Intel to Get $23 Billion in Government Grants & Loans Plus $25 Billion Investment Tax Credits, to Invest $100 Billion in … – WOLF STREET

IMPLODED STOCKS

Brick & Mortar Meltdown

Banks

California

Canada

CRE

Credit Bubble

Cryptos

Debtor Nation

Drunken Sailors

Europe

Federal Reserve

Housing Bubble 2

Inflation & Devaluation

Japan

Jobs

Markets & Companies

Oil, Gas, Power

Retail

Trucks & Cars

Trade & Transportation

The government is expected to award Intel $23 billion in subsidies, plus Intel expects to claim another $25 billion in Investment Tax Credits in order to invest $100 billion over five years in chip making capacity, research and development, and advanced packaging projects in the US, according to a slew of announcements today.

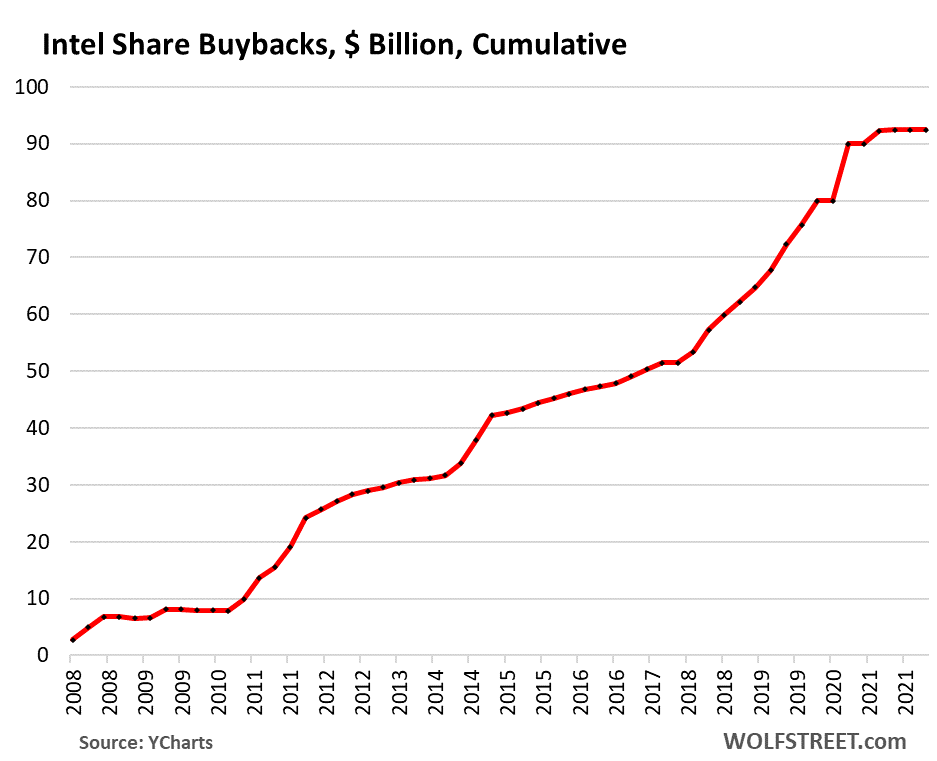

But since 2008, Intel has incinerated $94 billion in cash to buy back its own shares to prop up the price of its shares. Intel stopped doing share buybacks in 2021 under the new CEO Pat Gelsinger, as he steered the company back to investing its cash – and now taxpayer cash – into the future of the company in order to not be totally left behind.

If Intel hadn’t wasted $94 billion in cash on share buybacks to enrich its shareholders, it would now have the $94 billion in cash for its $100 billion investment, or it could have invested the $94 billion years ago in US-based research, development, and manufacturing plants, and it wouldn’t be so far behind now.

Today, Intel and the Commerce Department announced that they signed a non-binding preliminary memorandum of terms (PMT) under the CHIPS and Science Act, for $8.5 billion in grants that don’t have to be paid back plus up to $11 billion in loans.

In addition, Intel announced today that it expects to claim $25 billion in Investment Tax Credits as it plans to invest $100 billion over the next five years in chip making capacity, research and development, and advanced packaging projects in the US. The ITC was designed from get-go to incentivize companies to invest in the US, but apparently, that alone is not enough after all the share buybacks.

In addition, Intel is expected to receive up to $3.5 billion in separate funding for manufacturing of military and intelligence chips at its Arizona facilities, according to Reuters and Bloomberg.

The funds will be disbursed over time in phases upon reaching benchmarks and production goals. “The PMT provides that the direct funding award and federal loans are subject to due diligence and negotiation of a long-form term sheet and award documents, and are conditional on the achievement of certain milestones and remain subject to availability of funds,” Intel said.

And AI hype has to crown the whole thing: “AI is supercharging the digital revolution and everything digital needs semiconductors. CHIPS Act support will help to ensure that Intel and the U.S. stay at the forefront of the AI era as we build a resilient and sustainable semiconductor supply chain to power our nation’s future,” Intel said.

“The proposed funding would help advance Intel’s critical semiconductor manufacturing and research and development projects at its sites in Arizona, New Mexico, Ohio and Oregon, where the company develops and produces many of the world’s most advanced chips and semiconductor packaging technologies,” Intel said.

Intel’s project in Arizona (Silicon Desert) comprises several large facilities, the first of which should become operational by the end of 2024. Construction on the Ohio project is expected to be completed in 2026.

Intel is the biggest chipmaker to make a deal under the CHIPS Act so far. Smaller subsidy deals have already been announced by the US entity of BAE Systems, Microchip Technology, and GlobalFoundries. Hundreds of companies have lined up to get some handouts.

The CHIPS Act budgeted $39 billion in grants (of which Intel is getting $8.5 billion) plus loans and loan guarantees of $75 billion. The idea is to induce semiconductor makers to produce semiconductors in the US, rather than in Asia, with inducements that come on top of the 25% ITC.

We just relish those government handouts on a massive scale to the richest companies – sure, we get it, it’s good industrial policy and important for national security to put research, development, and manufacturing of the all-important semiconductors back onto US soil. But how about hitting foreign and US companies that import semiconductors and other products to the US with huge tariffs to pay for the subsidies? But no. So folks, hang on to your wallets. Just kidding. We’re going to borrow it. We’re going to throw it on top of the $34.5 trillion we already owe and no one is even going to notice it.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.![]()

Email to a friend

“up to $11 billion in loans”

What kind of interest rates do these loans carry?

The kind of rate you and I can only dream about?

Disgraceful.

What’s new it’s corporate welfare.

“WWII Italian fascist leader Benito Mussolini defines fascism as ‘the wedding of corporations and government’. This is exactly what we have in the US today – and throughout much of Europe as well.”

Were future share buybacks were prohibited as a condition of this deal ? How many elected officials were in position to profit from the deal ?

I see the WSJ is suggesting interest rates are going down. Still pushing the narrative .

Somewhere I read that samsung and taiwan semiconductor refused money under this program. They would have been required to fund the local schools, housing for their employees and housing for the local poor.

If the industry leaders think this is a bad deal, why is intel jumping all over it and bragging about it? Investors think intel gave up on being competitive a long time ago.

Don’t forget about lobbyist and PAC money. Obviously they wisely had budgeted for more “free speech” than their competitors did.

They were just the superior Citizens United, why whine about it?

As Trump said, “[They] just used laws of the land.”

Or are you one of those fools who think corporations do ANYTHING “for the good of all”, or “The country” unless there is a lot in it for them? (exception being arms companies in their own perverted way…..the econ I’m most familiar with…..grew up with it and still related to it)

Their shareholders and the rating agencies would say they have turned from fascist to communist and they’d be capitalistic toast.

They are “buying” some kind of soon to be very profitable “good will”. Revenues and stock value will show it in a couple years.

The grants and loans are not to compensate for their share buybacks but to ensure domestic production. Had they not stipulated domestic production and subsequent jobs I would absolutely agree it was just a handout.

1. If Intel hadn’t wasted $94 billion in cash on share buybacks to enrich its shareholders, it would now have the $94 billion in cash for its $100 billion investment. Is that so hard to understand?

2. Profits from production should compensate for investment in production. That’s how capitalism works.

3. Plus, there’s the 25% ITC that companies get to invest in the US. Isn’t that enough? If not, then impose 100% tariffs on all imports, including semiconductors and products that contain semiconductors. So there.

4. So now the taxpayer had to give Intel another $23 billion so that it then can make profits for its shareholder off that production?

Pardon the push back, but do I think it is a bit hard to understand your position, Wolf.

In the past, Intel did share buybacks — a policy that stopped in 2021.

Today, in the present, the US sees a strategic need to reshore domestic chip production and is providing incentives to a heavily capex-intensive industry to achieve that objective.

Is your position that any company/industry that wasted resources in the past should be restricted from participating in US GDP growth opportunities in the future?

I think you’re off the mark this time.

Companies doing share buybacks or having ever done share buybacks should never receive any subsidies at all period. They should be automatically excluded. Their shareholders can cough up that money. Not taxpayers. Share buybacks should be illegal market manipulation, which is used to be.

^^^

What Wolf said

Agree.

Buybacks are just returning cash to shareholders. If a company does have something compelling to invest in, give the cash to shareholders and let them invest elsewhere. Think of the billions in LTCG revenue for the Treasury.

As for banning corporations for engaging in a legal process, that sounds a lot like biting off your nose to spite your face.

Multinationals like Intel build foundries where it either makes sense logistically, or where they have to politically – I know the EU paid them a fortune to build in Ireland, and required chips to be fabricated on EU soil.

The political interference here is the issue. Intel would be stupid not to have their head in the trough.

I agree with Wolf. Why give the subsidy to Intel, as opposed to 10 start-up companies and/or competitors who want to invest in the US?

Intel and other companies made a strategic blunder by offshoring the bulk of production. Did they expect there would never be a need for chip production in the US? If so, they were wrong, and they shouldn’t be subsidized to correct that error. They should be penalized by having to watch new competitors take the US business and earn a subsidy while doing it.

“domestic chip production” ?

At the end of the day, it will be cost competitive or not.

NVDA is not going to INTL if their cost is 2x more than TSMC, unless it got subsidized by the US Gov.

The whole issue with the CHIP production is the economic/technological war with China. Once we said “you can’t buy our high end chip” and China decided to hoard all the “lower” end chips. Globally, we don’t have issue with capacity. But wait a few years, with all the new fabs – some will be sitting idle b/c they can’t compete.

Like Wolf said. If INTEL thinks there is a lot of money to be made in FAB, they can put THEIR money where their mouth is. Don’t put another burden on taxpayers. But we all know where their priorities are, with the execs and bonuses.

To add to what Wolf wrote.

Those share buyback programs were meant to goose the share price. That meant buying back at an as expensive rate as possible. Oh and taking out loans, loans for the sole purpose of buying back shares. And that is deliberately destroying ability of the company to invest/grow in the future just to make Wall Street happy.

There were damned good reasons to ban the practice in all but the most narrow cases until 1982 since it was considered market manipulation. Which is exactly what happened after it became legal.

“Intel would be stupid not to have their head in the trough.”

————————–

that’s what America, globalism, and success in capitalism have boiled down to ……

entities are stupid not to have their head in the trough

@ Wolf –

Thanks for your clear, and unpopular to many, opinion on share buybacks.

The CEO suite likes buybacks

Globalist’s dislike tarriffs

Welfare receiver’s like tapayer funding

@Wolf: Completely agree with your statement: “Share buybacks should be illegal market manipulation, which it used to be.”

However, most shareholders don’t benefit from this. Top management and the Board knows exactly what is going on in the company, they do the share buybacks to prop up the price and award themselves huge bonuses. They also sell off their huge stock options at elevated prices.

All outside shareholders can see is that their stock price going up and they think the company will continue to do well – and they are left holding the bag when the stock prices eventually collapse.

This happens again…and again…and again.

The Fed aids this process by keeping interest rates artificially low so “investors” have to chase yields in the stock market. Further, the 401k funds are “mostly/automatically” channeled into the stock market to prop it up as much as possible.

And so it goes on and on.

If there was one instrument that would reward savers with reasonable returns at low risk, we would have a completely different stock market altogether. But, the bigger players have decided how the game is to be played and surprise, surprise, it is all in their favor.

No, a lot of shareholders benefit from this. Share buybacks effectively launder income (taxable at income rates if disbursed as dividends) into share price gains, which are taxable at lower capital gains rates.

Right. It’s essentially paying dividends at a lower tax rate.

Now… Companies BORROWING MONEY to buy back shares… That should be illegal.

These financial incentives to Intel aren’t to rescue the company but to help the USA, at least in the eyes of the current government.

Sean S. – reminds me (in a slightly-different vein) of the long-gone-and-bonused pre-bankruptcy PG&E management who successfully dodged reinvesting in their grid while hiding behind the old meme of utility-investing as ‘low-risk and reasonable’ (…and CA PUC’s role not getting NEARLY enough scrutiny…). User’s rates now rising in the wake of that storm…

may we all find a better day.

If you were to audit profits earned by elected representatives on Intel stock during the buyback period, what do you think you would find?

Yes, Intel also produces votes to get grants and loans. Wolf’s basic capitalism. Look at who voted for it. I don’t blame Intel for buying in the congressional vote market.

The Whitehouse fact sheet on it also touts union jobs. Laundering money through unions is a time tested winner for some.

Tax all income at the same rate, including FICA, and a lot of issues would go away. Though it would cause problems in the vote market.

Except on-shore production has not been as profitable as off-shore. Someone crunched some numbers and decided that, at the time in question, share buy-backs were better for shareholders than investing in US-based facilities.

The government needed to provide large amounts of cash to overturn that equation.

Are you saying any company that ever did share buybacks or paid dividends (similiar goal of enriching shareholders) should not be able to get money from the US government to do something the government wants? Take Micron for example, today they are a “American company” with almost all their fabs in Asia. This program will encourage them to build new fabs in the US. That is a good thing.

The reality is that for multiple decades Taiwan and South Korea (and now China and Europe) have significantly subsidized semiconductor fabs. We can either insure we have enough manufacturing capacity here or we need to build up our military to defend Taiwan from invasion to protect the TSMC fabs – (those fabs are nearly indefensible.) The former is much cheaper and has a higher probability of success.

I do support the funding of manufacturing capital equipment and buildings. However I do not support the rest of the federal funding in this law. The US has very good R&D, design skills, etc.., no federal funding is needed in those areas.

Tariffs rarely work. They merely make the next level user of that product noncompetitive. For example, if computers double in price, expect engineering work and data centers to move outside the US. (Note: Tariffs products just from Cuba aren’t a problem, because anything they make is readily available elsewhere. But a tariff on semiconductors from outside the US would be a huge problem). A tariff would dry up demand so Intel would not be motivated to do this rapid fab expansion. A tariff would not accomplish your goal.

I spent over 30 years in the US semiconductor industry mostly on the design end but with significant insight into US and Asian fabs. Intel has been far from perfect, but if we want leading edge semiconductors in the US – there are 3 logic companies only 1 American – Intel and two more that do purely memory only 1 American – Micron.

Intel could have gone fabless like Nvidia, Qualcomm, AMD, etc and it probably would have been better for their stock price. But as Americans, we should be happy they didn’t.

A great company with a rich history like TI (as an example) has neither the expertise nor the $100B that Intel plans to spend just on its Ohio megafab ignoring all their other planned fabs. This is somewhere between the Manhattan project and the US building Liberty ships – when including test,packaging and some amount of domestic card assembly. The upstream and downstream support infrastructure that needs created is staggering. Remember that GF is the only significant pure foundry in the US today. Intel historically has had none.

I own Intel shares and I agree share buybacks should be made illegal again (or something that would help, like executives and board members not permitted to own any shares of the company they work for. Salary and performance bonuses only…a ban like that would kill one of the more selfish incentives to initiate buy backs (to pump up the value of the executives’ own shares and options).

Fascism (corporatism) at it’s best.

Dave,

AKA: regulatory capture/crony capitalism/unfettered capitalism/corruption etc etc

When big money and goverment act toghether at this level and this sytematic it is turning to corporatism, that is fascism.

State-backed enterprise.

correct

Chief Justice Roberts and the Fascist Economy by Gary North

Roberts has at long last legalized open economic fascism to America. Of course, it has been alive and well ever since the New Deal, and really since the First Bank of the United States (1791 to 1811). But now it has been placed under the judicial umbrella of a Supreme Court decision.

Economic fascism is the doctrine that there is a government-business alliance that makes the nation wealthy or strong militarily. This idea has never had a judicial basis before. Now it does.

The first fascist agency in post-Constitution history was the First Bank of the United States. It went out of existence in 1811. The Second Bank of the United States created a replacement: 1816 to 1836.

In the historic case, McCulloch v. Maryland, Chief Justice John Marshall announced that “the power to tax is the power to destroy.”

Marshall used this doctrine to keep Maryland from levying a tax on a private entity: the Second Bank of the United States. In striking down this state tax, Marshall established the legality of economic fascism in America: the government-business alliance.

Maryland correctly argued that Congress did not have the right to delegate sovereignty to a private agency. This was the judicial heart of the matter. But Daniel Webster, who was the Bank’s legal counsel, argued that Congress did have this right. Marshall sided with Webster.

Marshall’s creation of tax immunity for the Bank established the central legal principle of central banking. This is the cornerstone of the Federal Reserve System. It is sacrosanct. This is why any reference to Maryland’s case against the Bank is not discussed.

Roberts has enunciated as a principle of law the fundamental principle of the fascist economy: there is a legitimate government-business alliance, established by law, which places government over the private, profit-seeking business, and the business in return is granted some of the immunities possessed by the state. It means that a business can make you an offer you can’t refuse. This principle is now the law of the land.

I call it criminal-like behavior. Totally agree with Wolf’s position here.

Intel should be just nationalized if US worries about strategic importance of chip industry. It might do better than the current “privatizing profit and socializing cost” plan.

US is rapidly turning into soviet union by putting hands on the competitive scale, controlling media, faking elections, erecting trade barriers, and ending up with massive inefficiency.

39 billion in grants. What’s the problem? Small change, a blink of an eye to the U.S. government. Who knows, some of this money might even go to the actual cause once it gets past the corporate cronies.

I was reading about this and the “$100B” of construction Intel is planning. Apparently a large portion of that money is from the taxpayers though because no private investors are willing to take the risk on Intel now.

Sadly it appears that Intel is going to become a Ward of the State much like US Steel and General Motors did before it. If our “best” semiconductor company can’t stand on its own anymore then maybe we should just be glad that TSMC is building and planning to manufacture in the US now.

What are few billions between friends!

Welcome to the United States of Socialist Republic. Let us hope central planning, 5 year plans etc. works better than what it did in USSR, India, Pre-Nixon China.

The country would be well off by curtailing casino plays by Hedge fund billionaires and all their derivative games, fractional banking etc. Perhaps only a real revolution would do that. I keep reading younger generation is getting poorer and poorer to make that a possibility.

That reminds me a personal incidence circa 1989 – Me a NSF program director – Our directorate established to make C.Sc. degree and research a priority. Annual presentation by each PD to the bosses. I had a slide showing our trade deficit going to the south as much as possible (before the scales were reset). Included was a graph almost flatline showing our miniscule surplus via high tech. My question, Is the high tech really the solution all are hoping for if we cannot manufacture efficiently what we invent? Japan was our manufacturing slave at that time. The bosses did not like it but me, I am here only for 2 years to learn what is going on! I can quit even now!!

Recently, I opened a US Made iconic Bose 901 speaker of 1980’s to re-foam the speakers. Inside, the workmanship was ugly, childish. But was made in USA 🙂

Hey there! Thanks for sharing your insights and experiences from your time at NSF. It’s definitely a challenging landscape out there, especially when it comes to funding and the broader economic picture. Your story about the Bose speaker is a great reminder of the importance of both innovation and quality craftsmanship. As a new assistant professor diving into the world of computer science and AI, I’m learning firsthand about the complexities of navigating funding and research priorities. It’s a wild ride, but I’m excited to be a part of it!

…why ”Murican Exceptionalism’ has always troubled me – being ‘USA-made’ was NEVER a permanent guaranty of good workmanship/quality/value, only that we were capable of a general (daily) effort to make it so (before it became easier to ‘make’ money rather than actual goods)…

may we all find a better day.

Seems like this stimulus honey is going to be complicated in regard to the perception that Biden is destroying the economy.

Trump may claim he’s going to tax China goods in some way, but if Biden is making America Great Again by adding to the deficit by buying votes, this just gets incredibly, increasingly bizarre.

The irony here, is if Trump wins, he probably will cut taxes to supercharge these windfall programs, as the deficit accelerates into a super nova.

If Biden wins, what does he do with taxes as the deficit warps into a parabolic rocket?

Intel would need a decade to catch up with TSMC – if the government is truly desparate about chip manufacturing they should just break up the company into separate design and fabrication entities. Gelsinger aready proposed something like this, but did not act. Was probably busy lobbying for subsidy.

There is a reason buybacks used to be illegal.

Yes that didn’t sit well with me when I first heard about it this morning, even if they didn’t buyback shares! I heard about it and forgot about it quickly.

C Mon Prisoners. Shock ed and Awe ed by this subsidy? Lets just call it Operation Reverse Double Thrust Twist and call it a day. Looking forward to the FED dot plot article from the Lone Wolf today. No joke about that.

@DFB: As expected, the Fed left the dot plot with 3 rate cuts this year. They didn’t want to rock the market, so they chose to keep dangling the carrot in front of the rate-cut mania donkeys.

I expect Powell to continue to say that it all depends on the data. If we see more inflation spikes, they will “spin more positive news” by reducing the rate cuts to 2 this year while increasing the number of cuts in 2025. The rate cut mania donkeys will salivate at the increased # of cuts for 2025 and continue to throw more money into the market. I expect the charade to continue till the market cannot be propped up any more.

Having said all this, everything depends on the inflation numbers. LOL.

I already know what the sentiment on this website will be with this new windfall. However keep in mind that with the current trend of isolationism and the landscape of geopolitics, having an indigenous fabrication platform is now a must. We can either pay up and build these fabs in the states, or twiddle fingers about when and where China will strike within Taiwan.

With that being said, how much help do we give the corporations? Was this too much money being thrown out? I don’t think we’ll know until they start fabricating (albeit at a larger node than what I would like) and compare them against the economies of scale that China will deliver. And you can bet that China is throwing the kitchen sink at these kinds of projects as well.

In the end, I think these types of investments should be with stipulations where the C-Suite is limited as how much of the money they see and delivering upon promised timelines. It really is a pick your poison moment that leaves a sour taste in anyone’s mouth when seeing Wall Street get bailed out like this.

@DFB: As expected, the Fed left the dot plot with 3 rate cuts this year. They didn’t want to rock the market, so they chose to keep dangling the carrot in front of the rate-cut mania donkeys.

I expect Powell to continue to say that it all depends on the data. If we see more inflation spikes, they will “spin more positive news” by reducing the rate cuts to 2 this year while increasing the number of cuts in 2025. The rate cut mania donkeys will salivate at the increased # of cuts for 2025 and continue to throw more money into the market. I expect the charade to continue till the market cannot be propped up any more.

Having said all this, everything depends on the inflation numbers. LOL.

Fed Still Sees 3 Rate Cuts in 2024, But 2-Cut Scenario only 1 Participant Short,

“But the composition changed, with 9 participants expecting two or fewer cuts, and 9 expecting three cuts, and only 1 expecting four cuts. In other words, the two-cut scenario was short only one participant.”

https://wolfstreet.com/2024/03/20/fed-still-sees-3-rate-cuts-in-2024-but-2-cut-scenario-only-1-participant-short-holds-rates-at-5-50-top-of-range-qt-continues-as-planned/

The same as it’s been in my lifetime. Born under a trickle down, ketchup is a vegetable type leader and been indoctrinated ever since!

The biggest corporations get the best deals because they “put their own capital at risk” and “create jobs” and are MUCH more productive than the workers could possibly be.

I’m pretty good at buying shares of bad businesses, spending other people’s money and lying…. But not good enough!

Maybe if I can rip-off the design of the best, to make the 10th best product in the world and still lose money, then I’ll get a grant.

We will notice……..inflation will be running hot for a long long time.

JP kept the three interest cuts this year in light of existing inflation.

If that ain’t a pivot……it sure looks like one.

Goodbye middle class……your future is now as clear as a sunny day.

They intend to steal it all……..meantime our politicians plan the economy………soviet style. Chip act, climate act, etc etc.

It’s almost like watching a bad movie.

Always easier to invest dumb money than your own.

Might as well rob the tax payers while they can.

Friends might be right 10 – 20M might not be enough to retire in style anymore at the rate America is handing out free $$$.

Hah.

Why is “enriching shareholders” a bad thing? Isn’t that kinda the point?

This was about share buybacks (which used to be illegal for good reason). From the article:

“If Intel hadn’t wasted $94 billion in cash on share buybacks to enrich its shareholders, it would now have the $94 billion in cash for its $100 billion investment, or it could have invested the $94 billion years ago in US-based research, development, and manufacturing plants, and it wouldn’t be so far behind now.”

Taxpayers are paying for it now because Intel no longer has the cash to invest $100 billion in chip research and production because it blew that cash on share buybacks to enrich investors. That’s the point.

Share buybacks in the past and future should automatically make companies ineligible for subsidies and bailouts.

Totally agree

Stock buy-back was illegal until the U.S. congress and the Reagan Administration, decided that “Government is not the solution – Government is the problem” and consequently, stock manipulation through buy-back became the norm. With the current trend of giving free cash to dinosaur companies that survived the market place, based mostly due to stock manipulation and shear size, the basic principle of “survival of the fittest” is being violated. The next phenomenon that we are likely to see is for Boeing to ask for “free cheese cake” grant money under the excuse that they need the money to buy all the missing bolts that are missing on their airplanes. The reality with Intel is that not only the perverse way in which company executives enriched themselves through stock manipulation emanating from $94 Billion over 15 years, but also the fact that the company laid off more than 20,000 employees during this period of time, while violating the civil rights of workers of age 40+ and the U.S. Gov. just stood by and watched…

The part you missed, and apparently Congress/ subsequent administrations, is that:

“Government is not the solution – Government is the problem”

is in direct conflict with :

“the current trend of giving free cash to dinosaur companies”

It all goes to hell when the politicians engage in selective socialism.

As a laid off worker older than 40 I think your comment is right on. And this plant will be obsolete when it opens, if it opens. Commodity chips are coming out of Asia and high end chips are coming more and more out of Asia. And if China wants TSMC it will make an offer they cannot refuse and the US cannot do anything about it. China will just out engineer and reverse engineer and figure it out though. Unless Intel has a new idea….the kinds of ideas many of the 20000 laid off workers might have had this is just a gift to the top executives who got their ideas from Harvard Business School which is not known for its skills in design and manufacturing as we see with Boeing. The progress in high end chips that China has made in the last year are remarkable. And the success of Huawei in wiping out Apple in China is equally remarkable. Embargos work. Short American industry….go long on law and finance, defense and health care.

Dr.F/ChS – sounds more like gubm’t AND corps. (that consarned (and rapacious) ‘human nature’ not exclusive to either) are only major players in a much-larger ‘problem’…

may we all find a better day.

Time to just nationalize it. Crazy how much tax payers have funded so many things only to not get any of the spoils. If an industry is critical then at a minimum then state capitalism such as in the case of China. It isn’t like tech companies like Intel don’t have the capital so we pay them to produce here.

“Time to just nationalize it.”

I obviously don’t agree, but the selective socialism our government is engaged in might be worse than nationalizing it.

I’m on the same page as Wolf. Intel elected to use its cash to enrich shareholders, not to stay ahead of rivals like TSMC. The semi-conductor industry is constantly innovating. The only reason the West stays ahead of China is because of ASML(Netherlands) and TSMC(Taiwan). Intel and the US stopped the innovation years ago. IMO, Intel will not catch up. It’s like a bike race, once you lose the peloton, you’re screwed.

What was to stop Intel from going to the market to raise cash? Ummm… afraid that their stock would tank and the execs may not be billionaires much longer? What is wrong with that?

Because for fabs, companies in Taiwan and South Korea go to their government to raise cash and have done so for decades. The cost of capital is why semiconductor manufacturing is in Asia – nothing else. The primary cost of semiconductor manufacturing is not labor costs nor energy costs nor raw materials, but the cost of capital to buy the equipment needed to build ever smaller dimensions.

TimMc- …seem to recall the ‘conventional wisdom’ of the ’90’s was that we no longer had to dirty our hands or lands with a lot of ‘mundane’ manufacturing, as we would ALWAYS lead the world from our ‘Murican mastery of innovation and services (…the jobs exported securing future planetary peace and corporate profits via raising 2d/3d-World living standards…).

may we all find a better day.

This is just the latest in thousands of years of governments funding industries they believe will benefit them or their nation-states. From the Greeks backing Archimedes and his war engines (do NOT throw away 3 hours of your life watching “Dial of Destiny”) to Spain bankrolling Columbus to the British search for longitude to the US funding the transcontinental railroad. It always looks like a boondoggle at the time. “You’re giving him a huge pile of gold to do what??? That’s insane!” And sometimes it even is (see: Solyndra) But we always manage to stumble forward.

I thought a “legitimate” purpose of share buybacks was to lessen the capacity of very large shareholders- especially the hedge funds- to gain undue influence & at the extreme, board seats, to pursue short term rise in stock price by any & all means (including selling off assets).

I don’t know how often this happens, particularly with big companies like this one.

Just hard to see what happened to Intel. I got hired right out of college and worked there from 1990 to 2002. Part of the change was simply chips becoming commodities, failure to see and compete in new markets, and a shift in the culture.

Glen – another sad example of the financial ‘tools’ of management (human and otherwise) becoming more important than the putative offerings of the company they govern…

may we all find a better day.

American Capitalism: Failing Upwards.

A massive org formerly dedicated to the superiority of their architecture attempting to catch competitors building their own on the new, at taxpayer expense. Will GM EV’s be Intel Inside?

///

As a previous employee I must say, I have never seen a more destructive, aggressive and nihilistic management culture then in Intel. It was all about gutting the system and taking as much as one can…How bad could it get? Well…

1) I had to change positions in Intel because we found a fundamental flaw in the 14nm chip manufacturing process that was introduced by management’s negligence. Billions were lost…Millions in bonuses were made. 🙂

2) All engineers of a certain critical layer for the 10nm node left the company before the 10nm node went into RAMP…They needed to start from scratch. 2+ years delay on the project.

3) The most senior engineer in a mission critical layer was a recent college graduate with a total of 6 months training experience. They fired all the older people (with decent benefits to cut cost) a few months before that.

4)…

There is such a thing as too much money…Definitely.

///

As another former downsized age 50+ Intel employee, sad to say their software engineering practices aren’t much better. Employees got zero support, were expected to perform miracles on demand, expectations wholly unrealistic. Too many treacherous personalities abounded, not just in management.

Intel burned up billions chasing the mobile market, before finally giving up. Intel was so far behind when starting this, I don’t see how upper management thought they could ever catch up to the market leaders. A real head scratcher.

And as for inexperienced engineers placed into senior roles, that is an industry wide problem in tech, with predictable results. Even worse is forcing non-managerial employees to take on managerial duties they never asked for or wanted.

The inexperienced “senior” positions aren’t isolated to tech.

We have a middle management society. If we’re proven to be “good with people” and money hungry, then we’re “management material.”

Keep a clean, profitable facade and keep moving up.

Practical obstacles are to be put under the rug. When problems rear their ugly heads: Blame the subordinates!

Formula old as time, generally employed before the fall.

One thing about AI that seems questionable, is ubiquitous adoption.

The Internet in the Dot-com era, went from late night router connection pings to AOL and eventually spread like cancer, as everyone started discovering the wild West of the information highway. Ironically, paradoxically one of the biggest drivers of the web was porn.

The only reason I bring that up, is because I wonder about the overall growth engine that will drive AI into a globally adopted must have story.

The simple evolution of the early Internet is about increased availability of data and then the transfer speed — then evolution to smartphones and that exponential shift.

But, the only game changer I see in AI is in speculation that’s total hype.

I can understand that quantum computing will eventually allow for faster processing, but I can’t see how quantum AI will do anything that can’t be done in 2024. What am I missing? Why will Intel evolve from a cash burning machine into a wildly profitable perpetual cash printer?

FYI:

At Foundry Direct Connect this morning, the chip giant detailed an even more advanced process called Intel 14A. It’s expected to come online by 2027 and will use ASML’s $350 million High NA EUV machines to carve transistors into chips.

Looking back, it’s easy to think about a sta

Plus, this money comes with strings attached, like all the construction workers have to be union members. TSMC is completing a chip plant in Japan in have the time compared to in the US because there is not all the government red tape.

This is true.

I see this as a kind of tariff. I loath share buybacks and agree they should be illegal in most cases. That’s a separate issue. Gov incentives to keep production and jobs in the US is to prevent companies from offshoring the work, or in this case help them be competitive vs offshore companies. Protectionism that has its heart in the right place but its head elsewhere. See any TVs being made in the US anymore? See how those tariffs on Japanese TVs worked out? It’s like over protecting your kid – preventing them from learning to cope. If Intel can’t compete today, cash infusions won’t help. They don’t know what to do with cash, hence the buybacks. Now, if we’re ’leveling the playing field’ by matching, say China’s chip-maker incentives, that’s another story and the gov subsidies should be presented that way.

At least Intel ditched the finance guy ( CEO Swan) for and Engineer (Gelsinger). Unlike Boeing, who still has the finance guys running the show in Chicago and as a result its clown show keeps rolling along.

///

This game was started to the best of my knowledge with Otellini (2005-2013), continued with Krzanich (2013-2018) as CEO and Swan only carried the torch. Based on Wolfs chart I’d say:

Otellini ~20B in 8 years

Krzanic ~25B in 6 years

Swan ~40B in 3 years

To think that a cutting edge functioning fab costs 10B fifteen years ago…

///

Talk about short-sighted.

I notice that INTC will be building some of their new facilities in AZ and NM.

Both of these states are experiencing accelerating drought conditions. I’m no chip designer but the last I heard, chip manufacturing requires copious amounts of clean water.

Seems pretty stupid to me.

MOFO – haven’t you heard? Our spacecraft’s stores are inexhaustible (and the need to maintain it’s basic life-support systems unnecessary…). /s

may we all find a better day.

I worked at VMware when Gelsinger was CEO. During a town hall, someone asked him about the Presidential technology council (or whatever it is called) because Trump was President at the time.

Good old Uncle Pat said to that questioner “We have to be involved with the government. They’re the biggest player out there.”

Smart man.

In two years it’ll be:

“We have to be involved with the gubment. They’re the only player out there”.

This example is consistent with what Peter Zeihan claims the US is in for for the next decade: a massive amount of reindustrialization (deglobalization…bringing industry back to US) at insane cost which he believes is going to be almost entirely borrowed, resulting in higher interest rates for way longer than even most of the inflation hawks think. The logic being interest rates are a function of the demand for borrowed money. In other words, massive demand for loans allows banks and the market to charge higher interest rates. Inflation will also be higher, with an economy fueled by so much construction and, presumably, the higher costs of goods stemming from higher labour costs to staff the new factories with US workers. That the federal government would assist in this exercise also fits.

I hope all the performance milestones in these contracts work out better for the tax payers and government than the F-35 fighter jet fiasco. Maybe the chips will even work.

Great. With that kind of gubment money, Intel can keep their x86 CISC-architecture from the 1980’s going for a few more years and beef it up with even more gizmos (gigabytes of cache memory, clock frequencies that will require you to shield your CPU with some sort of casing, yet more “extensions” and of course more security holes – hell, they even manage to put security holes right in their processors !). And their outsorced R&D department at AMD (they sell T-shirts at Intel saying “i applied at AMD but they didn’t take me !”) will get a few pennies as well.

That’s what gubment money gets you.

Still like to understand why

1) It is wrong for a company to distribute any profits to shareholders via dividends or buybacks?

2) It is fine for Asian companies to get free money from their governments for manufacturing facilities in their countries but it is wrong for the US to do the same?

3) We think total dependency on the world’s only leading edge fabs merely 100 miles from China when they are threatening daily to invade makes sense?

Of course, you have AI hype right now, but all global players are investing in semiconductors manufacturing capacity massively.

If the market works as it should, there will be as massive downturn in prices. Once built. semiconductor facilities must be run al the time at the highest rate possible. Even if idled, they burn your cash like nothing else.

So, I guess we should expect Taiwan capacity to go in flames at some point. Poor stupid Taiwanese…

A downturn in semiconductor prices would be one of the best things that could happen to the economy. Bring on the capacity!

The boom bust roller coaster of semiconductor prices has gone on for 50+ years. The difference now is that China is publicly planning to take over Taiwan in the next few years, by force if needed.

If that occurs and US access to those fabs ( where the vast majority of sub 5nm silicon is built) are cut off either due to political reasons or because they were destoryed in war – what impact does that have on the US?

I view the split in the world semiconductor markets between the west and China / Russia as bringing a new dimension to the world’s economy especially if China takes control of Taiwan.

In 3, 10, 30 years; Taiwan may still be sitting as a free, independent nation (I hope) but I suspect it is more likely to end up as Hong Kong 2.0 with an economic divide between China and the west in at least advanced semiconductors. That is what China is publicly saying they want, why not believe them?

Believe me; over the years, Intel incinerated hundreds of billions dollars—most every hair-brained initiative by Paul Otenelli comes to mind. However returning the owners’ money to the owners is not incinerating it. Every major Intel acquisition has failed, except for the DEC acquisition. Intel lived off of DEC’s chip making know how for several generations. Better to give money to your shareholders rather than to other companies’ shareholders.

Comments are closed.

When stuff gets inflated like this, no one should be surprised when it gets deflated.

The liquidity drain of Quantitative Tightening has come entirely from ON RRPs. Reserves have lots of liquidity left to drain.

Services are big, and that one-month outlier was massive, and it drove down Core CPI and overall CPI.

Higher for longer becomes formalized one meeting at a time, as projections for “longer-run” federal funds rate keep getting raised.

A big driver is the “secular decline in the office market” that even slashed interest rates would not end.

Copyright © 2011 – 2024 Wolf Street Corp. All Rights Reserved. See our Privacy Policy