Why Applied Materials Stock Dropped Today – The Motley Fool

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

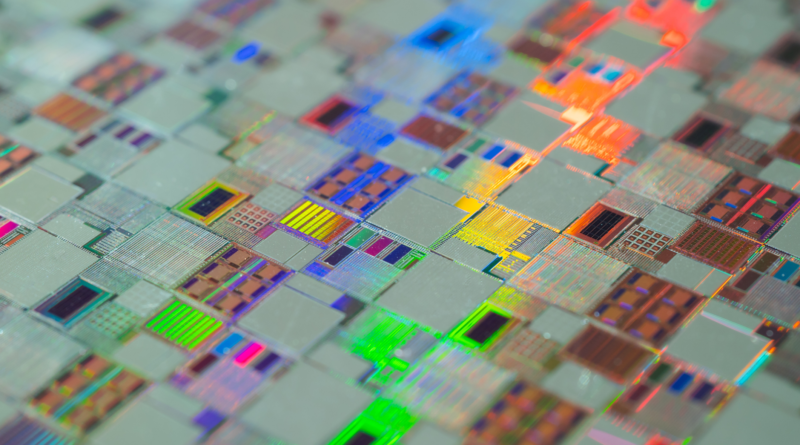

A new criminal investigation by the U.S. Justice Department overshadowed Applied Materials' latest strong quarter.

Shares of Applied Materials (AMAT -0.07%) fell more than 8% early Friday, then settled to trade down around 4.3% as of 3:30 p.m. ET as reports of a new criminal probe by the U.S. Department of Justice (DOJ) overshadowed the semiconductor-equipment specialist’s strong quarterly results.

On the latter, after the market closed on Thursday Applied Materials announced its fiscal fourth-quarter revenue arrived roughly flat from the same year-ago period at $6.72 billion, translating to 4% growth in adjusted (non-GAAP) earnings to $2.12 per share. Analysts, on average, were expecting earnings of only $1.99 per share on revenue of $6.5 billion.

Applied Materials CEO Gary Dickerson noted the company outgrew the broader wafer-fabrication equipment market for the fifth straight year, achieving record revenue, earnings, and cash flow in fiscal 2023.

According to a separate report by Reuters late last night, however, the U.S. DOJ has opened a criminal investigation of Applied Materials for potentially evading export restrictions on China-based chipmaker SMIC. More specifically, Reuters’ sources say the Justice Department suspects Applied Materials may have sent millions of dollars of equipment to SMIC via South Korea without export licenses. Such sales would have been in violation of U.S. sanctions put into place late last year aimed at curbing the flow of U.S. technology that could be used to advance China’s military and intelligence capabilities.

Applied Materials issued a statement insisting it’s cooperating with government officials “and remains committed to compliance and global laws, including export controls and trade regulations.” Recall the company also previously disclosed in October 2022 that it had received a subpoena from the U.S. Attorney’s Office in Massachusetts regarding certain China customer shipments.

It remains to be seen whether the investigation will result in any charges. But with the integrity of its impressive financial performance in doubt, it should come as no surprise to see shares pulling back in response today. So until we have more clarity on whether Applied Materials is guilty of evading government sanctions, I’m perfectly content watching this story play out from the sidelines.

Steve Symington has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Applied Materials. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

© 1995 – 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.