Artificial Intelligence (AI) Technology Doesn't Happen Without This Stock – The Motley Fool

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

Founded in 1993, The Motley Fool is a financial services company dedicated to making the world smarter, happier, and richer. The Motley Fool reaches millions of people every month through our premium investing solutions, free guidance and market analysis on Fool.com, top-rated podcasts, and non-profit The Motley Fool Foundation.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

ASML's technology is crucial in the manufacturing of high-powered chips.

Artificial intelligence (AI) requires many different technologies. While some investors focus on the companies that are developing or deploying AI models, these businesses need hardware with the computing power to create and use those models.

This is why stocks like Nvidia have such growth power: The company’s GPUs are used by essentially every company involved in AI.

There are alternatives to Nvidia, but all of those competitors have to use chips. While there are relatively few semiconductor manufacturers, all of them must purchase equipment for a process known as lithography from one supplier: ASML (ASML 1.12%).

Without ASML, AI wouldn’t be the same technology we see today. Luckily for investors, they can buy shares of a company that has a legal monopoly over its industry.

It’s rare to find true monopolies in today’s market, so when they appear, investors should take note. ASML’s machines are used in the lithography process, which puts the microscopic electrical traces on chips.

When a chip manufacturer like Intel or Taiwan Semiconductor talks about its chip technology, it’s often in reference to the distance between these traces, so a 3-nanometer (nm) chip has a minimum of 3nm spacing between each trace. The smaller the distance, the more transistors can be packed onto a chip, making them more powerful, more efficient, or a combination of both, depending on how it’s configured.

ASML’s extreme ultraviolet lithography systems are the only ones available that can achieve these performance levels, which gives them a monopoly. But it also gets the company caught up in political disputes.

The sales of the machines are heavily regulated because the West does not want China to have this technology. While ASML does some business with China, it is not allowed to sell its most advanced machines to that country.

This is also one of the reasons that tensions between China and Taiwan are so high: The technology China wants is only a short distance away. However, according to a report from Bloomberg, ASML can disable these machines remotely should an invasion occur.

This is just another piece of evidence that shows how crucial ASML’s technology is to producing cutting-edge chip technology. A company with this exclusive product is sure to have a premium price tag.

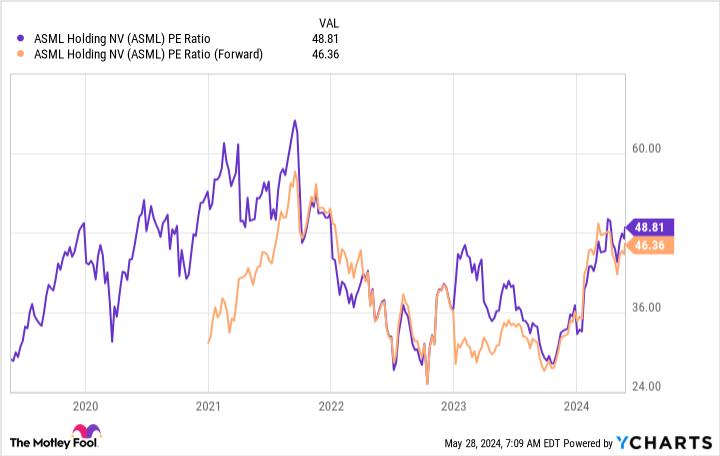

From a price-to-earnings (P/E) ratio, the stock isn’t cheap and isn’t looking to get any cheaper in the future.

ASML PE ratio data by YCharts.

Because the trailing and forward P/E ratios are nearly identical, it indicates there isn’t much earnings growth expected this year. This coincides with what management has guided for: It sees 2024 as a “transition year.” Next year is expected to be much stronger, so investors who buy the stock now shouldn’t expect earnings to skyrocket immediately.

Let’s look at Wall Street analysts’ projections to get an idea of the growth investors could expect in 2025. In 2024, they expect earnings per share (EPS) of $20.75, nearly identical to 2023’s $20.64 total. In 2025, those analysts expect EPS to rise to $32.29. That’s serious growth, and the P/E would drop to about 30 if it hit those projections.

So, should you buy ASML’s stock with that in mind? I’d say be patient. Most investors aren’t and won’t be willing to wait around for two years for substantial growth to happen. This could eventually cause a sell-off — an excellent time to scoop up shares. But that might never come, which could make now a great time to buy.

I can’t predict ASML’s stock price, but I know that AI demand and the chips that power it aren’t slowing down, which is great news for the business. This should result in a stock that crushes the market over a five-year time frame.

Keithen Drury has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short May 2024 $47 calls on Intel. The Motley Fool has a disclosure policy.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services.

Making the world smarter, happier, and richer.

© 1995 – 2024 The Motley Fool. All rights reserved.

Market data powered by Xignite and Polygon.io.