Stock Split Watch: Is ASML Holding Next? – The Motley Fool

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

Shares have risen over 1,500% since the company's last split.

ASML Holding (ASML -1.51%) is an unsung hero in the semiconductor industry. It builds lithography machines, which project ultraviolet light onto silicon to make advanced chips. Playing that crucial part has propelled the stock to strong investment returns over the years.

The company has split its stock before, but 2007 was the last time. Since then, shares are up more than 1,500%. Trading at over $700 per share, the stock has become more challenging for individual investors to swallow. So should investors look for a split soon?

I’ll peel back the data to paint a picture of what investors can expect and whether shares are a buy today.

Stock splits are important, but investors need to know what splits do and don’t do. For example, stock splits do lower a stock’s share price. However, they don’t change the stock’s valuation. Huh?

Think of it like this: Suppose you wanted to buy some pizza. A large pie costs $20. But it’s just you, so you don’t want to buy a whole pizza for yourself. Instead, the pizzeria cuts the pizza into four slices and sells them for five dollars each. Technically, you’re paying fewer dollars, but the pizza’s value didn’t change. The whole pizza is still $20, but you can buy a smaller piece for fewer dollars.

Stock splits work the same way. Splits break a company’s stock into smaller shares that cost less but represent smaller pieces of ownership in the business. Why do companies split their stock? Well, it makes shares easier to accumulate for individual investors, makes the stock more liquid in the market, and can sometimes generate excitement around the stock.

For starters, ASML has split its stock multiple times in the past. Below you can see the company’s split history:

Source: Table made by author. Data from companiesmarketcap.com

It’s been over 16 years since the last event — which doesn’t necessarily mean a split is due, but considering that the stock has risen over 1,500% since the last split, it would make sense. The current share price is up over $700 today.

Investors shouldn’t base their decision to buy or sell a stock on stock splits because they don’t impact a company’s fundamentals. Still, the anticipation of a split or reaction to an announcement could influence the share price in the short term.

Again, fundamentals and valuation play the most significant roles in investment returns, so that should be your North Star when looking at potential stocks. Fortunately, ASML is poised to thrive regardless of whether the stock splits. You’ve probably heard the buzz around artificial intelligence (AI) by now, but the hype seems well-deserved. According to industry analysts, AI could become a multi-trillion-dollar market by 2032.

The demanding requirements for immense computing power means companies will need advanced, cutting-edge chip technology to power that AI. This is ASML’s wheelhouse. The company owns the market for this high-end machinery, with an estimated 90% to 100% share.

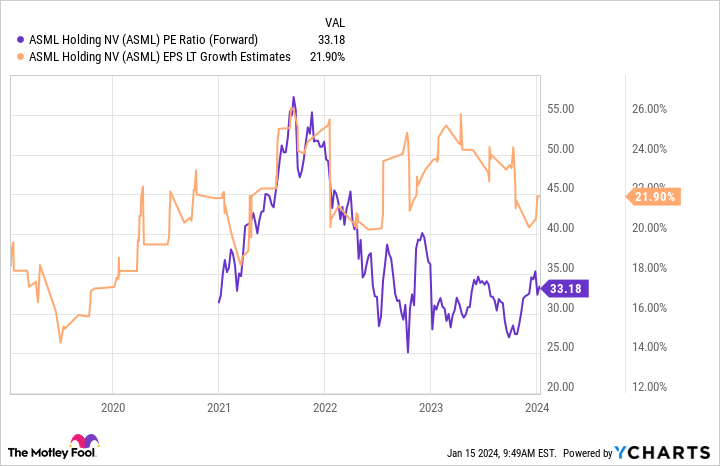

Analysts believe long-term earnings will grow by nearly 22% annually, on average. The stock’s forward P/E of 33 sounds steep, but the resulting PEG ratio (1.5) signals that the stock is reasonably priced in light of the expected earnings growth.

ASML PE Ratio (Forward) data by YCharts

Companies that dominate industries have pricing power, and the urgent investment into AI technology figures to be a tailwind for growth moving forward. ASML is a high-quality stock that investors should feel confident owning, regardless of whether the stock splits in 2024.

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

© 1995 – 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.