susceptible to blackmail due to the visibility of a user’s followers.

After a connection has been made on tiktok and snapchat, you can hide your followers from networks of other people.

Instagram does not hide that follower list meta as you guys know is already under a firestorm from the eu.

The eu is investigating whether it does enough to protect the mental health of its younger users.

A probe just announced last week, alleges Facebook and Instagram exploit the addictive tendencies of minors with quote rabbit hole effects.

Now I want to read a statement that meta gave us on this topic.

They say in part, quote, sextortion is a horrific crime and we’ve spent years building technology to combat it and to support law enforcement in investigating and prosecuting those behind it.

This is an ongoing fight where determined scammers and criminals evolved their tactics to try and evade our protections.

Of course, Wall Street is mixed on all of these regulatory and security challenges for meta two analysts.

I spoke to say they doubt that these regulatory headwinds will have any impact on the stock price.

One of them called Zuckerberg and Meta Teflon.

It’s also worth noting that shares have nearly doubled in the last year.

Uh Yasmin, thanks so much for digging into uh that that for us and bringing us the latest.

We um appreciate that reporting and look forward to more that you have on that subject.

All right.

Well, coming up, Tesla shareholders will have another chance to vote on Ceo Elon Musk’s pay package in June, but Musk isn’t the only one looking to push compensation packages higher.

We will discuss more.

Next on June 13th, Tesla shareholders will have another chance to vote on Ceo Elon Musk’s pay package.

It’s been worth as much as $56 billion.

That compensation was invalidated by Delaware Judge earlier this year, but Musk, not the only company leader pushing compensation packages higher.

Yahoo finance says Alexis Keenan has the details.

Yes, a lot of talk about whether the skyrocketing ceo compensation, executive compensation is due to Musk is must to blame.

Is there some Musk effect?

Because he did n before the Delaware court invalidated it that $56 billion compensation package.

Now, we wanted to find out how big these pay jumps are and also what’s driving them.

So we looked at these compensation packages for CEO S both before the must deal and after the Must deal.

And what we found is what really matters is about the size of these increases is the index, what, what we’re talking about, which CEO S are we talking about?

And also the size of the companies that they’re running.

So take a look at the number of the CEO S in the S and P who were awarded more than $50 million in annual compensation that had a four fold increase.

If you look at the five year period, that’s 2013 to 2017 before Musk’s 2018 pay package jumping all the way to 36 in the five years after.

So certainly those big awards, the S and P level are significantly quadrupling.

Then let’s go to just the biggest us companies.

And what we’re talking about here are companies that have more than 1 billion in annual revenue.

The median dollar amount awarded there also saw a jump.

You look at 2022 $22.3 million average paid there.

That was up 7.7% over 2021 then if you jump to 2023 you see there up 11 point 4% year over year.

Now, if we take though a much wider look and we take a look at the amount the dollar amounts awarded to CEO S in the Russell 3000, right?

So a bigger picture here if we look at 2018 to 2022.

So all after the must deal, you see, they all CEO S up 6.2%.

And then you see though a much more moderate increase when you take it to the CEO S that are companies that have revenues above 20 billion a year.

That’s just 2.4 increase over that time period.

Now, the whopping number there, 19.3% increase from 2018 to 2022.

Those are for the CEO S at the smaller firms under $50 million per year in revenue.

So the lesson here is really that maybe it’s not a must effect, maybe that is just an outlier and it’s really these companies that are under that $50 million per year in revenue mark that are driving these big jumps.

Uh So a lot to still watch here as pay either increases, moderates decreases.

Uh But what experts are telling me who put together and, and, and analyze these pay packages is that they expect to see a jump for uh the full year 2023 and as we go into 2024 as well, great reporting there, Alexis.

Thanks so much for putting that all in perspective for us.

Well, coming up next, wealth is dedicated to all of your personal finance needs.

Brad Smith has you for the next hour.

We will see you guys tomorrow.

Have a great day.