5 Best Semiconductor Stocks For 2024: May Edition – Forbes

From AI to 5G and Internet of Things (IOT), semiconductor stocks fuel tech innovation, long-term growth, and can offer significant investment returns.

getty

The semiconductor industry remains at the forefront of technological innovation and economic growth. With advancements in artificial intelligence, 5G and the Internet of Things (IoT) driving demand, selecting the right semiconductor stocks can offer you significant returns. In this article, I delve into companies that not only lead the charge in innovation but also offer strong investment potential. From established giants to promising upstarts, these selections are based on a rigorous analysis of performance indicators, market position and future growth prospects.

The semiconductor industry is on a transformative growth path, marked by an increasing demand from sectors like technology, automotive and consumer electronics. As we advance into 2024, it’s essential for investors to consider various factors shaping the industry, such as technological breakthroughs, supply chain intricacies and geopolitical dynamics that could influence production and market distribution.

Investors are drawn to semiconductor stocks for their growth potential, innovation leadership and the industry’s cyclical nature, which offers opportunities for strategic investment during low periods. The appeal of investing in this sector includes the chance to be part of groundbreaking technological advancements, portfolio diversification across tech-driven industries, and the potential for high returns from companies leading in innovation. Plus, some established players in the semiconductor space provide dividends, adding an income component to the growth prospects.

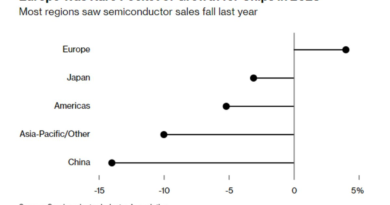

Currently, the semiconductor stock market is a blend of optimism and caution. The industry’s long-term demand trajectory remains strong, fueled by the relentless need for more sophisticated semiconductors in emerging technologies. However, challenges such as supply chain disruptions and geopolitical tensions have introduced a degree of volatility, with the U.S.-China tech rivalry impacting global supply chains and investment patterns.

Looking ahead at 2024, the semiconductor sector presents a cautiously optimistic investment landscape. Supply chain difficulties are anticipated to diminish, boosting production capabilities and distribution efficiency. Nonetheless, geopolitical uncertainties could unpredictably sway the industry. Despite these challenges, the enduring demand for semiconductors, driven by 5G expansion, AI advancements and broader digital integration, suggests sustained growth. Investors who leverage these trends should focus on companies with robust innovation, effective supply chain strategies and a strong foothold in critical technological domains.

In determining our top five semiconductor stocks for 2024, we followed a detailed methodology that balanced quantitative metrics with an analysis of company fundamentals. Our selection process emphasized earnings growth and the strength of a company’s balance sheet as primary indicators of financial health and potential for future success. Earnings growth is critical as it reflects a company’s capacity for innovation, market penetration and effective strategy execution. Similarly, a strong balance sheet, characterized by manageable debt levels and solid liquidity ratios, indicates financial stability and the ability to sustain operations through economic fluctuations.

Each company’s position within the industry, technological advancements and growth prospects in emerging sectors such as AI, IoT and 5G technologies were also evaluated. This involved examining market trends, regulatory impacts and competitive landscapes to pinpoint companies with a strategic edge for long-term growth. The approach aimed to identify semiconductor stocks that are well-positioned for growth based on a combination of current financial performance and strategic market positioning. This methodology prioritizes a comprehensive view of a company’s financial health and potential to adapt and thrive in the evolving semiconductor industry landscape.

The brain trust at Forbes has run the numbers, conducted the research, and done the analysis to come up with some of the best places for you to make money in 2024. Download one of Forbes’ most popular and widely anticipated reports, 12 Best Stocks To Buy for 2024.

Jason Kirsch

Nvdia headquarters

Nvidia, founded in 1993 and headquartered in Santa Clara, California, is a technology company renowned for its graphics processing units (GPUs) for gaming and professional markets. It is a leading force in the global semiconductor industry, particularly known for its graphics, high-performance computing and artificial intelligence (AI) innovations.

Nvidia’s GPUs are critical for driving the graphics in video gaming, but its application has expanded far beyond to include AI, deep learning and autonomous vehicle technologies, positioning the company at the heart of the AI revolution. The company’s CUDA technology, a parallel computing platform and application programming interface (API), has enabled dramatic increases in computing performance by harnessing the power of GPUs.

In addition to its core GPU products, Nvidia has diversified its portfolio to include data center solutions, automotive technology and AI platforms, catering to a broad range of industries seeking high-performance computing solutions. Nvidia’s strategic focus on AI and deep learning, combined with its pioneering GPU technology, has solidified its status as a leader in creating and accelerating AI technologies.

Nvidia’s commitment to innovation and strategic investments in key technology areas have driven its growth and solidified its position as a key player in the global technology landscape, shaping the future of gaming, professional visualization, data center computing and AI-driven applications.

Nvidia stands out as one of the premier semiconductor stocks for 2024, driven by its strategic positioning at the forefront of several transformative technology trends. Nvidia’’s core competencies in graphics processing units have evolved far beyond gaming into areas like artificial intelligence, data centers, autonomous vehicles and professional visualization, making it a critical enabler of modern computing paradigms.

The company is ideally positioned to capitalize on the exponential growth in AI and machine learning, both of which require the kind of high-performance computing capabilities that Nvidia’s GPUs offer. The increasing adoption of cloud computing and the expansion of edge computing also present significant opportunities for Nvidia, as its GPUs are increasingly used in data centers for complex computational tasks. Nvidia’s early and ongoing investments in autonomous driving technology and virtual reality position it to benefit from growth in these sectors as they move closer to mainstream adoption.

Financially, Nvidia has shown remarkable earnings growth, underpinned by its GPU market dominance and successful expansion into new markets. The company’s robust balance sheet features strong liquidity, minimal debt and substantial cash reserves, which afford it considerable flexibility to pursue further research and development, strategic acquisitions and other growth initiatives.

Nvidia’s competitive advantage lies in its comprehensive ecosystem, which includes hardware, software and platforms that accelerate AI and machine learning development. This ecosystem approach has helped Nvidia build strong relationships with developers, businesses and research institutions, further solidifying its market position. Additionally, Nvidia’s continuous innovation in chip design and its strategic use of acquisitions to enhance its technology stack and market reach give it a distinct edge over competitors.

Regarding valuation, Nvidia’s stock reflects the company’s aggressive growth trajectory and the high expectations for its future performance. While its valuation metrics may appear high relative to historical standards, they are justified by Nvidia’s potential for continued leadership and growth in key technology sectors. The company’s strong financial health and strategic positioning in high-growth markets suggest that Nvidia’s stock may offer significant upside potential for investors looking at 2024 and beyond.

Lisa Su, CEO of AMD, photographed in May 2023 by Jamel Toppin for Forbes

Advanced Micro Devices is a global semiconductor company known for its pioneering work in the fields of microprocessors, graphics processors and related technologies. Founded in 1969 and headquartered in Santa Clara, California, AMD has grown into a formidable competitor in the semiconductor industry, challenging industry giants and innovating across high-performance computing, graphics, and visualization technologies.

AMD’s product portfolio includes x86 microprocessors for desktop, laptop and server markets and semiconductor products for gaming consoles and home media platforms. The company has made significant strides in capturing market share within the PC and server processor markets, particularly with its Ryzen and EPYC series processors, which are praised for their performance, energy efficiency and value.

A key factor in AMD’s resurgence in recent years has been its strategic focus on high-performance and adaptive computing solutions. This approach has allowed AMD to capitalize on the growing demand for data center and cloud computing technologies and the sustained interest in PC gaming and content creation.

AMD’s commitment to innovation is also evident in its 2022 acquisition of Xilinx, a leader in adaptive computing, which positions the company to further broaden its product offerings and addressable markets. Through strategic partnerships, research and development, and a customer-focused approach, AMD continues challenging the status quo, driving technological advancements and delivering competitive and cutting-edge solutions to the market.

Advanced Micro Devices is regarded as one of the premier semiconductor stocks for 2024, benefiting from a confluence of industry trends and strategic positioning. AMD is well-poised to capitalize on the surge in demand for high-performance computing, gaming and data center technologies. The company has made significant inroads into these areas with its Ryzen CPUs and Radeon GPUs, which have received critical acclaim for their performance and efficiency. Additionally, the growth of cloud computing and the increasing need for more powerful processors to handle AI and machine learning workloads present substantial opportunities for AMD’s server-grade EPYC processors.

AMD’s financials underscore its ascent in the semiconductor industry. The company has demonstrated impressive earnings growth, reflecting its successful product launches and increasing market share in the PC and server segments. AMD’s balance sheet has grown stronger over the years, marked by improved cash flows and reduced debt levels, which positions it well for sustained investment in research and development and strategic acquisitions.

A key competitive advantage for AMD is its agile and innovative approach to product development, allowing it to quickly bring competitive products to market. AMD’s partnership with TSMC for chip manufacturing gives it access to leading-edge semiconductor fabrication technologies, which is crucial for maintaining its chips’ high performance and efficiency. This relationship and AMD’s focused R&D efforts enable rapid iteration and improvement of its product lineup, keeping pace with or outperforming competitors.

Regarding valuation, AMD’s stock reflects the company’s growth trajectory and the market’s optimism about its future prospects. While AMD trades at a premium relative to some peers, this valuation is supported by its potential for further market share gains and its role in driving forward the high-growth segments of gaming, data centers, and AI computing. Investors are drawn to AMD for its current financial performance and strategic vision aligning with future technology trends.

AMD’s strategic alignment with significant industry growth drivers, robust financial performance and competitive product offerings underscore its status as a top semiconductor stock for 2024. The company’s valuation captures its recent successes and potential for continued innovation and market expansion in the rapidly evolving tech landscape.

Copyright 2011 AP. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Intel, established in 1968 and headquartered in Santa Clara, California, is a multinational technology company and a leading manufacturer of computer processors and other semiconductor products. Intel is renowned for its microprocessors found in most personal computers, solidifying its status as a cornerstone of the computing industry. The company’s product lineup extends beyond CPUs, including chipsets, integrated graphics, memory and networking hardware, catering to various computing needs from consumer electronics to enterprise servers.

Intel’s innovations have powered decades of computing advancements, significantly contributing to developing desktop, laptop and server markets. Despite increasing competition in recent years, Intel continues to invest heavily in research and development, aiming to maintain its leadership in process technology and manufacturing capabilities.

With a strategic focus on cloud computing, the Internet of Things and the proliferation of smart devices, Intel is diversifying its portfolio to address emerging technology trends. The company’s efforts in areas like AI, 5G networking and autonomous driving technology underscore its commitment to evolving alongside the rapidly changing tech landscape. Intel’s enduring legacy and ongoing innovation drive its mission to shape the future of technology.

Intel is positioned as one of the standout semiconductor stocks for 2024, drawing on its extensive history, comprehensive product lineup and strategic initiatives that align with current and emerging technology trends. Intel is poised to benefit significantly from the ongoing expansion in artificial intelligence, cloud computing, 5G infrastructure and the Internet of Things. These sectors demand increasingly powerful and energy-efficient computing solutions, areas where Intel’s R&D and product innovation focus.

Intel’s earnings and balance sheet exhibit the company’s financial resilience and operational strength. Despite facing competition, Intel has maintained solid profit margins and revenue streams, supported by its diverse portfolio that includes CPUs and memory, networking and mobile computing products. Intel’s investment in next-generation technologies and aggressive push into AI and autonomous driving sectors underscores its commitment to growth and innovation.

Intel’s competitive advantage is multifaceted, stemming from its integrated design and manufacturing model, which allows for a rapid response to market changes and customer needs. This vertical integration, combined with Intel’s global brand recognition and market penetration, provides a significant edge over competitors. Intel’s ongoing efforts to improve its manufacturing capabilities and expand its product offerings in high-growth areas further solidify its market position.

Regarding valuation, Intel presents an intriguing proposition for investors. The company’s stock valuation reflects its current earnings and potential for future growth, particularly as Intel pivots towards burgeoning market segments. While the stock may trade at multiples that consider its challenges, Intel’s comprehensive strategy to address market demands and solid financial foundation suggest that it could offer substantial upside potential.

Stop chasing shadows in the market. Forbes’ expert analysts have pinpointed the 12 superstars poised to ignite returns in 2024. Don’t miss out—download 12 Best Stocks To Buy For 2024 and claim your front-row seat to the coming boom.

Taiwan Semiconductor Manufacturing, founded in 1987 and headquartered in Hsinchu, Taiwan, is the world’s leading independent semiconductor foundry. As a pioneer of the dedicated semiconductor foundry industry, TSMC manufactures various integrated circuits (ICs) for customers globally, serving major sectors, including computing, consumer electronics, automotive and telecommunications.

TSM’s business model focuses on providing semiconductor manufacturing services across the full integrated circuit (IC) fabrication spectrum, including advanced process technologies and wafer production. The company’s role is crucial in the global supply chain, enabling the design and production of cutting-edge semiconductor products without companies needing to own and operate costly fabrication facilities.

With its commitment to innovation and quality, TSM has established itself as a key player in the semiconductor industry, continuously advancing the frontiers of process technology. The company’s leading-edge processes, including its development of ultra-small nanometer technologies, have made it the preferred manufacturing partner for the world’s most prominent technology firms, driving advancements in smartphones, high-performance computing, and numerous applications within the Internet of Things and automotive industries.

TSM’s strategic investments in research and development ensure its technology leadership and capacity expansion to meet the growing demand for semiconductor devices, positioning the company at the forefront of the industry’s push towards more powerful, efficient and miniaturized electronic components.

Taiwan Semiconductor stands out as a top semiconductor stock for 2024, thanks to its critical role in the global supply chain and unmatched manufacturing expertise. TSM is well-positioned to capitalize on the growing demand for advanced semiconductor chips, fueled by advancements in 5G, artificial intelligence, the Internet of Things and electric vehicles (EVs). As the industry’s leading foundry for cutting-edge chip production, TSM’s services are in high demand from tech companies that require sophisticated manufacturing capabilities beyond their internal resources.

The company’s commitment to continuous research and development ensures its technological leadership, maintaining its edge with processes as advanced as 3nm. This focus secures TSM’s status as a vital partner for tech giants and positions it to adapt seamlessly to future technological shifts. Financially, TSM showcases strong earnings and a robust balance sheet characterized by high-profit margins, significant cash flows and a strategic reinvestment in technology and capacity expansion. These attributes underscore TSM’s ability to navigate the industry’s cyclicality and sustain growth over time.

TSM’s competitive edge is further solidified by its unparalleled manufacturing capabilities, diverse global customer base, and reputation for quality and innovation. This combination of operational excellence and market dominance ensures consistent service demand, reinforcing its market leadership.

In terms of valuation, TSM’s stock offers an attractive investment opportunity despite its premium valuation that reflects its superior growth prospects, operational efficiencies and strategic industry position. The company’s pivotal role in the future of technology and the high barriers to entry for its level of advanced manufacturing justify the stock’s long-term value potential.

Copyright 2022 The Associated Press. All rights reserved

Micron Technology, founded in 1978 and headquartered in Boise, Idaho, is a global semiconductor industry leader specializing in developing and manufacturing memory and storage solutions. Micron’s product portfolio includes dynamic random-access memory (DRAM), NAND flash memory and NOR flash memory, essential components in various electronic devices such as computers, smartphones, servers and automotive applications.

As a key player in the memory market, Micron has been instrumental in driving technological advancements that enhance the performance and efficiency of electronic devices. The company’s focus on innovation is evident in its contributions to developing next-generation memory technologies, including 3D XPoint, which significantly improves speed and endurance over traditional NAND.

Micron’s strategic approach to research and development, combined with its global manufacturing footprint, enables the company to maintain a competitive edge in the fast-paced semiconductor industry. Through collaborations with industry partners and a commitment to sustainability, Micron aims to address the growing demand for high-quality memory solutions while minimizing its environmental impact.

With its rich history of innovation and a robust portfolio of memory technologies, Micron Technology continues to shape the future of data storage and processing, playing a crucial role in advancing the digital economy.

Micron Technology stands out as one of the best semiconductor stocks for 2024, poised to capitalize on several key industry trends. As digital transformation accelerates globally, the demand for memory and storage solutions is skyrocketing, driven by technological advancements such as artificial intelligence, 5G, cloud computing, and the IoT. Micron is well-positioned to meet this surging demand with its leading-edge DRAM and NAND technologies. The company’s ongoing investments in next-generation memory technologies, like 3D XPoint, further solidify its role in enabling faster and more efficient data processing for various applications, from consumer electronics to enterprise data centers.

Financially, Micron demonstrates robust earnings growth and a strong balance sheet. Despite the cyclical nature of the semiconductor industry, Micron has managed to navigate market fluctuations successfully, maintaining healthy profit margins and cash flow. This financial resilience is crucial for sustaining high levels of investment in research and development and is essential for staying competitive in the fast-evolving tech landscape. Additionally, Micron’s strategic management of supply chain and production capabilities has helped it mitigate the impacts of global semiconductor shortages, underscoring its operational excellence.

Micron’s competitive advantage lies in its comprehensive portfolio of memory solutions and its ability to quickly adapt to technological shifts. Unlike many competitors specializing in DRAM or NAND, Micron’s expertise in both areas allows it to offer a broad range of products to meet diverse market needs. This versatility, combined with a strong patent portfolio and close collaborations with technology partners, gives Micron a unique edge in developing integrated solutions that address complex data storage and processing challenges.

Regarding valuation, Micron’s stock presents an attractive investment opportunity, particularly when considering its growth prospects relative to its current market valuation. While semiconductor stocks can be volatile, Micron’s solid fundamentals, strategic position in critical technology growth areas, and financial health suggest its stock is potentially undervalued, offering a compelling entry point for investors looking to benefit from the ongoing expansion of the digital economy.

Investing successfully in semiconductor stocks requires a strategic approach that combines long-term perspectives, diversification and thorough research. Given the cyclical nature of the semiconductor industry, which experiences peaks and troughs based on demand for electronic devices and technological advancements, adopting a long-term perspective is crucial. This approach allows investors to weather short-term volatility while capitalizing on the industry’s growth trajectory.

Diversification is particularly important when investing in semiconductor stocks. The industry encompasses various companies specializing in different segments, such as manufacturing, equipment and design. By spreading investments across various sub-sectors, investors can reduce risk. Some companies may excel in developing cutting-edge technology but face operational challenges, while others might excel in production efficiency but lag in innovation. Diversification ensures that an investor’s portfolio can benefit from sector-wide growth while minimizing the impact of any company’s underperformance.

Thorough research underpins successful investment strategies. Investors should analyze a company’s financial health, market position, research and development capabilities, and growth potential in emerging technologies. Understanding the specific drivers of semiconductor demand, such as advancements in 5G, AI and IoT, can also provide valuable insights into which companies are well-positioned for future growth.

The rationale for diversification when investing in semiconductors stems from the sector’s inherent volatility and rapid pace of technological change. No single company dominates every aspect of the semiconductor industry, and shifts in technology, supply chain disruptions or changes in consumer demand can significantly affect a company’s performance. Investing in a range of companies can capture the sector’s upside potential while mitigating the risks associated with any firm’s fortunes. This strategy enables investors to achieve a more stable and potentially rewarding investment experience in the dynamic semiconductor industry.

The semiconductor industry is poised for significant growth in 2024, driven by technological advancements and increasing demand across various sectors. Among the companies leading the charge, Nvidia, AMD, Micron, Taiwan Semiconductor and Intel stand out as semiconductor stocks to watch. Each company is uniquely positioned to capitalize on key industry trends such AI, 5G, cloud computing and the Internet of Things.

Nvidia continues to dominate in the realms of AI and gaming, with its GPUs becoming increasingly indispensable for data centers and autonomous technologies. AMD’s impressive performance in both the CPU and GPU markets, driven by its Ryzen and Radeon lines, positions it as a strong competitor to Intel and Nvidia. With its focus on memory and storage solutions, Micron is set to benefit from the data explosion by AI and machine learning technologies. TSM, the world’s leading semiconductor foundry, is critical in the supply chain, manufacturing chips for industry giants and benefiting from the overall growth in chip demand. Lastly, with its diversified approach towards computing, IoT and AI, Intel is strategically moving to regain its leadership position in the semiconductor industry.

Each company showcases strong earnings growth and robust balance sheets, indicating its capacity to invest in innovation and expansion. Their competitive advantages, from Nvidia’s ecosystem approach to TSM’s manufacturing dominance, set them apart in the industry. Despite high valuations reflecting their growth potential, these stocks represent significant opportunities for investors looking to tap into the semiconductor sector’s expansive future.

In summary, Nvidia, AMD, Micron, Taiwan Semiconductor, and Intel are strategically aligned with the future of technology, making them the top semiconductor stocks for 2024. Their involvement in key technological advancements and strong financial foundations make them compelling choices for investors seeking growth in the dynamic semiconductor market.

The brain trust at Forbes has run the numbers, conducted the research, and done the analysis to come up with some of the best places for you to make money in 2024. Download one of Forbes’ most popular and widely anticipated reports, 12 Best Stocks To Buy for 2024.